The Great Crypto Crash: October 10 as Turning Point and the Bitcoin Halving Factor

It should have turned out differently. Not only crypto analysts, but major financial institutions like Goldman Sachs and JPMorgan predicted new highs for Bitcoin in the fourth quarter — price forecasts went as high as 220,000 dollars, and Fundstrat saw the potential at 250,000 dollars half a year ago (more on that here).

But often, when many are very confident, things turn out differently. Especially in the crypto market. Instead of giving the industry a “Moonvember” (a November with prices shooting to the moon), prices for Bitcoin, Ethereum and Co are collapsing. Since Bitcoin’s all-time high on October 6 at 126,000 dollars, the largest cryptocurrency has lost 33 percent of its value within six and a half weeks — on this Friday morning, only 84,000 dollars per BTC are being paid at the exchanges.

The same applies to the entire crypto market, which alongside BTC now encompasses 9,100 different crypto assets. Since the peak on October 7 at a market cap of 4.3 trillion dollars, 33% of that has been destroyed — the market capitalization now stands at only 2.9 trillion dollars.

Earlier cycles show how severe it can get

How bad could it get? In the two previous market cycles, declines of 70 to 80 percent were seen. If that were to repeat, BTC would fall to between 25,000 and 37,000 dollars. Such a scenario would cause massive problems for leading Bitcoin treasury company MicroStrategy of Michael Saylor.

Meanwhile, crypto assets were one of the few bright spots for many in a year of continued multi-crises (Ukraine war, Gaza war, US-China conflict, Sudan war, etc.). The Bitcoin price developed strongly in year one of self-proclaimed crypto president Donald Trump and reached ever new heights — first 100,000, then 110,000, finally the area above 125,000 dollars. This also helped companies like Circle (USDC), Gemini, Bullish and several others go public.

Trump’s administration created strong impulses with several measures (stablecoin law, US securities regulator drops lawsuits against crypto companies, crypto reserve, Bitcoin for pension provisions, etc.), which not least benefited the Trump family itself quite a bit of money.

October 10 as the turning point

But ultimately, it was Trump himself who ended the crypto show. October 10, 2025 is considered the decisive turning point — just a few days after Bitcoin and the crypto market reached all-time highs. On October 10, 2025, Trump announced additional 100-percent tariffs on a range of Chinese products, beyond the already existing tariffs.

The measure came after China restricted the export of rare earths (important for high-tech products). The announcement triggered strong reactions in financial markets. For example, the S&P 500 saw 1.5 trillion US dollars in market value destroyed within minutes, and the crypto market was also shaken. BTC fell from 126,000 dollars to 110,000 dollars in the days that followed.

