HyperLiquid: Stablecoin strategy drives HYPE token to new heights

HyperLiquid, a decentralized exchange (DEX) for derivatives trading, has established itself as a dominant player in the DeFi sector and is now planning to launch its own stablecoin. This development has led to significant price movements of the native HYPE token and has attracted the interest of institutional partners.

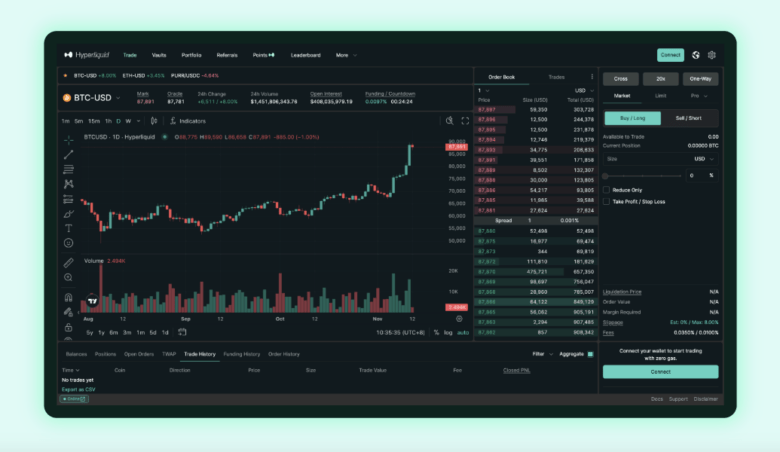

HyperLiquid is a special kind of decentralized crypto exchange (DEX): With its own Layer-1 blockchain and the native HYPE token, the project attempts to combine the performance of centralized exchanges with the advantages of decentralized systems. Moreover, HyperLiquid focuses heavily on leverage trading. The DEX allows leverage of up to 40x, which can result in high gains but also particularly high losses. This is likely to attract especially risk-affine professionals who, particularly in the current bull market, enjoy placing bets on price developments of crypto assets.

HyperLiquid’s Market Position

HyperLiquid currently controls approximately 70% of the decentralized perpetual futures market and records a monthly trading volume of almost $400 billion in derivatives as well as $20 billion in spot trading. According to DeFiLlama data, the platform generates approximately $106 million in revenue. Of the $5.6 billion in stablecoins on the platform, 95% consists of USDC.

USDH: Stablecoin Initiative as Alternative to USDC

Last Friday, September 5th, HyperLiquid announced plans for its own stablecoin called USDH, which is intended to serve as a “HyperLiquid-first” alternative to bridged assets like USDC. The selection of the stablecoin provider will be made through a stake-weighted validator vote on September 14th.

Competing Providers Four teams have submitted proposals for USDH:

- Paxos Labs: Offers a regulatory-compliant stablecoin according to the US GENIUS Act and EU MiCA framework, with 95% of interest earnings intended to be used for HYPE token buybacks

- Frax Finance: Details of the proposal were not further specified

- Agora: Also plans to use earnings from US Treasury reserves for HYPE buybacks or the Assistance Fund

- Native Markets: A HyperLiquid-native team

Circle’s USDC Integration Parallel to the USDH initiative, Circle has announced the introduction of native USDC and the Cross-Chain Transfer Protocol Version 2 (CCTP V2) on HyperLiquid. This integration is intended to enable institutional on- and off-ramps via Circle Mint and strengthen the platform’s liquidity. The publicly traded company and issuer of USDC apparently has no intention of surrendering HyperLiquid to an alternative stablecoin without a fight.

Therefore, CCTP V2 was now launched on short notice – with the promise that it would enable seamless USDC transfers between HyperLiquid and other supported blockchains with capital efficiency, without relying on wrapped tokens or legacy bridges.

Impact on the HYPE Token

Since the stablecoin announcement on Friday, the HYPE token has risen by approximately 12% to more than $50 per token and is trading only 2.3% below its all-time high of $50.99. The planned buyback mechanisms of various USDH providers could create continuous demand for HYPE tokens.

The USDH plans aim for compliance with the world’s leading regulatory frameworks. The US GENIUS Act and the EU MiCA framework create clearer rules for dollar-backed tokens, which could provide competitive advantages to compliantly designed stablecoins.