For the First Time, a “Big Three” Agency Rates a Bitcoin-Based Company – with Junk Status

For the first time, one of the “Big Three” rating agencies, namely Standard & Poor’s (S&P), has evaluated a company whose business model is substantially based on Bitcoin holdings. Whether this is cause for celebration, however, is doubtful. S&P Global Ratings has assigned Strategy Inc (MSTR)—the world’s largest Bitcoin treasury company—a “B-” Issuer Credit Rating. This B- rating falls within the non-investment-grade range, colloquially also referred to as “junk bonds.”

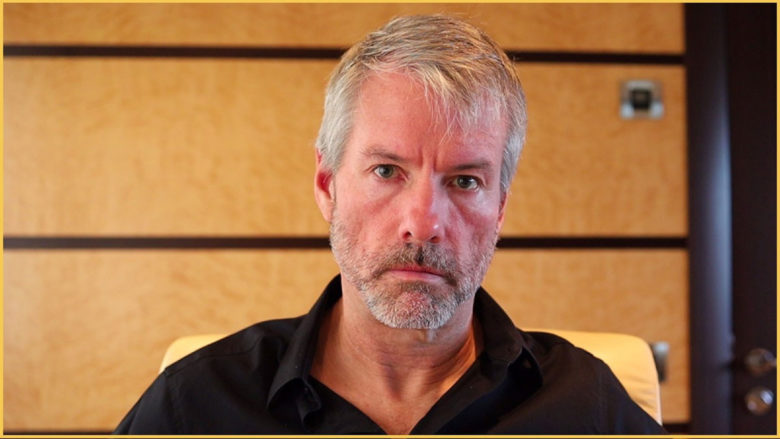

Strategy Inc (formerly known as MicroStrategy) has transformed under the leadership of Bitcoin evangelist Michael Saylor from a software company into a Bitcoin treasury corporation that systematically accumulates Bitcoin through the issuance of stock and bonds. With Bitcoin holdings (640,800 BTC) currently worth approximately $73 billion USD, the company is the spearhead of a new corporate category. The market capitalization currently stands at just under $85 billion USD.

However, S&P identifies the extreme Bitcoin concentration as a significant weakness. “The high Bitcoin concentration, narrow business focus, weak risk-adjusted capitalization, and low US dollar liquidity” weigh on the rating, according to the analysts. Particularly problematic: The company primarily holds Bitcoin, while debts, interest, and dividends are due in US dollars. This represents a fundamental currency mismatch.

Negative Capitalization Under S&P Methodology

The assessment of the capital structure is particularly drastic. S&P points out that Strategy shows significantly negative total capital under their risk-adjusted capital (RAC) methodology. Since the rating agency deducts Bitcoin holdings from equity—justified by the “significant market risk that does not correlate with traditional market risks”—a negative capital base results as of the second quarter of 2025.

Additionally: The company generates virtually no operating cash flow. In the first six months of 2025, operating cash flow was negative at minus $37 million. Of the $8.1 billion in pre-tax profit, over $8.1 billion came from Bitcoin appreciation—the small software business is running at break-even at best.

Convertible Bonds as a Sword of Damocles

S&P sees liquidity risks in the outstanding convertible bonds of over $8 billion, of which $5 billion are currently “out of the money” and mature starting in 2028. The analysts warn: “There is a risk that the convertible bonds mature precisely when Bitcoin is under severe stress.” This could force Bitcoin sales at rock-bottom prices or a restructuring.

Additionally, the preferred stock dividend of over $640 million annually burdens liquidity. While Strategy can defer dividends, perverse incentives would exist: If payment is deferred for four quarters, preferred shareholders receive seats on the board of directors.

Strengths: Market Access and Debt Management

S&P positively evaluates the “strong access to capital markets” and “prudent management of the capital structure.” Strategy has deliberately placed no maturities in the next 12 months and finances itself primarily through equity. The market capitalization of approximately $80 billion provides considerable flexibility.

“The company is unique in its scope,” S&P notes. While the strategy is public and easily replicable, Strategy offers investors established access to indirect Bitcoin exposure through convertible bonds, preferred stock, and common stock.

The rating agency also highlights elevated cybersecurity risks: If private keys to digital wallets are lost or stolen, Strategy could lose access to Bitcoin. While the company diversifies across multiple institutional US custodians, insurance covers only a fraction of the total value.

Outlook: Stable, but Limited

The stable outlook is based on the expectation that Strategy will continue to handle maturities prudently and maintain capital market access. A downgrade threatens if market access becomes difficult or debt management problems arise. An upgrade appears unlikely in the short term and would require improved dollar liquidity, reduced use of convertible bonds, and proven crisis resilience.

S&P acknowledges Strategy as an innovative pioneer but sees significant structural weaknesses in the Bitcoin concentration, negative capitalization under its own methodology, and liquidity risks. The B- rating reflects the tightrope walk between visionary strategy and financial risk.