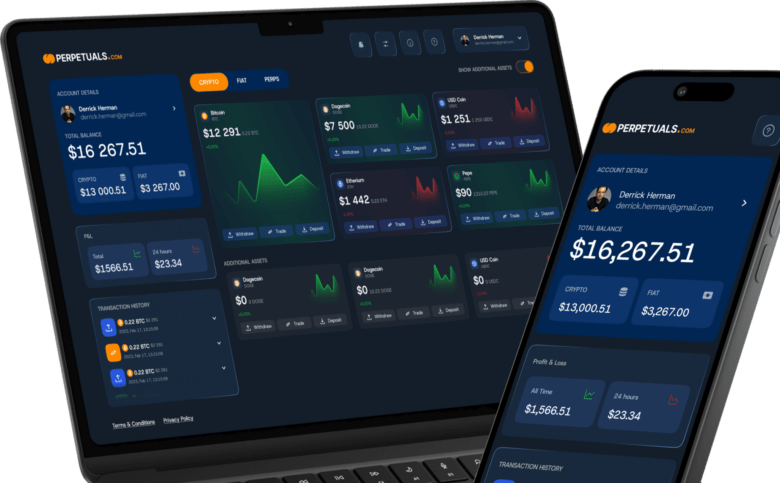

Scoop: Crypto Derivatives Platform Perpetuals.com Is Raising at a €250M Valuation

The EU-regulated cryptocurrency derivatives trading platform Perpetuals.com is seeking to raise 5% equity at a post-money valuation of €250 million, Trending Topics has learned. The company operates under European financial market regulations and has secured necessary licensing to provide institutional-grade trading services for digital assets. Just recently, Perpetuals.com led by crypto veteran CEO Patrick Gruhn, launched in the EU.

„After our last €100 million round when we had neither an MTF license nor were live, and both are now available, we are raising 5% at €250M post-money valuation. We are currently in negotiations with several interested investors, including both VCs and financial market players – essentially competitors, though it’s more about synergies because they have customers and we can deliver new/better products to them“, CEO Patrick Gruhn tells Trending Topics.

Gruhn, born in Germany, is well known for his Swiss company Digital Assets AG, which was sold to FTX for around $400 million in 2021. Gruhn later worked for FTX and described the sale as ‘the biggest misjudgement of his life’. Now he wants to prove to the industry that he can once again set up a new crypto platform in line with the strict regulations.

Business model and regulatory framework

Perpetuals.com operates as a multilateral trading facility (MTF) under the European MiFID II financial markets directive, subjecting the platform to the same stringent supervisory standards required of traditional financial institutions. This regulatory compliance represents a key differentiator from most unregulated platforms in the cryptocurrency space.

As a fully electronic trading platform regulated under European financial market regulations, Perpetuals.com cannot directly accept customers. Instead, the company partners with licensed brokers to provide access to its trading infrastructure. The primary partnership is with Backpack EU, accessible at eu.backpack.exchange, which offers perpetual futures through the Perpetuals.com platform.

The platform’s business model centers on providing perpetual futures – financial derivatives without expiration dates that have gained widespread adoption in the cryptocurrency sector. These instruments are based on academic concepts developed by Chicago financial scientist Adam K. Gehr and Nobel Prize-winning economist Robert J. Shiller.

Extension to tokenised stocks

Backpack EU serves as the European subsidiary of Backpack Exchange, a rapidly growing trading platform with over $160 billion in trading volume and presence in more than 150 countries and regions. The partnership allows investors to trade on Perpetuals.com 24/7 through Backpack EU’s brokerage services.

Perpetuals.com is led by an experienced team of digital asset pioneers, including CEO Patrick Gruhn (software developer, lawyer, and serial entrepreneur), Dr. Robin Matzke (legal lead and former special advisor to the German Bundestag), and Nayia Ziourti (regulatory lead with over a decade of experience as a regulatory attorney). Perpetuals.com plans to expand its product offering in the future to include options, traditional futures, swaps, and tokenized stocks, building on its current focus on perpetual futures trading.