AI unicorns MiniMax and Zhipu AI demonstrate how IPOs could work in Europe

The start into the AI year 2026 is very clearly shaped by China. Zhipu AI from Beijing and MiniMax from Shanghai, two AI unicorns, went public on the Hong Kong stock exchange on Thursday and today Friday, respectively, and successfully placed their shares there. Both companies generally build open source AI models and count among the AI Tigers that are set on building international counterweights from China to the currently dominant US LLMs.

The two IPOs on the Hong Kong stock exchange got off to a good start, particularly MiniMax’s share price surged strongly and drove the company’s valuation upward. Together, the stock market newcomers bring just under 16 billion dollars in market capitalization to the table. Here’s the quick overview:

- Zhipu AI (internationally operating under Z.ai, officially Knowledge Atlas Technology):

- 558 million US dollars in IPO proceeds

- Valuation currently at: 4.4 billion dollars (34.2 billion Hong Kong dollars)

- MiniMax Group

- 619 million US dollars in IPO proceeds

- Valuation currently at: 11.4 billion dollars (92.3 billion Hong Kong dollars)

This means that MiniMax is now somewhat more valuable than Europe’s most valuable AI startup Mistral, which secured a valuation of 11 billion dollars in September 2025 through a funding round that included ASML among others; and Zhipu AI exceeds with 4.4 billion dollars the valuations of many AI startups from Europe such as Synthesia (approximately 4 billion dollars), but falls significantly short of the valuations of rising AI startups like Lovable from Sweden (6.6 billion dollars), ElevenLabs (6.6 billion dollars) from London, or Helsing (12 billion euros) from Germany.

This also shows one thing: AI companies from Europe have already reached the size that would qualify them for an IPO — Helsing is already as reported considered one of the candidates for IPOs in 2026.

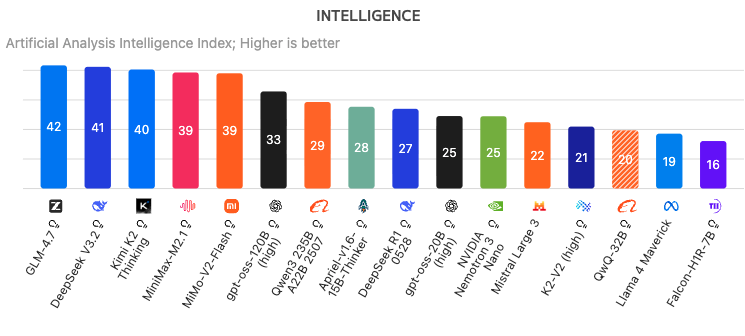

Zhipu AI currently dominates open source AI

While the LLMs of the two stock market newcomers currently play a rather subordinate role in the concert of frontier models, they have already shown that they can become world-class with open source LLMs. Currently, Zhipu AI with its GLM 4.7 is at the top of the Artificial Analysis ranking in the open source sector, ahead of DeepSeek (China), Moonshot AI with Kimi K2 (China), and MiniMax’s best model.

Nevertheless, MiniMax is worth almost three times as much on the stock exchange as Zhipu AI, which appears to be technically superior. This is likely due in part to political reasons. Because Zhipu AI (Beijing Zhipu Huazhang Technology Co., Ltd.) and its subsidiaries were added to the Entity List by the US Department of Commerce in January 2025 and thus banned from the US market. The justification: The US government claims that Zhipu AI uses US technology to support the modernization of the Chinese military, particularly through research cooperations that could be used for defense purposes. MiniMax, on the other hand, has no such restrictions and has already held events in New York, Miami, and San Francisco to excite developers there for its own AI models.

Zhipu AI focuses on China, MiniMax goes international

Zhipu AI has specialized in the development of universal “large models” and divides its business primarily into two segments: In the on-premise deployment area, it offers customized solutions that run directly on the customer’s infrastructure, while the cloud-based deployment segment enables access to models via the cloud. The company’s products and services find broad application in sectors such as smart devices, finance, manufacturing, retail, and healthcare, with the business focus currently primarily on the domestic market.

MiniMax, on the other hand, is positioned much more broadly and internationally. The company’s main business field is the provision of AI-native products and services for individual users, developers, and enterprise customers around the world. The company’s large language model product line includes MiniMax-M2 and MiniMax-M1; in addition, there is the company’s video generation model, which covers text-to-video and image-to-video, and a multilingual speech generation model. The company operates in the Chinese market and in foreign markets.