Bitcoin Crashes Below $100K, Losing 22% Since October’s All-Time High

They’re melting away like rarely before this year: On Thursday evening, Bitcoin fell to a price of just $98,000 – the lowest since May 2025. This puts BTC now 22 percent below the all-time high of $126,000, which was reached just on October 6 – a little more than a month ago.

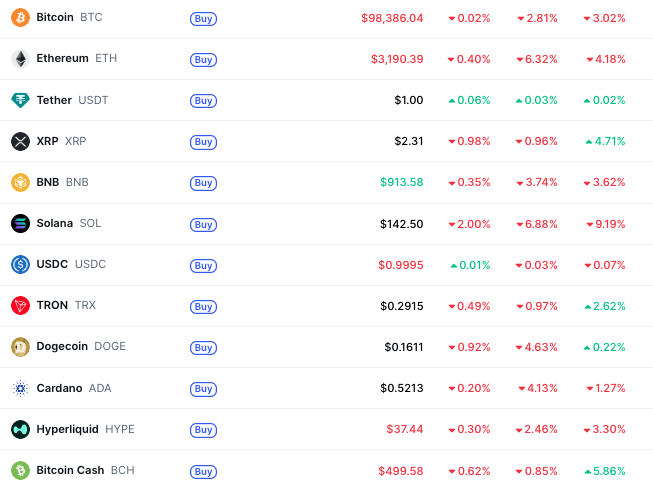

This now also means that since the peak of market capitalization, which was at more than $4.3 trillion in early October, more than one trillion dollars have been wiped out – currently, all crypto assets combined weigh in at $3.3 trillion. Because it’s not just Bitcoin suffering right now, but also altcoins:

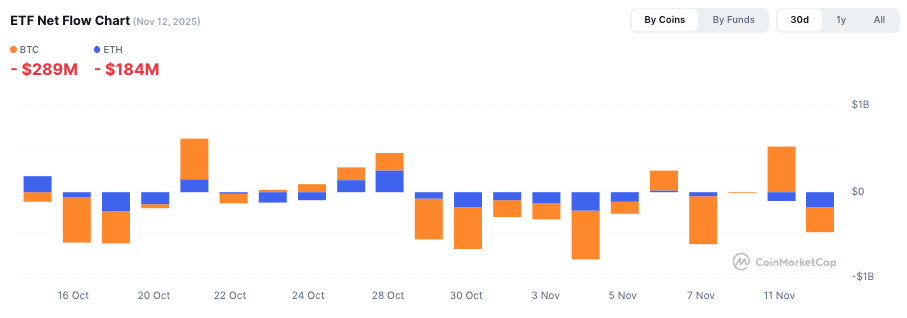

Not surprisingly, the mood in the crypto market is pretty dismal, with Fear & Greed indices currently pointing to Fear and threatening to fall to “Extreme Fear.” The situation doesn’t look any better for institutional investors on Wall Street who invest in ETFs. In recent days, there have been significant outflows from exchange-traded funds for Bitcoin and Ethereum:

A tricky constellation

The reasons for the price declines aren’t clear-cut, but should primarily be sought in the US – events there (Trump, ETFs, interest rate moves) have consistently had a major influence on the price development of crypto assets over the past year:

- Economic uncertainty due to US government shutdown: The longest government shutdown in US history is leading to missing economic data (e.g., delayed CPI reports) and increasing market uncertainty, causing investors to switch to traditional investments.

- Declining probability of a Fed rate cut: The chances of a December rate cut have fallen from 85% to below 67% after Fed Chair Powell took a hawkish stance – fewer rate cuts mean less liquidity for risk assets like crypto.

- Massive ETF outflows: Over $2.6 billion was withdrawn from Bitcoin and Ethereum ETFs in the past week, which directly pressures the price and shows that institutional investors are pulling back.

- Weak labor market data and economic slowdown: ADP reports show weekly job losses of 11,000 positions, Goldman Sachs reports 50,000 jobs lost in October – this intensifies recession fears and leads to a flight from risky assets like cryptocurrencies.