Emerald Horizon: Austrian SMR Builder Raises at a Valuation of €790 Million

Austria is witnessing the emergence of an international-scale financing round. The Graz-based company Emerald Horizon, founded in 2019 and specializing in the development of so-called Small Modular Reactors (SMRs), is currently setting up a financing round at a valuation of 790 million euros.

Emerald Horizon CEO Florian Wagner confirmed this to Trending Topics — and also that a sum in the single-digit millions has already been raised, with strong global interest (e.g., from Southeast Asia or the Middle East) in investing higher double-digit million sums into the Graz-based company. The company valuation is extensively justified in a 68-page document; initial investors have already come on board at this valuation. The capital round is divided into two parts: the first part for Austrian investors is complete, and now comes the part for international investors, also at the 790 million euro valuation.

Emerald Horizon develops thorium-based mini nuclear power plants that, in container-sized modules, are intended to supply electricity as Energy-as-a-Service to corporate customers at very low prices.

In recent weeks, Emerald Horizon has hosted delegations from the Malaysian royal family, Oman’s energy ministry, and Saudi Arabia’s ministry of investment. Global interest in SMRs is driven by two major trends: on one hand, they can help enable CO2-free energy supply; on the other, there is massive demand for new energy sources due to the massive expansion of AI data centers not only in the USA but also in the Middle East, Asia, and Europe. The recent entry of former Austrian National Bank chief Robert Holzmann into Emerald Horizon would boost the confidence of potential investors (more on that here).

SMR Sector Gaining Momentum from AI Boom

Closing deals is currently not easy, however. “You have to talk to 100 investors so that maybe two actually come on board. Interest is huge, but closing the deal is much harder,” Wagner tells Trending Topics. Given the current state of the young SMR industry, he remains optimistic: numerous competitors have received high funding sums this year, including Valar Atomics (130 million dollars), Aalo Atomics (100 million dollars), TerraPower (650 million dollars), and Radiant (165 million dollars).

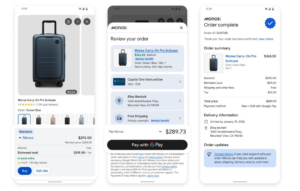

Emerald Horizon pursues an unconventional business model. Instead of selling the SMR modules, they remain the company’s property. “We don’t charge a purchase price. We finance that separately and only charge Energy as a Service,” Wagner explains. The price is intended to be 8 to 10 cents per kilowatt-hour of electricity. For comparison: the electricity price in Austria currently averages around 30 cents/kWh.

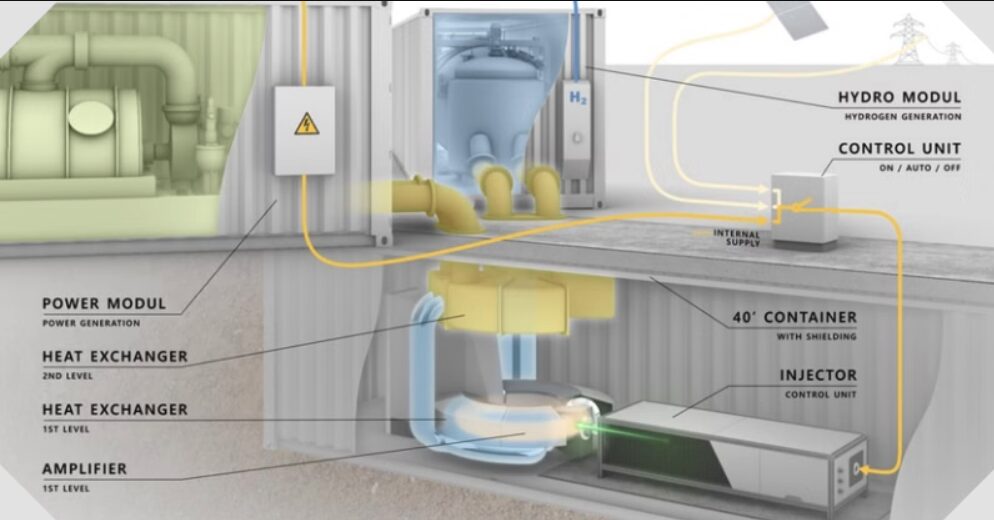

This model offers several advantages: “You always maintain control over your modules. You already protect yourself legally against the customer dismantling them or causing trouble, because they’re our modules.” At the same time, the due-diligence problem shifts to the manufacturer: “Whether it runs for five years or 20, that’s our problem, not the customer’s.” The company handles installation, supply, and operation of the reactors. Customers pay only for electricity actually produced. This is how the mini-reactor called ADES (Accelerator-Driven Energy Source) is supposed to work:

Molten Salt and Thorium

The functioning of Emerald Horizon’s SMRs differs fundamentally from conventional reactors. The system is based on thorium in molten salt, activated by a neutron accelerator, not by a critical chain reaction. “When the neutron generator is switched on, the neutrons hit the thorium. It breaks apart and this heats the salt,” Wagner explains in simplified terms. The heat is stored and can be converted on demand into electricity, process heat, or hydrogen. The centerpiece is a molten salt storage system operating at 550 degrees Celsius.

The decisive advantage: “The most important aspect of SMRs won’t be the technical question, but the regulatory question,” Wagner emphasizes. “Because you don’t need uranium-235 to generate neutrons, no trans-uranic waste and no weapons-grade plutonium are produced.” This goes over well with regulatory authorities.

Another advantage is that this process produces no thallium — a problematic substance with hard gamma radiation that occurs in conventional thorium reactors. “That only happens when you combine it with neutrons from uranium. With neutrons from the accelerator, no thallium is produced,” Wagner explains.

VDL Groep as DeepTech Partner

Raw material supply is unproblematic: thorium is a byproduct of rare earth mining and is often considered waste. “The amount you need is so small it’s negligible. One module needs 340 kilos and runs for 20 years.” Emerald Horizon pursues a multi-stage product strategy. The molten salt storage system developed for the SMRs will come to market as a standalone product in 2027, including for photovoltaic systems. By 2030, the SMRs are then to reach the market.

“All key components already exist in real form,” Wagner says. “They’re now being optimized, subjected to stress tests, and then brought together.” Emerald Horizon has secured Dutch company VDL Groep as its manufacturing partner. “That’s the ultimate deep-tech partner,” Wagner says, as the Dutch technology conglomerate VDL, with 16,000 employees, specializes in co-development. VDL is known, for instance, for manufacturing nanometer lithography machines for ASML — supplying a very important component for the global chip industry.