Adapting To The New Situation: 7 VCs From The Region Share Their Priorities And Near Future Plans

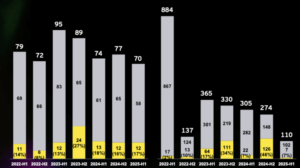

The projected decline of venture capital financing in Q1’20 will be the second steepest quarterly decline in the past ten years after the Q3’12 36% drop, states a recent analysis by CB Insights. The intelligence platform bases this prediction on data from the past four quarters. Private market funding in the first quarter of 2020 is on pace to reach $77B, more than 16% down compared to the last quarter of 2019, and nearly 12% down in comparison to the same time last year. A slowdown is predicted. “Private financings could soften significantly, as happened in 2001 and 2009,” is the exact way Sequoia Capital put it in a note to its founders some weeks ago. Postponing fundraising efforts and even examining EU-aid options is what CEE fund LAUNCHub Ventures advised portfolio companies recently.

Although VC is a long game and short-term optimizations are rarely the success or failure factor, venture capitalists will do have to adjust to the situation too. Some LPs already share concerns. One good thing in the CEE region is that still the participation of institutional LPs whose cash depends strongly on public markets in the VC industry is low, and at least the surge of the capital markets on global will have less impact. Yet although most of the funds we asked are open for business, it’s not all roses – the launching of long-expected funds in the region (like 500 Startups Istanbul) is postponed, valuations are expected to go down making the price of the capital less attractive for founders, and the early-stage founders are expected to suffer most.

We’ve asked VCs from Bulgaria, Romania, Greece, and Turkey, most of who have regional focus to share how the situation is affecting their business, what are they planning to do, and what are their forecasts .

DANIEL LORER, BRIGHTCAP VENTURES

Brightcap Ventures is a €23M seed and startup fund, focus on Bulgarian companies

Trending Topics: How is the Coronavirus crisis affecting the VC industry and your business and plans in particular?

Daniel Lorer: The COVID-19 crisis is now a global emergency of unprecedented dimensions. It has reached every corner of the planet in weeks. Will it fold back just as fast? We don’t know yet, and everyone is asking themselves the same question. The VC industry is tightly correlated with, but lagging behind public markets. Public markets bear the initial impact of market-making events, whereas private equity in general, and venture capital in particular, feel their impact a bit later. So undoubtedly, the VC industry will be under strain as any other industry on the planet.

Are you planning on freezing investments? If so, for how long?

We are not planning a freeze at present. The situation may slow us down, but we know that a lot of extraordinary companies are born in difficult times- so we keep looking.

How are your LPs reacting?

Our anchor investor, the EIF, will likely be one of the institutions tasked by the EC with the recovery of the small and medium sector after the crisis. If anything, the current situation will only make their resolve stronger. Mature investors know that crisis, while being super disruptive, also provides significant investment opportunities – for the public, but also for the private markets.

Are you considering channeling investments into areas such as digital health and biotech solutions or anything else?

These are promising sectors, but the current emergency has not changed our outlook.

How do you think the VC industry will react and are you expecting a change of focus?

We expect that most of the VCs will pivot their attention during the next few months towards supporting existing investments – making sure they can continue to operate after the crisis.

Which types of startups will be most affected?

We can already see the challenges of mature travel, hospitality, sports, and events companies, and B2C startups in these segments will likely be affected first. Who’s next – probably the right question to ask is who’s not?

What are your expectations regarding valuation adjustments?

They will come down, which should stimulate the appetite for deals among long-term investors.

_________

ZLATOLONA MUKOVA, NEW VISION 3

New Vision 3 is a €23M fund, specialized in the areas of fintech, blockchain, circular economy and AI, seed and startup stage, focus Bulgaria

Trending Topics: How is the Coronavirus crisis affecting the VC industry and your business and plans in particular?

Zlatolina Mukova: We are trying to keep to our original plans and adapt to the new challenges. This is not always possible because some of our portfolio companies are having a hard time – withdrawing investors, a sharp decrease in sales volume, lack of supplies of equipment, etc.

Are you planning on freezing investments? If so, for how long?

We are not planning to freeze investments as long as our LPs are in good shape and continue supporting us. Moreover, we have to find additional resources to support companies until private investors step in.

How are your LPs reacting?

