The Anthropic Effect: Fear of AI Agents Trigger Major SaaS Stock Sell-Off

When AI agents complete tasks and create individualized software – what need is there for Software as a Service? This question is not only being asked by companies, but increasingly by shareholders as well. Currently, SaaS stocks are being heavily sold off at stock exchanges.

The recent release of new AI features by the company Anthropic under the name Claude Cowork has caused considerable turbulence in stock markets. Software and data service providers, whose business models are being called into question by the new automation possibilities, were particularly affected.

Claude Cowork as the trigger for the sell-off wave

Anthropic is currently positioning itself as the anti-OpenAI: instead of targeting the masses and advertising, the chatbot Claude is increasingly becoming a work tool with which one can write code and also complete a variety of work tasks.

Anthropic expanded its AI tool Claude Cowork with specialized functions for marketing, law, and finance. These plug-ins automate complex workflows that previously required expensive specialized software and extensive personnel resources. The announcement led to a revaluation of numerous technology companies by investors.

Particularly affected sectors

Legal databases and information services

The strongest price declines were suffered by providers of professional databases. Thomson Reuters, operator of the legal database Westlaw, recorded a price decline of almost 18 percent. British competitor RELX (LexisNexis) lost 14.4 percent in a single day, followed by another 1.3 percent the next day. Dutch provider Wolters Kluwer lost around 13 percent.

Analysts attribute the losses to the fact that Anthropic’s legal plug-in can take over functions such as reviewing confidentiality agreements, compliance checks, and the creation of legal briefings. This fundamentally calls into question the traditional licensing model of these companies.

Advertising and marketing agencies

Large advertising groups also came under pressure. Publicis lost over 9 percent in value after the company announced it would allocate around 900 million euros for AI acquisitions. Omnicom recorded a decline of over 11 percent. British WPP fell by 11.8 percent, followed by another 3.7 percent the next day.

Analysts at Barclays rate advertising agencies as particularly at risk should AI agents in the future be able to autonomously plan and execute campaigns.

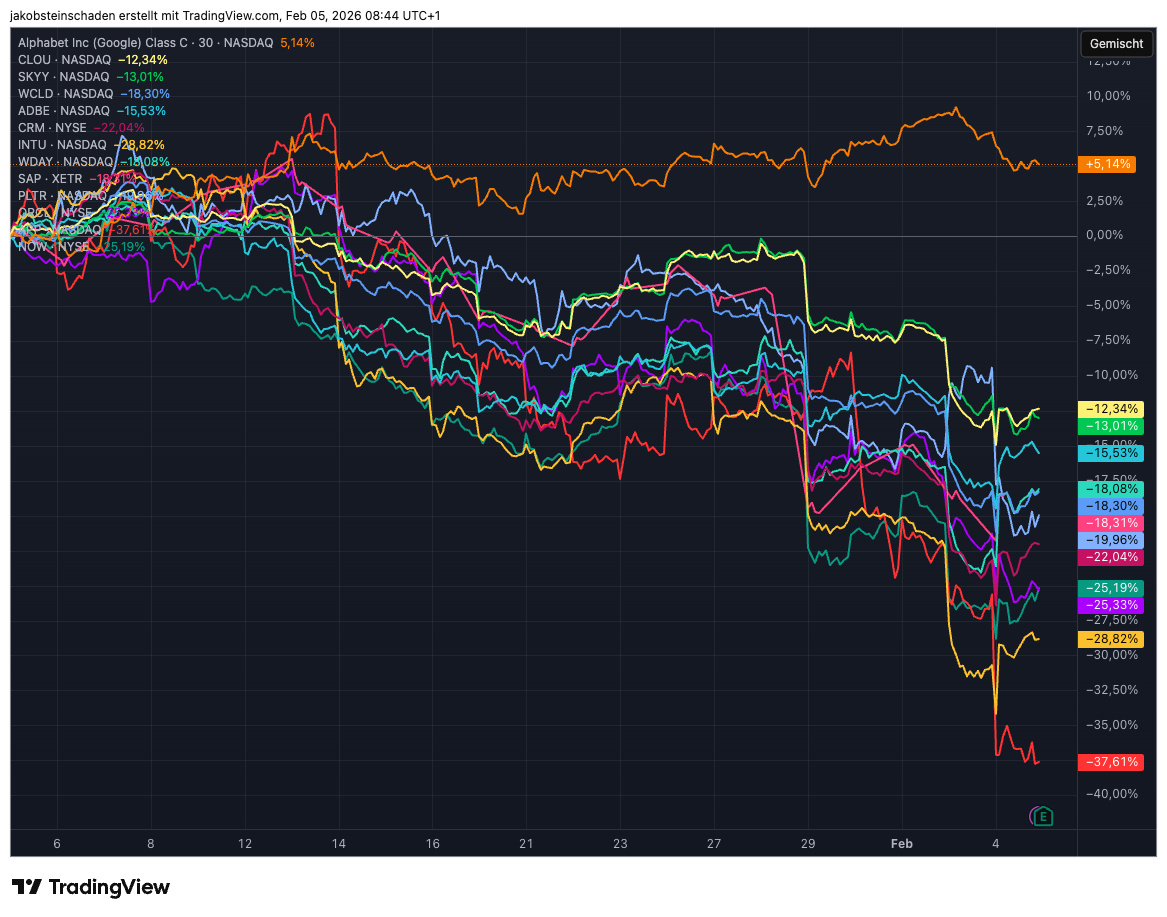

Here is the stock price of Alphabet over the month compared to SaaS-heavy ETFs and leading software companies:

- Global X Cloud Computing ETF (CLOU)

- First Trust Cloud Computing ETF (SKYY)

- WisdomTree Cloud Computing Fund (WCLD)

- Adobe

- Salesforce

- Intuit

- Workday

- SAP

- Palantir

- Oracle

- AppLovin

- ServiceNow

Chip sector also under pressure

Parallel to software losses, semiconductor manufacturers also came under strain. AMD recorded the largest single-day loss since 2017 with a decline of 17.3 percent, despite the company having posted solid quarterly figures. Analysts at Jefferies explained that expectations had been too high beforehand.

Qualcomm fell about 9 percent after market close after the company provided a weaker revenue outlook. CEO Cristiano Amon attributed this to industry-wide shortages of memory chips. Nvidia, the leading provider of AI chips, lost 3.4 percent.

Global impact

The sell-off wave also hit Asian markets. In Australia, Xero fell sharply, in China the Hong Kong-listed Kingsoft Corporation lost value, and in India IT service providers Infosys and Tata Consultancy Services came under pressure.

Bitcoin, often regarded as an indicator of risk appetite, fell as reported to 70,000 dollars. This means BTC is now 45 percent below its all-time high in October 2025 at 126,000 dollars (more on this here). The comparison to the DeepSeek shock of 2025 is practically unavoidable.

Background and outlook

The market reaction reflects fundamental uncertainty about the impact of generative AI on established business models. While AI technology was initially seen as a growth driver for software companies, investors now see the risk that this technology could make existing providers obsolete.

The traditional Software-as-a-Service (SaaS) model, in which license fees are charged per user, is coming under pressure when AI tools make it possible to accomplish the same tasks with significantly fewer staff. Anthropic itself is reportedly preparing a new funding round at a valuation of over 350 billion dollars, which underscores the different valuation of AI developers compared to traditional software providers (more on this here).

Whether the price declines represent a permanent revaluation or a temporary overreaction will become clear in the coming months. What will be crucial is the extent to which established companies can develop their own AI sol