Gemini Delivers: In Year 3 after ChatGPT, Nobody’s Laughing at Google Anymore

December 2022: ChatGPT triggers red alert at Google; even co-founder Sergey Brin, long since operationally retired, returns to code again. “They will definitely want to come out and show that they can dance. And I want people to know that we made them dance,” Microsoft CEO Satya Nadella boasted in February 2023, convinced that OpenAI and Microsoft had reinvented internet search with AI and finally found a way to grab Google’s billion-dollar search business. In February 2023, Google Bard’s botched launch sends observers laughing and the stock price tumbling.

By late 2025, nobody’s laughing at Google’s AI anymore. True, OpenAI’s surprise success with ChatGPT flushed Google—which has called itself an “AI First” company since 2016—out of its comfort zone, but defeat it? Not a chance. By late 2025, Google stands on AI as solid as ever, boasts Gemini 3 as the world’s best LLM on the market, landed a hit with Nano Banana as an image generator, owns its own chips, has billions of existing users for AI rollout, counts OpenAI arch-rival Anthropic in its portfolio, and above all: has a clear regulatory path. And CEO Sundar Pichai? He’s already being celebrated as a pretty damn good “wartime CEO”—meaning he’s not just a capable manager in easy times, but also in crisis.

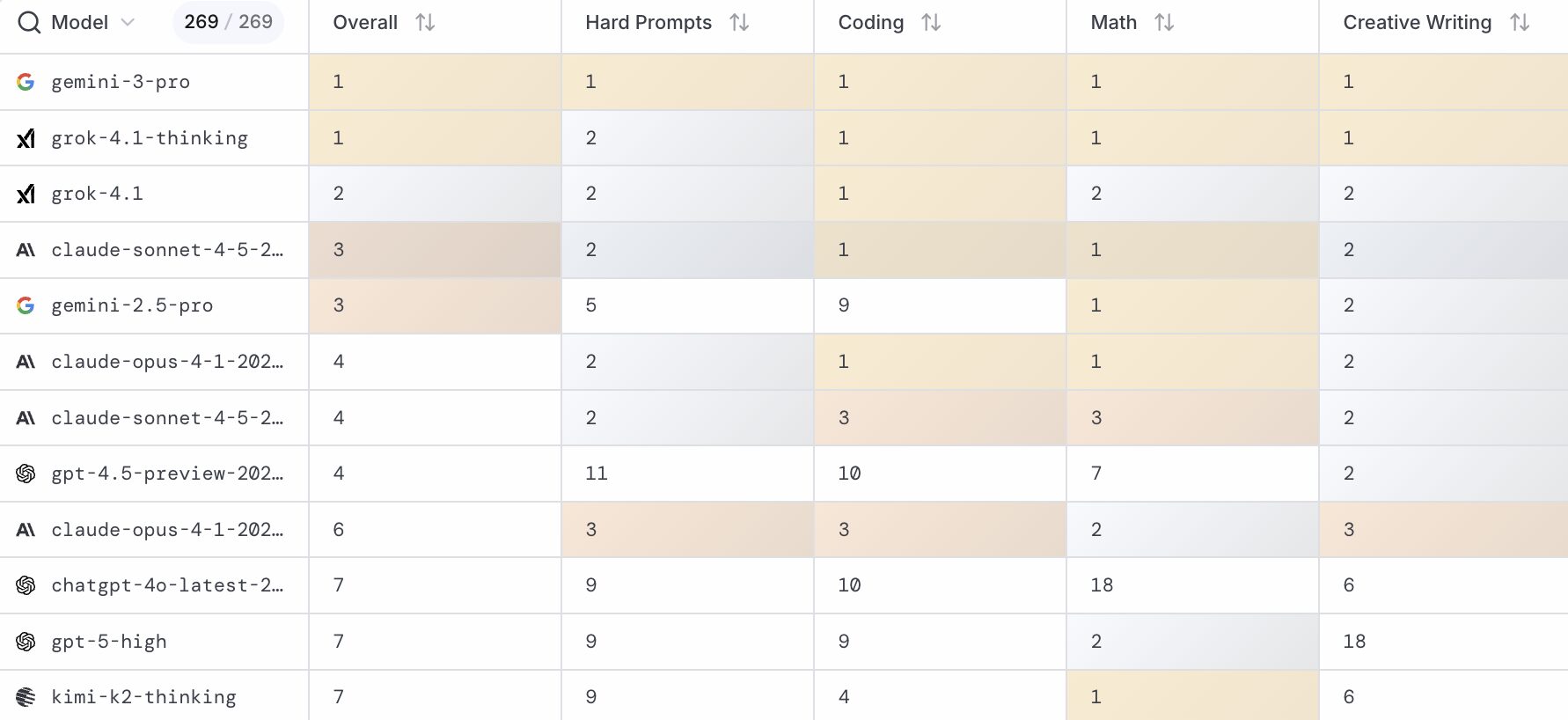

1. Gemini 3 Pro beats OpenAI, Anthropic, and xAI

With the release of Gemini 3 Pro, Google has stormed back to reclaim the benchmark tables and relegated rival models Grok 4.1, GPT-5.1, and Claude Sonnet 4.5 to the sidelines. Critics and developers praise in particular the seamless, native multimodality and significantly reduced hallucination rate, which makes the model the new gold standard for complex problem-solving. Gemini 3 Pro bears some responsibility for the hype around OpenAI cooling considerably. On LMArena, you can see how Gemini 3 Pro has claimed the top spot in the LLM charts and dominates in coding, mathematics, and creative writing alike.

2. Breaking up the company is off the table

Years of uncertainty from the Damoclean sword of antitrust breakup by the U.S. Department of Justice have evaporated. Google convincingly demonstrated that the market has been redefined by the emergence of generative AI and competition is fiercer than ever—an argument that judges and regulators ultimately accepted. Spinning off Chrome or Android is off the table; since mid-2025, Google can focus entirely on product innovation.

