Bitcoin Crashes to $70,000: 45% Plunge from All-Time Coincides with SaaS Stock Sell-off

With a price of around 70,000 dollars, the world’s largest cryptocurrency is now a full 45 percent below its own peak value from October 2025 at 126,000 dollars on Thursday morning – and has thus lost almost half its value in approximately 4 months.

The Bitcoin price has broken through several significant thresholds downward on Thursday during Asian trading hours. On the cryptocurrency exchange Bitstamp, BTC fell to 69,101 dollars, while on other trading platforms such as Coinbase it reached a daily low of 70,002 dollars. Over a 24-hour period, Bitcoin recorded a decline of up to 7.5 percent before losses were partially recovered.

The different price levels on various exchanges point to increased selling pressure on the Bitstamp platform, which belongs to Robinhood. This discrepancy between trading venues is particularly evident when falling below the psychologically important 70,000-dollar mark. After a peak of over 126,000 dollars in early October, Bitcoin has been in a downtrend for several months, with market observers considering further corrections to possibly 60,000 dollars as possible.

Concerns about AI investments weigh on technology stocks

The renewed Bitcoin price crash occurred in parallel with sharp losses on Asian and American stock markets, particularly in the technology sector. The MSCI Asia Tech Index already recorded its fifth decline within six trading sessions, led by South Korean technology stocks, where the Kospi fell by around four percent. The weakness followed disappointing quarterly results from companies such as Alphabet, Qualcomm, and Arm, which intensified concerns that investments in artificial intelligence could reach their peak faster than expected.

As reported, the rise of coding AI has triggered massive concerns about how promising software-as-a-service companies are positioned for the future. If companies with Claude from Anthropic can simply tailor software for themselves, do they still need large SaaS providers? It was evident that stocks of companies such as Salesforce, Intuit, Workday, Palantir, and Oracle have recently been severely impacted.

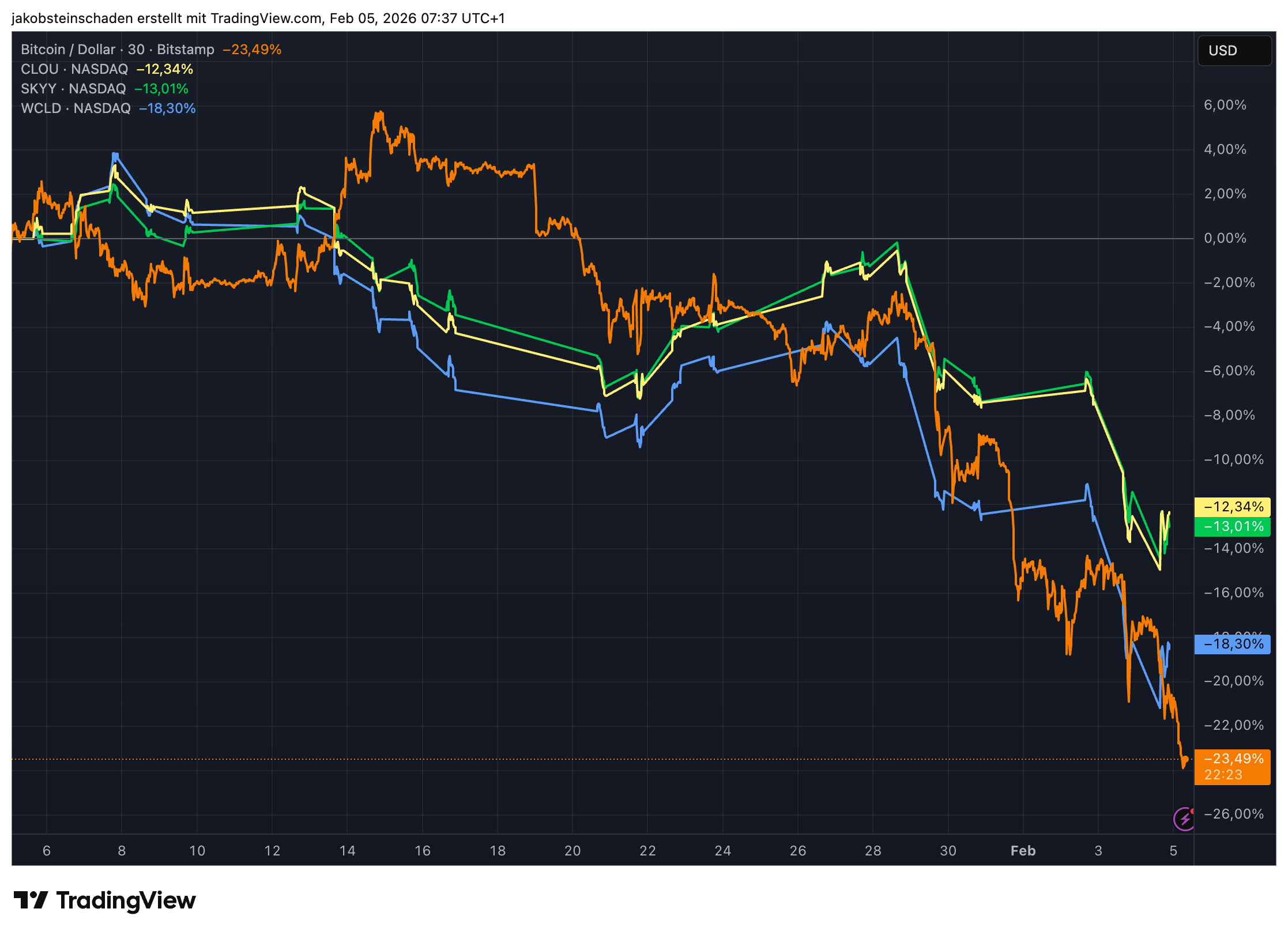

If one compares the Bitcoin price with ETFs dominated by SaaS companies such as

- Global X Cloud Computing ETF (CLOU)

- First Trust Cloud Computing ETF (SKYY)

- WisdomTree Cloud Computing Fund (WCLD)

then one sees clear parallels:

Bitcoin is increasingly behaving like a high-volatility risk asset, particularly during equity-market-driven corrections with thin liquidity and rising macroeconomic uncertainty. The digital currency already fluctuated sharply between 73,000 and 76,000 dollars at the beginning of the week, which market participants interpreted more as a sign of fragile conviction than as a clear trend reversal. Price movements below the low 70,000-dollar mark have accelerated a broader unwinding of leveraged positions and triggered numerous forced liquidations.

Precious metals intensify selling pressure on commodity markets

Industry observers see in the current development the end of a phase of complacency among institutional market participants. The operations manager of Synfutures explained that crowded positions built up during the rally following the introduction of Bitcoin ETFs are now being unwound. Price movements would now be driven more strongly by accounting mechanisms than by narrative developments, with sentiment having become significantly more risk-averse.

Pressure on cryptocurrency markets was intensified by violent movements in precious metals. Silver plunged by up to 17 percent, while gold lost over three percent, triggering a brutal unwinding of positions and also severely hitting tokenized precious metal products on crypto platforms. These parallel developments underscore the current role of Bitcoin as a highly volatile risk asset in an environment of rising uncertainty about valuations in the technology sector and the sustainability of AI-driven investment cycles.