European Startup Associations Call For United Tech Of Europe After Brexit

Friday, the 31st of January 2020 – the last day of the United Kingdom as part of the European Union. What will that mean for the digital society and economy, and for European tech ecosystems? With the UK being the most vibrant startup ecosystem throughout Europe, attracting founders from all over the union, and … there are many uncertainties that might occur. But also opportunities for policy change and more coordinated actions.

Here’s the original text that the Bulgarian Startup Association (BESCO) sent us, signed by thirteen European tech and startup associations from ten countries (see list below):

London is Europe’s most attractive city for investment in tech industries and startups. Since the British people voted to leave the EU in 2016, repeated extensions of Brexit have only further drawn out the uncertainty felt by the European Tech ecosystem. Would London remain the hub of European startups after January 31st? At the moment, Germany seems next in line for the European startup throne, having overtaken France in terms of investment in its startups.

Instead of engaging in a horse race between London, Paris, Amsterdam , Berlin and other European hubs, we believe in a more positive vision for our continent: the time has come to strengthen Europe as a startup powerhouse and become the “United Tech of Europe”.

Keep data flowing freely

We refuse to see the new relationship with our British friends as a competition. We believe that our ecosystem needs a large unified digital single market to produce Tech giants. UK startups would lose a lot if their political leaders were to turn London into a haven for deregulation. European regulations like GDPR might be tough to implement but we hope that the UK will recognise the importance of data flowing freely between our scale-ups, on a continental level. If transferring data across borders becomes more problematic after the UK leaves, it will severely harm the level-playing field we need to scale our companies, particularly AI startups and platforms. Startups need proper and reliable data adequacy arrangements between the UK and the EU.

Open the doors to talent

International talent is one of the driving forces behind the UK’s startup success story. By leaving the EU, concern about freedom of movement, visa and immigration regulations will make it difficult for the UK to hire foreign workers. France and the Netherlands recently announced key measures to become hotbed locations for international talent. It included “Tech Visas” that make it easy for any tech talent across the globe to join our startup ecosystems in less than 2 weeks with their families. France recently announced that any tech company is now eligible for these attractive visa schemes.

EU leaders need to adopt similar measures for a United Tech Europe. Re-routing the vital source of highly-skilled labour to several different European hubs will require key reforms. The complex recruitment processes and limited work permits, which vary between countries, should be simplified with the creation of a European Startup Visa.

● A unified share option scheme should be established for startups to support their global reach and facilitate competition with larger corporate players and other global startup-ecosystems. This scheme would give startups and scaleups the opportunity to issue standardised share options across the 27 countries of the EU.

Break down barriers to investments

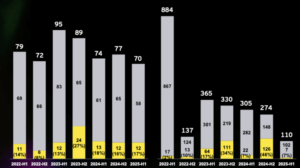

UK startups can claim an Olympic gold medal for tech investment: 11.43 billion euro raised in 2019, accounting for a third of Europe’s total. French Tech (€5.03 billion) and Germany, (6.09 billion) lag behind. Brexit is a massive wake-up call for the European tech investment scene,

which is still fragmented and suffering from a lack of integration: a major reason behind the lack of transnational investment in startups. French and German ecosystems’ heavy reliance on domestic investors proves that Europe is still far from being a “Digital Single Market”. In France 73% of investors in AI startups are French. In Germany, 64% are German. In parallel, European investors represent 16.5% of foreign investors in AI in France and 17% in Germany. EU’s financial institutions have a historic opportunity to achieve a “ Capita Union”, taking appropriate measures to develop pan-European funds and fostering cross-border investments.

The top 100 US companies invest six times more in their local startup ecosystem than their European counterparts. The recent acquisition of the European car sharing leader Drivy by an American company demonstrated the lack of ambition of large European corporations in the mobility sector. Building European tech giants will require clearing the path to “Exit”, through acquisitions or IPOs. The EU has some twenty different stock markets and a number of European entrepreneurial success stories have chosen to be listed on the NASDAQ rather than here at home. Given the importance of the London Stock Exchange (LSE) on the European and world stages, Euronext’s acquisition of the Irish stock exchange in 2018 was part of a wider plan to attract companies that might rethink their London listings in the wake of Brexit. By unifying the European capital markets, our leaders could pave the way to a stock exchange specifically dedicated to the valuation of technological players – a European NASDAQ.

Brexit has created a unique momentum for policy change. Our ambition is to overcome the patchwork of national regulations and clear the way for European-born Tech giants. Today, we join forces and call for the “United Tech of Europe” – with or without the UK. United we stand, divided we fall.

The position is signed by:

Nicolas Brien, France Digitale; Christian Miele, German Startups Association; Simon Schafer, Startup Portugal, CEO Factory.com; Martin Uhnak, Sapie The Slovak Alliance for Innovation Economy; Markus Raunig, Austrian Startups; Ricardo Marvão, Beta-i Jan Bormans, European Startup Network; Ivan Vasilev, BESCO The Bulgarian Startup Association; Bas Beekman, StartupAmsterdam; Benedikt Blomeyer, Allied for Startups; Peter Kofler, Danish Entrepreneurship Association; Augustin Jarak, Startup Croatia; Liz McCarthy, Scale Ireland.