Bitcoin climbs back to $91,000 amid hopes for US interest rate cut in December

Bitcoin reclaimed the $91,000 threshold on Wednesday, ending a phase of significant price volatility. The cryptocurrency posted a 4.5 percent gain within 24 hours, reaching $91,755. The recovery marks a rebound from a dip to roughly $81,000 the previous week. Trading volume surged to $114 billion – more than double the prior day’s level.

From the all-time high of $126,080 reached in October, Bitcoin currently sits roughly 29 percent below peak. The past weeks have been marked by substantial losses that temporarily wiped out all gains from 2025.

Institutional Interest and Monetary Policy in Focus

Market observers cite waning institutional interest and uncertainty surrounding US Federal Reserve policy as the main drivers of the preceding crash. During an October price collapse, open-interest positions worth $19 billion were unwound. In total, Bitcoin derivatives worth approximately $335 million faced liquidation.

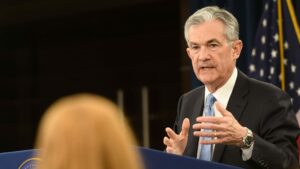

Vincent Liu, Chief Investment Officer at Kronos Research, characterizes the current move as a technical rebound. Broadly elevated risk appetite across markets is supported by an 80-percent probability of a Federal Reserve rate cut in December. According to CME FedWatch Tool data, this probability stands at 84.7 percent. Fed Chair Jerome Powell previously offered no clear guidance on further rate cuts, creating additional uncertainty.

Positive signals extend beyond cryptocurrencies: US equity markets also posted gains – the Dow Jones Index rose 0.67 percent, the tech-heavy Nasdaq 0.82 percent. Other cryptocurrencies advanced as well. Ethereum climbed 2.8 percent to $3,038, XRP gained 1.6 percent to $2.22. Solana posted a 2.9 percent gain to $143.26, while BNB jumped 3.9 percent to $897.90. The broad market movement signals stabilizing investor sentiment.

Further Developments Remain to Be Seen

Whether the recovery proves sustainable or merely interrupts a longer-term downtrend remains uncertain. Analysts are closely monitoring inflows into exchange-traded funds (ETFs), positioning in derivatives markets, and institutional capital flows to assess the path ahead.