The billion-dollar money shuffle between OpenAI, Nvidia, and Oracle

Yes, recent days have brought fantastic investment sums around Oracle, Nvidia, and OpenAI to light. At the center lies a historic contract between OpenAI and Oracle worth $300 billion for cloud computing services over approximately five years, beginning in 2027. This amounts to an average of $60 billion per year—more than the gross domestic product of many countries.

This deal is part of “Project Stargate,” an initiative to build data centers that require as much energy as four million households (approximately 4.5 gigawatts, equivalent to two Hoover Dams). The agreement secures OpenAI the necessary computing capacity for larger AI models and global expansion.

The impact was immediately felt:

- Oracle shares rose 36%, the best day since 1992

- Oracle co-founder Larry Ellison briefly became the world’s richest person through an $88 billion wealth increase

- Oracle’s cloud revenues have already risen 77%

- Nvidia’s stock price increased 4%, corresponding to a $170 billion market cap gain

It should be noted that these are press releases and letters of intent.

Nvidia and Oracle as Leverage Against Microsoft

Oracle will need to make massive hardware investments to implement the OpenAI deal. According to the Financial Times, Oracle plans to spend around $40 billion on Nvidia chips, including approximately 400,000 of the most powerful GB200 chips. These will power the new data center in Abilene, Texas—a central component of the US Stargate project.

While these deals are said to complement existing OpenAI partnerships with other tech giants like Microsoft and SoftBank, it’s also clear that OpenAI can thus distance itself from Microsoft’s cloud. It’s now known that Microsoft will hold about 30 percent of OpenAI, having already invested approximately $13 billion in the ChatGPT maker as an early investor.

In parallel, we see that Microsoft has already abandoned OpenAI exclusivity and incorporated AI models from companies like Anthropic, Meta, or xAI into its offerings and some of its products.

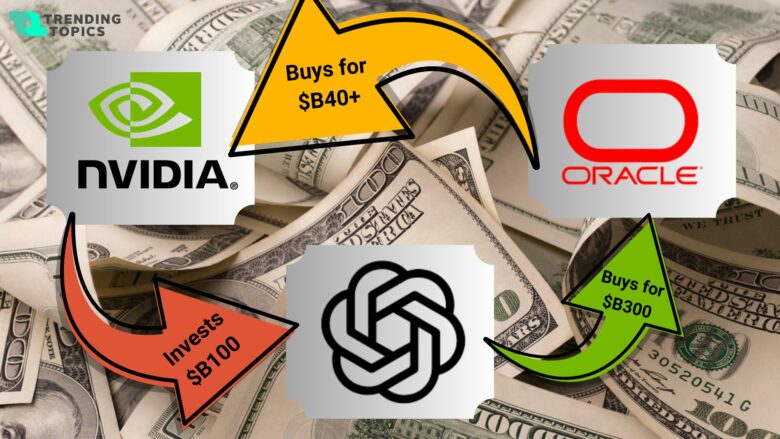

A Remarkable Cycle

What makes these business relationships particularly fascinating is the emerging money cycle:

- Nvidia invests in OpenAI: Nvidia announced a $100 billion investment in OpenAI, beginning mid-2026; Nvidia will invest $10 billion at a time in OpenAI

- OpenAI pays Oracle: OpenAI uses funds to pay Oracle for cloud services ($300 billion over 5 years)

- Oracle buys from Nvidia: Oracle in turn invests billions in Nvidia chips. $40 billion alone is earmarked for the Texas data center

This triangular system creates a kind of closed loop where the three technology giants are simultaneously customers, suppliers, and investors for each other.

Strategic Significance

These agreements go far beyond normal business relationships. They create an integrated ecosystem that:

- Provides planning security for all parties involved

- Strategically leverages technological dependencies

- Optimizes capital flows and distributes risk

- Secures market dominance in AI infrastructure

The Stargate project, involving all three companies, underscores the collaborative nature of these relationships and strategically positions the US in global AI competition.

Conclusion

What appears at first glance to be separate business deals reveals itself as a sophisticatedly orchestrated network of mutual dependencies. Nvidia, Oracle, and OpenAI have created a system where each partner is a customer, supplier, and/or investor of the others.

Aus Datenschutz-Gründen ist dieser Inhalt ausgeblendet. Die Einbettung von externen Inhalten kann in den Datenschutz-Einstellungen aktiviert werden: