“Blackwell sales are off the charts”: Nvidia posts $57 billion revenue in Q3

These are numbers many have been waiting for – and only those already betting on an AI bubble burst will be disappointed. Because NVIDIA reported record revenue of $57.0 billion for the third quarter of fiscal year 2026 (ending October 26, 2025) – a 22 percent increase versus the previous quarter and 62 percent year-over-year. The Data-Center business also hit an all-time high at $51.2 billion, rising 25 percent versus Q2 and 66 percent year-over-year. Profit jumps 65% to $31.9 billion.

GAAP and Non-GAAP gross margins stand at 73.4 and 73.6 percent respectively; earnings per share amount to $1.30 under both calculation methods. For the fourth quarter, the chip giant projects revenue of $65.0 billion. That’s particularly interesting because prominent investors like SoftBank and Peter Thiel recently dumped their NVIDIA shares – widely interpreted as a signal they don’t believe in further growth for the chip giant.

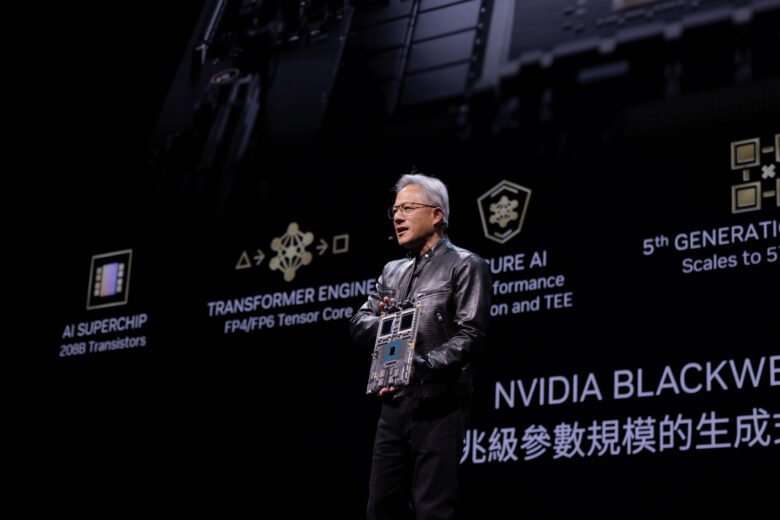

CEO and founder Jensen Huang, however, comments on the figures in unambiguous terms: “Blackwell sales are off the charts, and cloud GPUs are sold out, and cloud GPUs are sold out. Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

The AI ecosystem is scaling rapidly, Huang continues: “AI is going everywhere, doing everything, all at the same time.” In the first nine months of the fiscal year, NVIDIA returned $37.0 billion to shareholders through share buybacks and dividends. The next quarterly dividend of $0.01 per share will be paid on December 26, 2025.

All threads converge at NVIDIA

The Data-Center segment is driving growth through a series of strategic partnerships. NVIDIA has reached an agreement with OpenAI to deploy at least 10 gigawatts of NVIDIA systems for next-generation AI infrastructure. Anthropic will run and scale on NVIDIA infrastructure for the first time – initially with 1 gigawatt of compute capacity via Grace Blackwell and Vera Rubin systems.

With Oracle, NVIDIA is building the largest AI supercomputer Solstice for the U.S. Department of Energy, featuring 100,000 Blackwell GPUs, plus another system called Equinox with 10,000 GPUs. In South Korea, the company is collaborating with the government and industry giants like Hyundai Motor Group, Samsung Electronics, and SK Group to expand national AI infrastructure with over 250,000 NVIDIA GPUs.

NVIDIA has also announced a partnership with Intel to develop multiple generations of custom Data-Center and PC products with NVLink. The Blackwell architecture achieved the highest performance and best overall efficiency in SemiAnalysis InferenceMAX benchmarks, delivering a tenfold throughput per megawatt compared to the previous generation. The first Blackwell wafer was produced on U.S. soil at TSMC’s Arizona facility, while Blackwell has reached volume production.

Automotive and Robotics gain momentum

In the automotive segment, NVIDIA reports $592 million in revenue (up 1 percent Q/Q, up 32 percent Y/Y). The company unveiled the DRIVE AGX Hyperion 10 platform for autonomous vehicles and closed a partnership with Uber to scale the world’s largest Level-4-capable mobility network with 100,000 vehicles starting in 2027.

Together with U.S. manufacturing and robotics companies like Agility Robotics, Amazon Robotics, Caterpillar, Foxconn, Toyota, and TSMC, NVIDIA is driving America’s reindustrialization with Physical AI. The new IGX Thor platform is designed to bring real-time Physical AI directly to the edge.