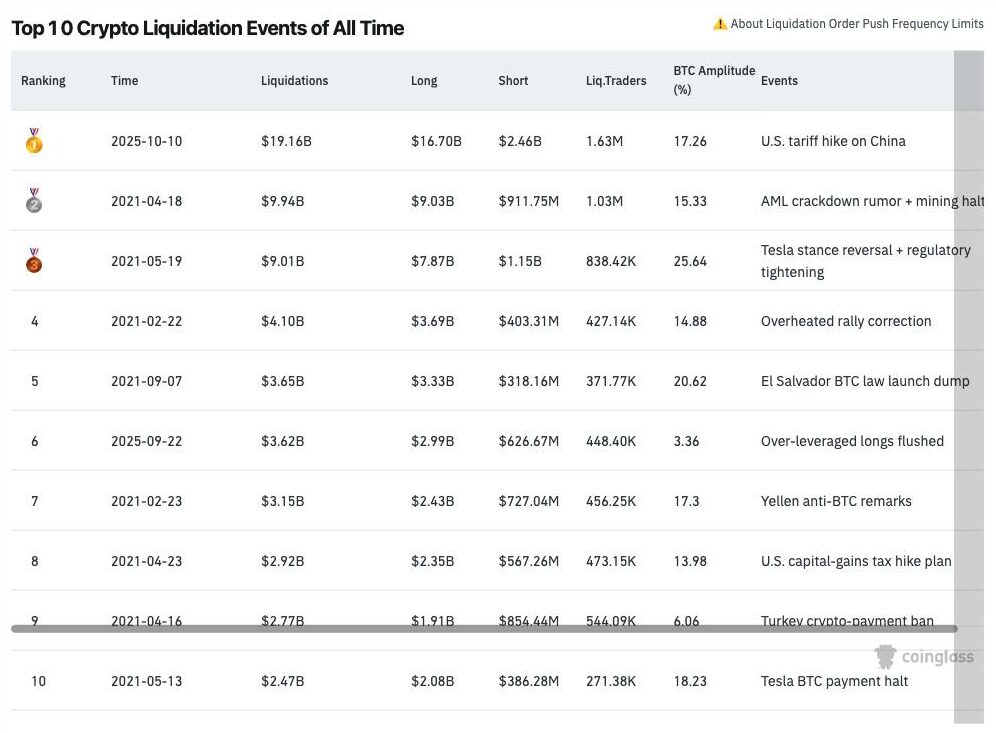

October 10 is the decisive turning point in crypto development in 2025. On this day of the flash crash, there were unprecedented liquidations totaling a hefty 19 billion dollars. Ed Prinz describes in his guest article how this October 10 crash continues to have effects today. “Markets with already thin liquidity reacted extremely sensitively. Once the first stop loss marks fell, automated liquidation systems activated and triggered a cascade effect that reinforced itself. Altcoins in particular crashed massively, as their liquidity is more fragmented and automated mechanisms take effect faster,” says Prinz.

On October 10, data from sources like Coinglass show, long positions worth almost 17 billion dollars (i.e., exchange bets on further rising crypto prices) were liquidated with massive losses for one and a half million traders. This October shock continues to this day because the market was thinned out and sentiment completely reversed.

Neither like gold, nor like tech stocks

The October 10 shock was followed by a toxic mix that ultimately triggered the larger crypto crash, sending Bitcoin below 90,000 dollars and simultaneously wiping out all gains from 2025 eliminated. Most recently, the closely watched “50 week moving averages” fell below an important mark, and for many it was clear: Now the bear market has begun, the time of Bitcoin bulls is over for now.