They are advising us to be cautious, but also look for and grasp any opportunities.

Your fund is required to have private co-investors in every deal. Is that going to be a problem?

We can expect problems on the deal level, but we expect even more serious problems at fund level. We are happy that we were able to finalize the first three deals of New Vision 3 Fund where our investment was matched 1:1 with private money.

Are you considering channeling investments into areas such as digital health and biotech solutions or anything else? How do you think the VC industry will react and are you expecting a change of focus?

We will consider a change in focus as long as we find attractive opportunities. Digital health might be such area, but there are many other areas related to information analysis, personal data, online shops, digital services, video streaming, media platforms, etc. which are evidencing a substantial increase in demand already.

Which types of startups will be most affected?

It depends on how long it will take to overcome the pandemic. In terms of stage of development, startups in the “Valley of death” which are not supported by their existing investors. In terms of sectors, startups selling hardware to businesses, startups supplying goods and services to the tourist industry, automotive and airline industry, and many others, it is difficult to predict at this stage.

What are your expectations regarding valuation adjustments?

If the business is slowing down globally it is natural to expect valuations are likely to decline.

_________

APOSTOLOS APOSTOLAKIS, VENTURE FRIENDS

In 2016 VentureFriends was launched as the first 100% private investment fund in Greece, in 2018 VentureFriends closed the second fund of €50M with a focus on Greek and European founders.

Trending Topics: How is the Coronavirus crisis affecting the VC industry and your business and plans in particular?

Apostolos Apostolakis: Startups are by definition organizations that invest significantly upfront in people so that they are able to grow fast. When demand for their services vanishes, startups have to cut down much deeper compared to a steady-state business that had not undertaken the extra investment to support high growth. The negative effect varies by startup type and typically affects more the b2c startups (groceries and food delivery ones apart) compared to the b2b ones. However, apart from some exceptions, in general, the effect is negative because there is a severe slowdown in demand for consumer and business services. This disruption, which will hopefully last for 1-2 months, will be followed by a recession for at least another year and that again forces investors and startups to rethink business plans and expectations. Startups have to focus on unit economics and profitable, yet lower, growth, while investors also have to evaluate in a stricter manner existing and new investments.

Are you planning on freezing investments? If so, for how long?

We will not freeze investments because we believe there are opportunities in all situations and even more in a crisis. We believe that strong founders will persevere and go ahead and create great companies, and actually the crisis is yet another filter for driven, passionate people who are willing to go ahead despite the unfriendly/risk-averse investment environment.

How are your LPs reacting?

Our LPs are calm. We have shared with them our outlook and plans of addressing the situation and all of them have reacted positively. Especially in Greece we have been through crises before and have learned how to be adaptable, frugal and tenacious. Therefore, we believe we are prepared to adjust.

Are you considering channeling investments into areas such as digital health and biotech solutions or anything else? How do you think the VC industry will react and are you expecting a change of focus?

On our side, digital health was already on our radar. Biotech solutions not so because it requires a different skillset which we don’t have. There are VCs looking in that space and I am sure the VC industry will further open up to those opportunities.

Which types of startups will be most affected?

There are 2 demand disruptions happening now. One is at the local level. Countries are forcing local consumers to stay in and consume the absolutely necessary: food, content and some products purchased online. This disruption is huge because even startups catering to local services cannot operate. For instance, there are no restaurants or beauty salons open, therefore if you are a service relying on the operations of those businesses you also have no business.

This disruption will hopefully go away in a few weeks and therefore those b2b or b2c startups depending on local services will recover sooner.

Then the second demand disruption is for services that require an opening of borders and intercountry flow of people. It will take longer, at least 2 more months to reverse this disruption of the international flow of demand. Therefore it goes without saying that b2b or b2c startups related to the travel sector are the most affected and will take longer to recover.

Apart from domestic vs international, another framework to use is necessary versus discretionary needs. After the current shock, we will enter a recessionary period. In that period, consumers and businesses will think more about necessary vs nice to have needs. Therefore some purchases will be postponed and the criteria would be the level of utility provided by those purchases.

What are your expectations regarding valuation adjustments?

Capital will be more carefully deployed and apart from psychology, this is also because revenue expectations for most startups are downgraded. As a result, valuations will also come down. We have deflation of the exuberance and reversion down to what it was a few years back. Investors will offer less capital at lower valuations and startups will have to do more with less.

