Crypto rally and Bitcoin ATH in the fall? Why many are betting on Q4 2025

Everything is on track, the cycle repeats itself, and the fourth quarter of 2025 is shaping up to be intense. If you take a look around in the crypto sector right now, you’ll notice: Many companies and investors are preparing for a hot autumn. An autumn that could bring new all-time highs for Bitcoin, but also for altcoins like Ethereum, Solana, or Dogecoin.

And that’s even though Bitcoin has already climbed this year—first to about $110,000 following Donald Trump’s re-election and then to $124,000 in mid-August.

Still, many analysts believe: The real breakthrough is yet to come. Some go so far as to predict that under optimal conditions, BTC could more than double to $250,000 this year—while others expect a worst-case scenario that could see a drop down to $64,000.

Why Are So Many Bullish?

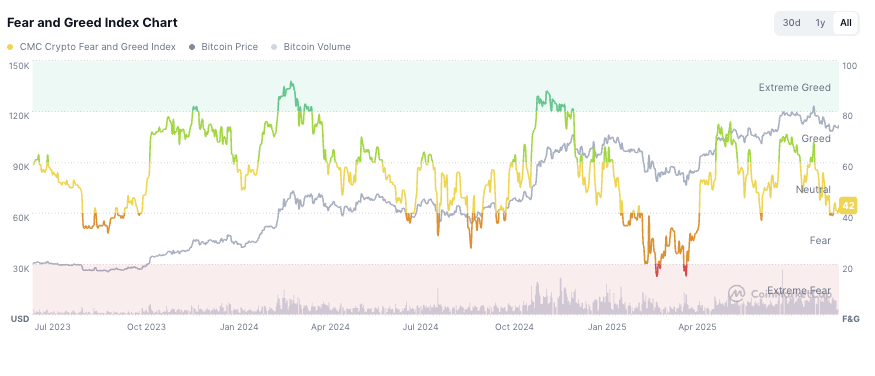

But the crypto market isn’t actually that bullish yet. Whether you check CoinMarketCap or Alternative.me: The Fear & Greed Index has mostly been neutral in recent weeks. Investors are neither particularly hesitant about buying crypto nor overly enthusiastic.

This is also reflected in the tracker for a possible altcoin season. Such a season would occur when 75% of the top 100 coins outperform Bitcoin over the past 90 days. That’s nowhere near the case—currently, just “52” altcoins have performed better than BTC in the last three months.

So, basically: Despite Bitcoin’s price at $124,000, there’s no real euphoria yet. Two scenarios are possible: Either many think that 2025’s highs are already behind us, or—on the contrary—the best phase for Bitcoin and co. in 2025 is yet to come, namely in the fourth quarter that begins in a few weeks.

What Is Expected for Q4 2025

Several events are frequently cited when discussing the future price development of cryptocurrencies:

- Another cut in U.S. interest rates in mid-September:

The expected rate cut by the U.S. Federal Reserve could spark a “risk-on” environment favorable for cryptocurrencies like Bitcoin. - Uptober & Pumpvember:

Historically, the fourth quarter often brings upward trends and price gains for Bitcoin and altcoins—after rather mixed summer months. This may be due to traders returning from summer holidays and becoming more active. Still, many warn against relying too much on past trends. - New altcoin spot ETFs get approved:

The U.S. SEC is currently reviewing 92 applications for crypto-based ETFs, including products for Dogecoin, Solana, XRP, and Litecoin. If some are approved, it could attract interest from institutional investors. - The halving effect kicks in:

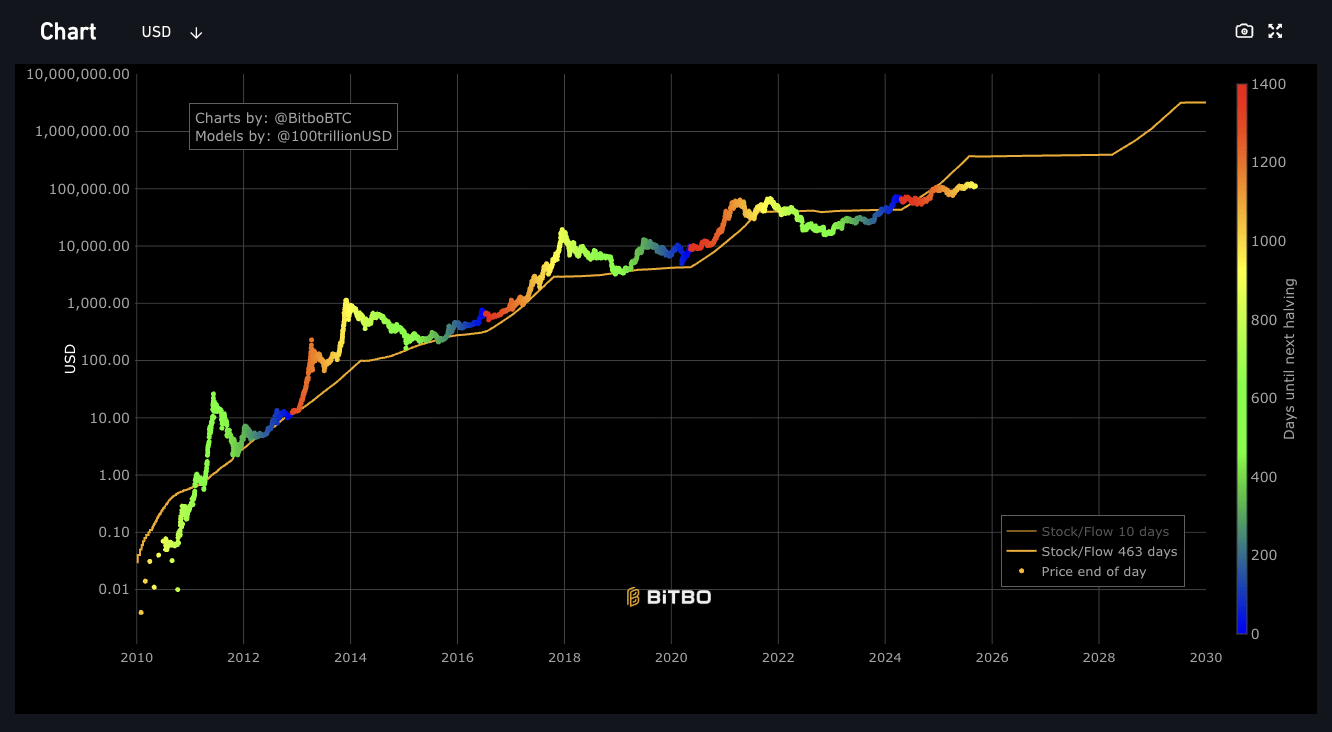

The Bitcoin halving, which occurs every four years, leads to reduced new BTC issuance, meeting rising demand. Historically, new all-time highs have followed 12–18 months after previous halvings. If history repeats, BTC should hit a new ATH in 2025, between April and October. This means: Either another new record is coming, or the August ATH at $124,000 was already it.

Or: Everything turns out differently. The still-popular Stock-to-Flow (S2F) pricing model for Bitcoin is currently far off target. If BTC were truly following the four-year cycle, it should now be trading at $367,000 per coin—but it’s not. S2F is massively off; BTC is currently only about a third of that value, at $112,000.

Crowd at the Exchange Ahead of October

Despite everything, many companies are betting heavily on Q4 2025—as can be seen at the stock exchange. Since the “GENUIS Act” (see Circle) stablecoin law in the U.S. and further crypto initiatives by the Trump administration, crypto companies have been lining up to go public. Here’s an overview:

- CoinShares (asset manager): Aiming to go public via SPAC (Vine Hill) at a $1.2 billion valuation in Q4 2025

- Figure Technologies (blockchain lending): IPO planned in September 2025 with a valuation of up to $4.1 billion

- Gemini (exchange): The Winklevoss twins’ crypto exchange aims for an IPO with a target valuation of $2.22 billion (September 2025)

- Circle: The USDC stablecoin maker already has a market cap of about $28 billion (IPO in June 2025)

- Bullish: The crypto exchange backed by Peter Thiel is currently valued at around $7.5 billion (IPO in August 2025)

- Bitpanda: The Austrian crypto broker is seeking a stock listing; both Frankfurt and New York are in the running

- BitGo: As reported, the crypto custody specialist has also filed documents for a U.S. IPO

Naturally, companies have different reasons for going public, and the business models of listed firms vary widely. But if they all believed Bitcoin’s ATH for 2025 was already reached in August—they would hardly be scrambling to go public via IPO or SPAC.

Bitcoin Cycle Repetition Is Very Questionable

Will history repeat itself, with Q4 bringing a new all-time high for Bitcoin and a strong signal for the wider crypto market? Not everyone thinks so. Bitcoin analyst PlanC (“Bitcoin Quantile Model”) is already warning against betting on Q4 2025:

“Anyone who thinks Bitcoin has to peak in Q4 of this year does not understand statistics or probability. The halving is completely irrelevant at this point, and there is zero fundamental reason—other than a psychological, self-fulfilling prophecy—for the peak to occur in Q4 2025. From a statistical and probability standpoint, it is equivalent to flipping a coin and getting tails three times in a row, then betting all your money that the fourth flip MUST BE tails.” – PlanC

So, it’s just as possible that BTC already hit its 2025 peak in the summer because the market priced in an expected autumn rally—and nothing happens in the fall. That would be in line with an old saying that has often proven true in the crypto sector: “Buy the rumors, sell the news.”