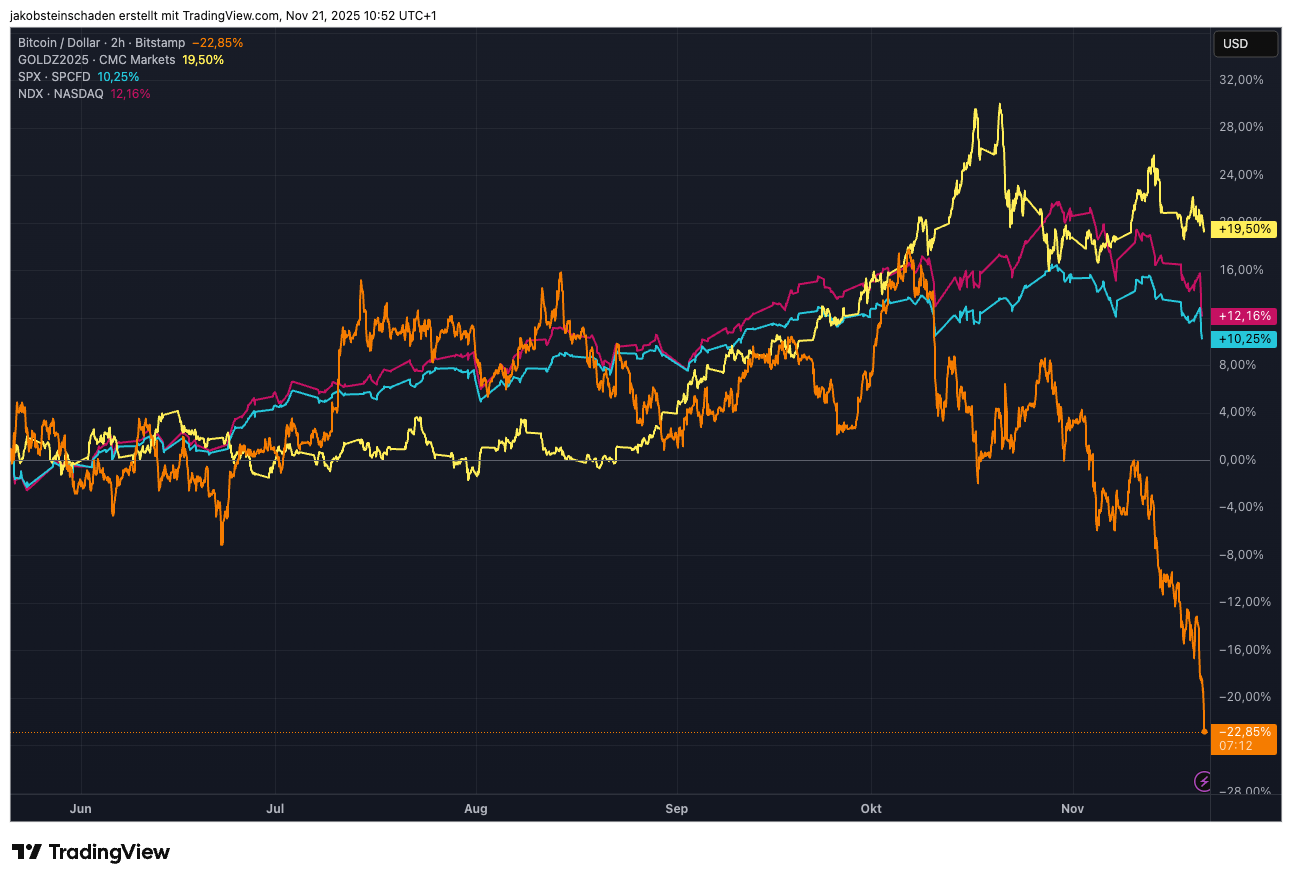

Bitcoin was certainly one of the winners of the year alongside the big topics of artificial intelligence or atomic energy. Compared to the price developments of other assets, it shows that Bitcoin behaves neither the same as gold, which reached new record values in 2025, nor the same as stocks (here compared with the tech-heavy S&P500 and Nasdaq100). Here in the comparison of the past 6 months:

Bitcoin is now 13 percent below the year-start price

What you can certainly see from the charts: Bitcoin reacts much more volatilely to certain events than other asset classes. This also refutes once again the thesis that BTC is a stable store of value and inflation hedge. Anyone who thought that in early 2025 will now be bitterly disappointed, because Bitcoin is now 13 percent below the value of January 1, 2025 and thus far below what inflation is causing worldwide.

This volatility is primarily amplified by two things: Crypto ETFs and leveraged trading. For Bitcoin and Ethereum exchange-traded funds, massive outflows can currently be observed. Overall, US Bitcoin spot ETFs have already lost around 3 billion US dollars in November. On Thursday, November 20 alone, 1.1 billion dollars were withdrawn, mainly from Blackrock’s Bitcoin ETF. This makes clear: Institutional investors no longer want BTC and Co and want to get their investments to safety before losses increase further.

Speaking of leverage trading. The decentralized exchange HyperLiquid stands as an example of one of the big trends of 2025 in the crypto industry. Leveraged trading in cryptocurrencies means that you enlarge your trading position with borrowed capital, which amplifies potential gains and losses. The trader deposits collateral (margin), and the broker multiplies the equity with the leverage, for example 10x or 50x. In leveraged crypto trading, traders usually don’t own the actual coin but only speculate on price movements, which increases profit opportunities but also risk. On HyperLiquid this Friday, you can clearly see that within 24 hours, values (mainly price bets on BTC) of 2 billion dollars are liquidated.