_________

MIRELA YORDANOVA, LAUNCHUB VENTURES

LAUNCHub Ventures is the second fund of the same partners, €19M seed and pre-Series A, almost invested, focus on CEE and founders in the diaspora, currently raising new €60-80M regional fund

Trending Topics: How is the Coronavirus crisis affecting your business?

Mirela Yordanova: Our main focus at the moment is the wellbeing of our portfolio companies. We are working directly with the founders in order to map out all the measures that need to be taken in these uncertain times. Some will be affected more than others. But there are also some that are even able to grow and by supporting their customers in the time of crisis through their products and services.

When it comes to our team, we’re now fully remote. The nature of our work allows us to work remotely, it’s also something we are quite used to, and it doesn’t affect our efficiency.

Are you planning on freezing investments? If so, for what period?

We will continue scouting for new opportunities and making new deals. We continue to meet founders online and have now canceled all in-person meetings. With this in mind, we do have less bandwidth to do so as our main focus is at supporting our portfolio. We are just closing our next fund and we’ll have even more resources to support the ecosystem – much needed in these times of crisis.

How are your LPs reacting?

Knowledge is power — especially in times of uncertainty. We are constantly updating our LP’s with the latest information regarding the health of our portfolio companies. Most of our non-institutional LP’s are successful entrepreneurs, who have built tech companies and also serve as a great source of advice for our portfolio founders.

Are you considering switching focus to digital health and biotech solutions or anything else? How do you think the VC industry will react and are you expecting a change of focus?

We like to say we are sector agnostic – we are looking for strong teams with scalable business and initial traction. This is not going to change. We do have a few investments in the digital health sector (Mediately, Slovenian company making drug information accessible to doctors, and Find Me Cure, a search engine for clinical trials based in Bulgaria), so we do have experience in working with digital health startups. If there is another opportunity in this sector – we’ll definitely look into it.

What are your expectations regarding valuation adjustments?

Having in mind that the current tumbling volatility of the stock market that directly correlates with venture capital markets, there is a little question that we should expect a big drop in startup valuations and total funds raised in 2020.

_________

CRISTIAN DAN MUNTEANU, EARLY GAME VENTURES

Romanian €25m early-stage investment vehicle with a focus on seed and Series A rounds in Romanian legal entities

Trending Topics: How is the Coronavirus crisis affecting the VC industry and your business and plans in particular?

Christian Munteanu: When it comes to an economic downturn, early-stage VCs are less affected in terms of revisited valuations as they do not pay the premium late-stage funds they always pay. But early-stage VCs should worry about the business impact of the crisis on startups at the beginning of their life when they are the most sensitive to shrinking demand.

Are you planning on freezing investments? If so, for how long?

We are not planning actual freezing, but we shall exercise prudence in our future investment activity, at least until the end of 2020.

How are your LPs reacting?

Our LPs are also concerned about the evolution of the pandemic and its negative effects on the economy. We share the same opinions on what needs to be done in the near future.

Your fund is required to have private co-investors in every deal. Is that going to be a problem?

What we see happening is that all “startup tourists” have left, be it wannabe entrepreneurs or pretended investors. Those that hold vested interests in the industry are here to stay and these are the co-investors we work with.

Are you considering channeling investments into areas such as digital health and biotech solutions or anything else?

At EGV we do not invest in healthcare, biotech or medical devices and we do not have any plans of moving into these fields.

How do you think the VC industry will react and are you expecting a change of focus?

This is not the first crisis that the VC industry has passed through. It won’t be the last one either. The VCs will adapt their investment strategies, will contain the damage, will act cautiously and will negotiate tougher. But, in the end, the world will survive, the planet will keep spinning around and the good startups will raise money.

Which types of startups will be most affected?

There is a saying: “In a tornado, any turkey can fly”. Well, the financing tornado is over and turkeys won’t fly anymore. Access to capital will be more difficult, the competition will increase and, probably, the valuation will go down a bit.

What are your expectations regarding valuation adjustments?

Yes, we expect the valuations to decrease as a reaction to the more difficult financing conditions during and post the pandemic. This is what history taught us as it happened after each and every economic downturn.