This regulatory clarity now gives Google a massive strategic advantage over Big Tech rivals still caught in proceedings. Investors breathed a sigh of relief, as the integrated ecosystem of search, browser, mobile, and cloud remains intact. Precisely this synergy across divisions proves to be the decisive lever for rolling out AI features quickly and broadly to billions of users without being hampered by artificial barriers.

3. Proprietary AI chips guarantee independence from Nvidia

While companies like OpenAI and Meta exhaust themselves in costly bidding wars over Nvidia’s latest GPUs, Google benefits from the foresight of having begun developing its own TPUs (Tensor Processing Units) over a decade ago (from 2015 onward). The now sixth-generation iteration of these chips enables Google to train and operate Gemini 3 and Nano Banana at lower costs than competitors incur. This vertical integration has become the company’s quiet but powerful competitive advantage.

Independence from external supply chains also means Google need not fear bottlenecks. While competitors must ration AI features or charge premium prices to cover hardware costs, Google can pursue aggressive pricing models and integrate powerful AI tools for free into its products. Margins remain healthy despite the AI offensive, which impresses Wall Street sustainably.

4. Anthropic as an ace up the sleeve

14 percent of OpenAI rival Anthropic belongs to—yes, exactly—Google. The strategic investment in Anthropic has proven a brilliant chess move that gives Google dual insurance in the AI race. Even though Gemini is the internal flagship, Google benefits massively from Anthropic acting as a “friendly rival” that eats into OpenAI’s market share. Since Anthropic also uses Google Cloud as infrastructure, a large portion of the investments flows back to Google indirectly as cloud revenue.

At the same time, Anthropic serves as a technological and regulatory hedge position. Should unforeseen hurdles arise in developing its own models, Google has immediate access to the partner’s “Constitutional AI” technology. This alliance also prevents pure Microsoft/OpenAI dominance from taking hold in the enterprise sector and offers corporate customers an attractive alternative within Google’s orbit.

