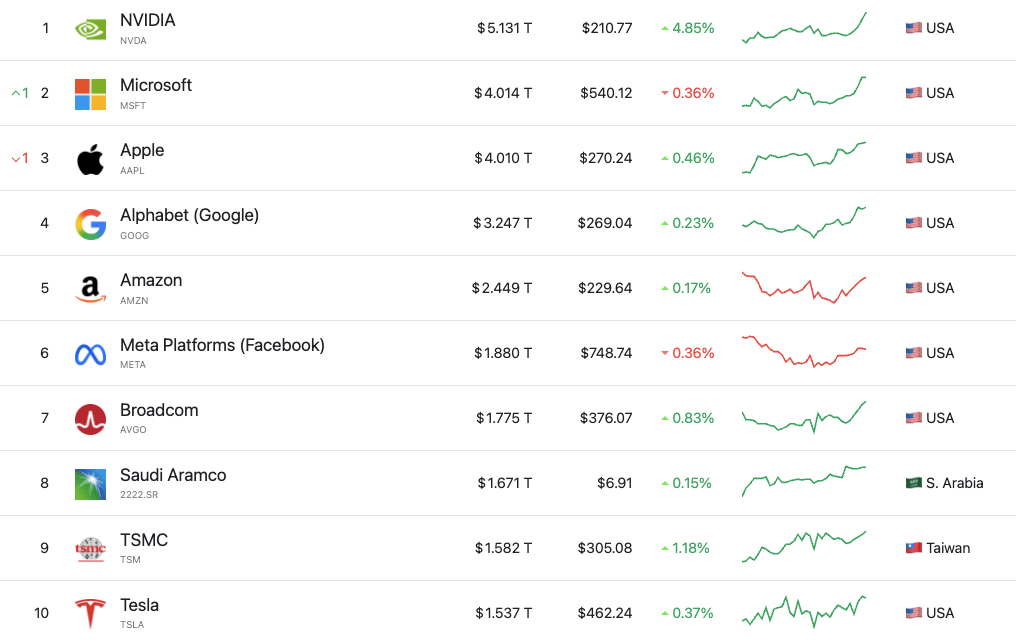

Nvidia becomes the first company to reach a market capitalisation of $5 trillion

Chip manufacturer Nvidia reached a historic milestone on Wednesday: The company became the first publicly traded company worldwide to surpass a market capitalization of five trillion US dollars. The stock rose by five percent in early trading on Wall Street, reaching a valuation of 5.13 trillion dollars. The speed of this development is remarkable – just three months ago, Nvidia had broken through the four trillion mark.

Alongside Nvidia, other technology companies also reached significant valuation milestones: Apple crossed the four trillion dollar mark for the first time on Tuesday, while Microsoft surpassed this threshold again, having already reached it in July.

Rapid Development Through AI Boom

The company’s growth momentum is unprecedented: Three years ago, before OpenAI’s release of ChatGPT, the valuation stood at around 400 billion dollars. Within a very short time, Nvidia reached one trillion dollars in market capitalization, two trillion in February 2024, and three trillion in June of the same year. In the past six months alone, the stock has gained over 85 percent.

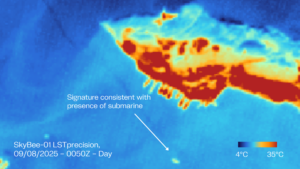

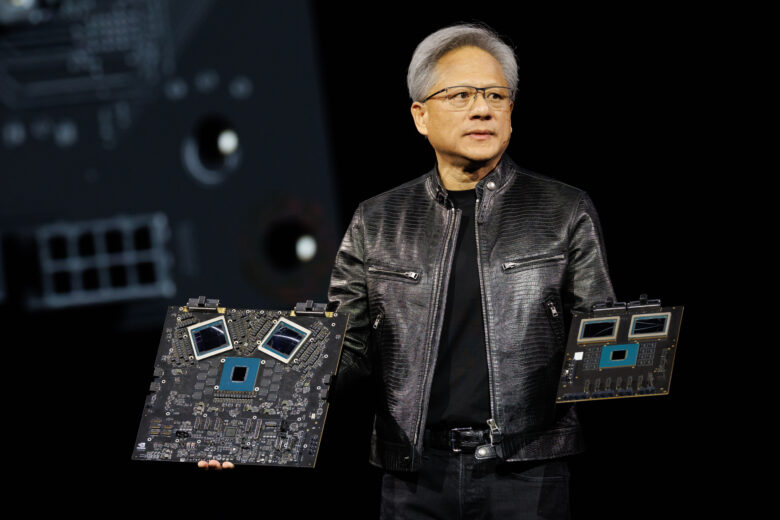

A key driver of this development is the high demand for Nvidia’s AI chip technology, which holds a dominant position in training and operating large language models. CEO Jensen Huang announced on Tuesday that the company has already secured orders worth half a trillion dollars for the next five quarters. This announcement caused the stock to rise by five percent the previous day, adding over 200 billion dollars to the market capitalization.

Market Outlook and Investments

Bernstein analysts interpret Huang’s forecasts to mean that Nvidia could be heading toward chip revenues well above 300 billion dollars in calendar year 2026 – significantly above Wall Street’s previous expectations of 258 billion dollars. According to Huang, the six largest cloud computing companies – Amazon, Meta, Google, Microsoft, Oracle, and CoreWeave – will increase their capital expenditures to 632 billion dollars by 2027.

At the same time, Nvidia itself is investing billions in its customers, including a planned 100 billion dollar investment in OpenAI announced in September.

Challenges in China Business

Despite the impressive growth, Nvidia faces challenges, particularly in the Chinese market. The latest generation of graphics processors, including the Blackwell chip, is currently unavailable in China due to US export controls. This has already cost the company billions in lost revenue.

US President Donald Trump announced that he would address the issue of Blackwell chips at his meeting with Chinese President Xi Jinping this week, fueling speculation about possible access for Nvidia to the Chinese market. A 15 percent revenue share for chip exports to China, agreed upon with the US government earlier this year, has yet to be codified into law.