_________

ENIS HULLI, 500 STARTUPS ISTANBUL

An early-stage VC fund focused on defensible technology exporting companies created by Turkish and Southeast European teams. 500 Istanbul’s $15M first fund was launched in 2016 and has 40 investments in Turkey, Bulgaria, Greece, Ukraine, Romania and Hungary. 500 Istanbul’s larger Fund II was expected to close in Q2 and the partners will probably postpone it to Q3 this year.

Trending Topics: How is the Coronavirus crisis affecting the VC industry and your business and plans in particular?

Enis Hulli: The current crisis has a huge impact on the economy and greatly affects us as well. Putting all the fundraising difficulties due to fragile financial markets and lack of liquidity a lot, it impacts our portfolio as well.

Are you planning on freezing investments? If so, for how long?

We are not planning to freeze investments, however, we have to postpone our new fund launch and wait until everything goes back to normal. We will continue to do follow-on investments from Fund I and back our entrepreneurs.

How are your LPs reacting?

Most of our LPs are trying to estimate how long it will take for things to go back to normal and are doing cash flow adjustments to make sure they are prepared.

Are you considering channeling investments into areas such as digital health and biotech solutions or anything else? How do you think the VC industry will react and are you expecting a change of focus?

We’ve done 6 investments in health-tech from Fund I. Spirohome is a respiratory health device (highly applicable in today’s situation) and Vivoo is a wellness assistant for everyone to track their health continuously. We will continue to fund health tech companies with the new fund. A lot of the generalist VCs in the US have health-tech as one of their core focuses. I hope European VCs will start investing more in the space as well.

Which types of startups will be most affected?

Every startup will be affected but the ones in HORECA, retail and travel will be affected the most.

What are your expectations regarding valuation adjustments?

I don’t expect a major valuation adjustment on tech companies except that growth will slow down significantly, which can have an indirect effect. The market was already pushing for profitability and it will continue to push for that in every vertical. We closely track our portfolio runway and flag companies with cash flow problems. That’s when we do discretionary down marks, just to be on the safe side.

_________

IVAYLO SIMOV, ELEVEN VENTURES

The second fund of Eleven (first was €12M in acceleration phase), is a €6M pre-seed and seed fund with a focus on Bulgaria; additionally runs corporate innovation accelerators with focus on fintech and digital health

Trending Topics: How is the Coronavirus crisis affecting the VC industry and your business and plans in particular?

Ivaylo Simov: Actually some of the best performing funds are vintage years from when a crisis struck, i.e. 2000 and 2008, as better deals at more reasonable valuations are made in off-peak times. However, although we may not be hit directly, we need to pay special attention to the health of our underlying portfolio companies and how we can support them to weather the crisis.

Are you planning on freezing investments? If so, for how long?

We are not freezing our investments, but adapting our strategy in two directions: a) we’ll preserve more cash for follow-on investments in the existing portfolio and b) we’ll become even more selective in making new investments, i.e. only within our core focus on a few industries like fintech and healthtech, where there’s a synergistic effect with the rest of our portfolio.

How are your LPs reacting?

So far so good, but obviously the crisis is putting a lot of pressure on liquidity for everybody apart from the biggest institutional investors. Still given a long life (10+ years) of VC funds, they remain one of the safer or at least less volatile bets.

Are you considering channeling investments into areas such as digital health and biotech solutions or anything else? How do you think the VC industry will react and are you expecting a change of focus?

There are a few obvious winners (like digital health) and losers (travel and tourism) in the current situation, but overall we expect the world to become even more digital and even more direct-to-consumer via online channels after this crisis. Hence VC funds with their technology focus are ultimately better positioned than non-IT focused investors.

Which types of startups will be most affected?

It depends on how you look at it – negatively or positively. From our portfolio Ebag (online grocery shop) is by far the most affected in a positive way. They’ve seen a 10 fold increase in demand overnight. On the other end of the spectrum, in terms of negative effects, companies in the travel & tourism and HORECA industries are currently seeing the biggest decrease in sales.

What are your expectations regarding valuation adjustments?

Crisis years are usually the buyers’ market, so valuations will be toned down. Yet the best companies will still be able to raise funds at reasonable terms. The biggest hit will be for those middle-of-the-road ones that were struggling even before the crisis and those without any cash cushion.