5. Gemini grows toward ChatGPT

Search, Workspace, Android, Chrome: Google has platforms through which it can grow its ChatGPT rival Gemini—and it does. The Gemini app now has 650 million users, no longer that far from the 800 million ChatGPT counts.

6. Google stock thrives while OpenAI allies crash

On the stock market, Sundar Pichai is currently being celebrated: The Alphabet stock races from all-time high to all-time high, driven by the realization that Google not only survived “Code Red” but leveraged it as a catalyst for a new era. Google’s parent Alphabet is currently at all-time highs, market cap at 3.5 trillion dollars—even Warren Buffett recently invested substantially in the stock.

In contrast, the OpenAI camp faces mounting skepticism. The hoped-for “Google-killer” effect, for instance with Microsoft’s Bing search, has failed to materialize. Stocks of close OpenAI partners like SoftBank (major investor) and Oracle (cloud partner) have crashed 26% and 20% respectively over the past month, while Google surged toward new all-time highs.

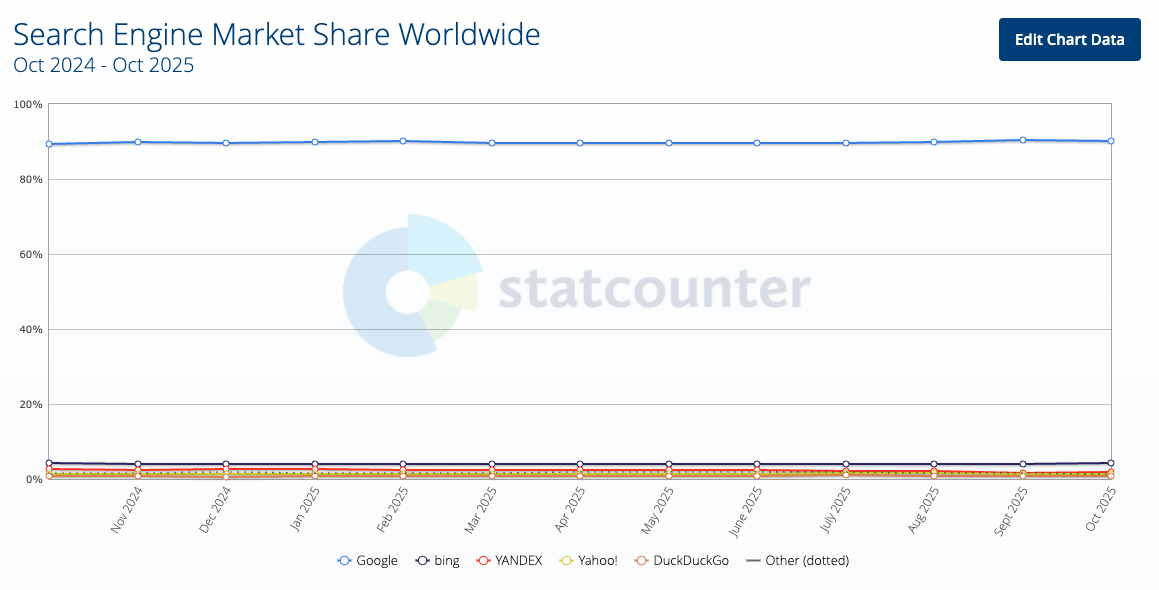

7. Core search business runs without disruption

By souping up Bing with OpenAI AI, Microsoft had hoped to finally break Google’s search monopoly and tap into the billions in search ad revenue. However, two things happened: First, users are creatures of habit and keep googling as before—plus Google gets to keep its Chrome browser. Second, OpenAI has distanced itself from Microsoft (and turned to Oracle, SoftBank, etc.) and wants to become the ultimate search engine itself.

Meanwhile, Google’s search engine runs unimpeded. Recently there was another record quarter. Alphabet’s consolidated revenue rose 16% year-over-year, or 15% to $102.3 billion in the third quarter of 2025. Google Search & Other, YouTube ads, Google subscriptions, platforms and devices, and Google Cloud each achieved double-digit growth in the third quarter, it was reported.