Trump Promises $2,000 Stimulus: Bitcoin Jumps 4% as Crypto Markets Rally

US President Donald Trump announced a “dividend of at least $2,000 per person” from tariff revenues on Truth Social on Sunday. The payment is intended to go to all Americans, “except for high-income individuals,” as Trump wrote. The amount currently equals approximately 1,729 euros. In his post, Trump praised the US economy and claimed that tariffs would bring in “trillions of dollars,” which could soon be used to pay off the enormous national debt. “People who are against tariffs are FOOLS!” the President added.

The announcement comes at a critical time: The Supreme Court is currently deliberating on the legality of Trump’s comprehensive tariff policy. Traders on prediction markets are largely betting against judicial approval. On Kalshi, the probability of Supreme Court approval is only 23 percent, on Polymarket 21 percent. Trump posed the rhetorical question on Truth Social: “The President of the United States is allowed and fully authorized by Congress to stop all trade with a foreign country, which is far more burdensome than a tariff, and to license a foreign country, but he is not allowed to impose a simple tariff on a foreign country, even for reasons of national security?”

Investors See Stimulus Effect for Bitcoin and Stocks

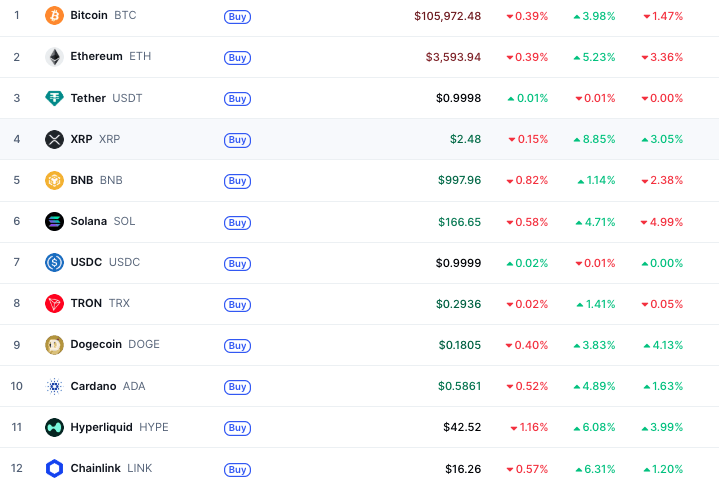

Cryptocurrency prices rose significantly after the announcement. Bitcoin climbed back to $106,000 (+4% in 24 hours), Ethereum to $3,600 (+6%), XRP to $1 (+9%). Overall, altcoins across the board saw significant gains. US President Trump himself also benefits from rising crypto prices through several companies associated with him.

Investors and market analysts are celebrating the announcement as an economic stimulus that drives up prices of cryptocurrencies and other assets. Anthony Pompliano, investor and market analyst, commented on Trump’s announcement saying: “Stocks and Bitcoin only know they must rise in response to stimulus.” Analysts at The Kobeissi Letter predict that about 85 percent of US adults should receive the $2,000 stimulus checks, based on distribution data from the COVID era. Some of the stimulus will flow into the markets and increase asset prices.

Bitcoin analyst and author Simon Dixon clearly explained the dynamics: “If you don’t put the $2,000 into assets, they will be inflated away or only serve to pay interest on debt and be sent to banks.” The announcement also comes in response to political pressure: Following recent Democratic victories in gubernatorial elections and the mayoral election in New York, criticism emerged from Trump’s own ranks that he was not paying enough attention to his core voters, whom he had promised a decrease in the cost of living during the presidential campaign.

Warning About Long-Term Inflation Effects

Despite the positive market reaction, experts warn of long-term consequences. The Kobeissi Letter emphasizes that any economic stimulus ultimately leads to fiat currency inflation and loss of purchasing power. The proposed stimulus checks will increase government debt and lead to higher inflation over time. In his post, Trump speaks of “almost no inflation,” however, price increases are proving stubborn at most recently 3.0 percent.

Additionally, there are other economic concerns: The consequences of the AI boom, such as potential mass layoffs or higher electricity prices, worry the population. In New York and other major cities, high housing costs remain a central issue. Recently, warnings about an AI bubble in the stock market have also emerged – many US citizens hold stocks, often in connection with retirement planning. Trump, however, emphasizes “record stock prices” and writes: “Record investments in the USA, plants and factories are sprouting up everywhere.”