Cloover: Berlin Fintech for Energy Transition Secures €1 Billion in Financing

It’s one of the largest financings Europe has seen not just in the ClimaTech sector, but across the board in recent years: Cloover from Berlin, specialized in financing solutions for PV systems, heat pumps and more, is bringing in around one billion euros (1.2 billion dollars) in a mix of debt and equity from investors and a major European bank – plus a guarantee from the European Investment Fund (EIF) worth 300 million euros. 22 million US dollars in equity come from VCs (lead investors: MMC Ventures, QED Investors); the debt facility amounts to 1.2 billion US dollars.

The big goal: More than eightfold revenue growth by 2026, with projections reaching a hefty 500 million US dollars in sales for that year. Cloover sees itself not as a competitor to Enpal or 1Komma5°, which sell directly to end customers, but as a B2B partner for installers who need an end-to-end software platform to optimize sales, financing, and operation of PV systems, heat pumps and more in private homes.

In the interview, CEO and co-founder Jodok Betschart (who previously built the EventTech startup Evenito) discusses the financing, what will happen with it, what partnership he has closed with Austrian startup Heizma, and how he sees the role of renewable energy in the AI age alongside nuclear power:

Jodok, first explain to us: What is Cloover and what can it do?

Jodok Betschart: We started Cloover a little over two years ago with the goal of advancing the energy transition and enabling every household to become energy independent. Since AI has taken over the world, it’s become clear that we need to expand energy supply and make energy available more efficiently and cost-effectively. We want to enable every household to become energy independent with just a few clicks and without upfront investment.

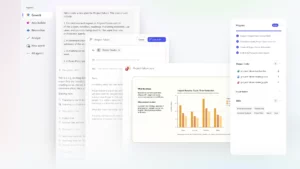

We’ve built an AI operating system that helps installation companies work more efficiently and network better – with manufacturers, households, energy providers, and investors. This allows us to offer energy installations or renovations for 100 to 150 euros per month. We combine AI workflow tools, financing, energy, and procurement in one platform.

Trending Topics: You just received financing of 1.22 billion US dollars – an impressive sum. How is this structured?

Jodok Betschart: We raised 22 million US dollars in equity in our Series A, with QED and MMC as co-leads, followed by Bosch Ventures, BNVT, Lower Carbon, Earthshot Ventures, and CentroTech. At the same time, we secured 1.2 billion US dollars as a debt facility.

We use these 1.2 billion to finance installations and offer them to households as monthly installments – financed for 100 or 150 euros per month over 25 years. This way, every household has access to these installations without having to wait until they’ve saved up the money. Additionally, we received a 300-million guarantee from the European Investment Fund – the best government backing you can get.

So you’re solving one of the fundamental problems of the energy transition: high acquisition costs. It’s like with cars – you finance it instead of buying it outright?

Exactly, very well put! In the automotive sector, it’s completely normal that over 80 percent of all cars are financed. Exactly the same thing is now happening in the renewable energy sector. We can offer these systems for 100 to 150 euros per month because we can finance them over 20 to 30 years.

Nowadays you often combine multiple systems: solar system, battery, heat pump, maybe an air conditioning unit plus energy-efficient renovations. That quickly costs 30,000 to 50,000 euros. Not many households have that cash available immediately. With our financing, they can start right away, have full flexibility, and can exit anytime if, for example, they inherit money or get another loan.

Are you ClimaTech or more Fintech?

We’re a hybrid model that combines climate, fintech, and AI operating systems. We spoke with over 100 installation companies and quickly realized: with a pure software solution, you don’t solve the right problems. No installer just needs a better planning solution – they need help with liquidity to finance end customers and reach new markets.

We started with working capital and end-customer financing and then expanded: from lead generation through closing to system monitoring. Only with this combination can you really solve the pain points of installation companies and the entire value chain.

Do end customers come directly to you or does everything go through the installation companies?

We don’t go directly to the end customer because we don’t want to compete with installation companies. We focus entirely on supporting installation companies so they can work more efficiently and compete against the big players.

The installation company – usually very local and regional – goes to the house on-site, convinces the owners, and then uses the Cloover platform for closing, planning, and further steps. We have an indirect B2B2C approach and connect installation companies with the various stakeholders in the value chain.