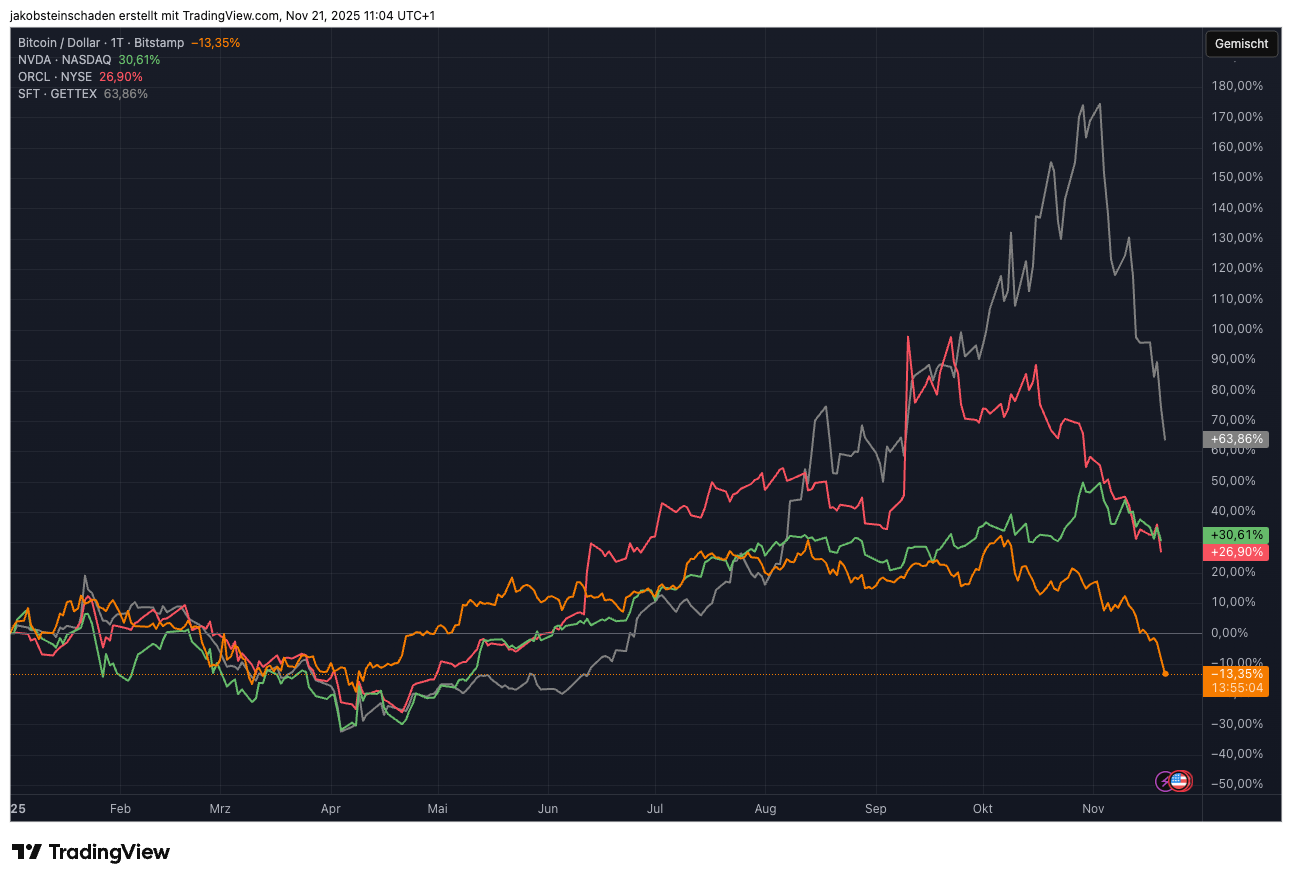

Such market mechanisms ensure that the Bitcoin price can quickly turn and then be amplified in cascades (or as today: weakened). This distinguishes Bitcoin — in a negative way — also from AI stocks like Nvidia or Palantir, which are also currently giving up significantly because fears of an AI bubble are sweeping through markets. However, neither Nvidia, nor Palantir, nor Oracle, nor Softbank are losing as strongly and as quickly as Bitcoin:

Has the 4-year cycle struck again?

What can one conclude as an interim summary? The outlook for crypto assets is difficult, after all, they would need to gain more than 10 percent from the current level just to get back to the level of the year’s beginning, and more than a third to get back toward the all-time high. Both seem unrealistic in the short term: In the US, labor market data are delayed and only come after the next Fed meeting to interest rate cuts; the China trade dispute will not ease in the foreseeable future; AI stocks are running out of steam; and so on. Bright spots on the horizon are currently hard to spot, while the crypto market continues to turn downward.

What about looking at the good old 4-year cycle? Has it been maintained again after all? The Bitcoin halving is an event anchored in the Bitcoin protocol that occurs roughly every four years, in which the reward for mining new blocks is halved. This reduces the amount of newly created bitcoins and thus decreases supply. Through this scarcity, combined with constant or increasing demand, pressure is created that historically has contributed to new all-time highs (ATHs) in the Bitcoin price. This mechanism makes Bitcoin deflationary and is seen as the main reason for the long-term appreciation of the cryptocurrency, as fewer new coins come to market and thus scarcity increases.

We remember: Historically, there were new ATHs for Bitcoin 12 to 18 months after the last halvings. The last Bitcoin halving occurred on April 20, 2024. Between April 20, 2024 and October 6, 2025, when BTC reached 126,000 dollars, there are 17 full months and half a month. If that remains the case, then the pattern has indeed repeated. In the coming days and weeks, when the dust settles and a new bottom is reached, we will know more.