What is your concrete business model?

Our main revenue comes from installation companies. We charge a software platform fee, and the end customer naturally pays interest over a term of up to 25 years. We have a mix of software platform fees, interest rates, and additional elements like fully integrated insurance and energy contracts. But the main revenue right now is software fees from installation companies.

You have an AI-powered credit system that doesn’t rely solely on traditional creditworthiness metrics. How does that work?

That’s one of our main differences from traditional banks. A bank looks at the past and credit rating possibilities. We, on the other hand, also look at future energy gains and savings. We know the assets, the installers, have access to the performance of installed systems, and can precisely estimate how much a household will save.

We have the ability to factor in future energy savings alongside normal credit information. This allows us to offer an installment purchase model to customers who wouldn’t be financed by a normal bank – such as self-employed people or retirees who still own a house. Our acceptance rate is much higher than traditional banks, and we have very low default rates.

You have a cooperation with Austrian startup Heizma. What does such a partnership look like in concrete terms?

Heizma is one of the best heat pump installers in Austria and our first customer in the Austrian market. They use the Cloover platform and can now offer an installation that costs 30,000 to 40,000 euros for 100 to 200 euros per month.

When Heizma is on-site with the customer, they use our platform, ask a few questions, and our AI-based underwriting model gives a decision in real time: how we can finance the person, for how long, and on what terms. This gives Heizma the opportunity to close customers who might otherwise have been left behind. Already in December, we were able to make many closings with customers who wouldn’t have gotten a loan from a bank.

How do you differentiate yourselves from competitors like Enpal or 1Komma5°?

Enpal and 1Komma5° do a great job, and we need them in the market. But we actually need hundreds, if not thousands of such providers. We support every small and medium-sized company so they can keep up with Enpal and 1Komma5° and have the same opportunities.

90 percent of all installations are still done by local, regional companies, only about 10 percent by the big players. The most scalable way is therefore to support existing companies and make them more efficient. We don’t want to buy up installation companies or store hardware ourselves. We just want to optimize the value chain – with financing, procurement, installation efficiency, and energy management.

What role does AI play for you specifically?

AI is extremely important at different levels: in procurement, financing, installation efficiency, and performance optimization of energy components. We use OpenAI, Google, and others in the background and build our own AI models based on that.

We’ve invested heavily in talent, a very strong CTO with 20 years of AI experience, many senior people in the Berlin office. With AI, you can work much more efficiently. You need fewer junior people who just execute code, but more experienced people who know how to combine these elements. That’s a main reason why we raised the 22 million in equity.

What can such an AI operating system for energy accomplish in the future?

We already offer an energy management system that coordinates different assets like solar systems, batteries, and heat pumps. But the potential is much greater. Ultimately, every household should be an independent producer, consumer, and market participant.

You can then build a virtual platform, control these assets in a coordinated way, and have them participate in the market. Energy has become a strategic resource through AI. We want to offer solutions along the value chain: in procurement, installation, the sales process, and the management of thousands of assets. That’s very complex, but that’s exactly our approach.

You had around 8 to 9 million euros in monthly revenue in 2025 and want to reach a run rate of 500 million in 2026. How will that work?

The 8.5 to 9 million by the end of December (meaning MRR, note) corresponds to an annualized revenue run rate of almost 100 million. By the end of 2026, we want to reach 35 to 40 million per month, which then gives us the 500 million run rate. We almost increased tenfold in 2025 and grew profitably. A fourfold increase in 2026 is definitely achievable.

Many talk about a downturn in the solar industry. How do you see that – especially with regard to the nuclear renaissance in the wake of the AI wave?

We need all energy components – nuclear power plants and renewable energy. They’re not mutually exclusive, but complementary. Nuclear expansion will take another 20 to 30 years. Over the next 20 to 30 years, we need strong expansion of renewable energy capacity: solar, heating, cooling.

Over the next 10 to 20 years, we’ll need millions of air conditioning units because it’s getting hotter and productivity is declining. Many companies are evolving from pure roof installers to holistic energy providers that combine different elements. We support this with our solution – so that a roof installer becomes a comprehensive energy provider.

Thank you for the exciting insights, Jodok, and continued success!

Thank you – I really enjoyed it!