BTC below €35,000: Crypto and stocks crash after US rate hike

For a moment one thought that the worst was over but then it hit again: The prices of cryptocurrencies and the most important stock indices in the USA have collapsed as a result of the interest rate turnaround in the USA. Bitcoin has now fallen below €35,000, Ethereum is only holding at €2,600. BTC and ETH have each collapsed by seven to nine percent compared to the previous day.

Overall, the crypto market loses more than €100 billion in market cap in just a few hours – going from €1.7 trillion to less than €1.6 trillion. Because the massive losses of BTC and ETH are also joined by severe declines, especially in the Ethereum alternatives: Solana, Cardano, Avalanche, Near Protocol, or Polkadot each lose more than 10% across the board compared to the previous day.

US interest rates raised by 0.5%

Now the connection to the US interest rate turnaround. The US Federal Reserve (Fed) raised the key US interest rate by 0.5% on Wednesday evening and thus officially said goodbye to the loose monetary policy of the 2000s and 2010s. In the future, the US base rate will be between 0.75% and 1%. It is the largest hike in 22 years and is intended to fight dramatic inflation at levels not seen in 40 years. Most recently, it was 8.5% in the USA. The aim is to bring inflation back to 2% – and higher interest rates are seen as the best remedy.

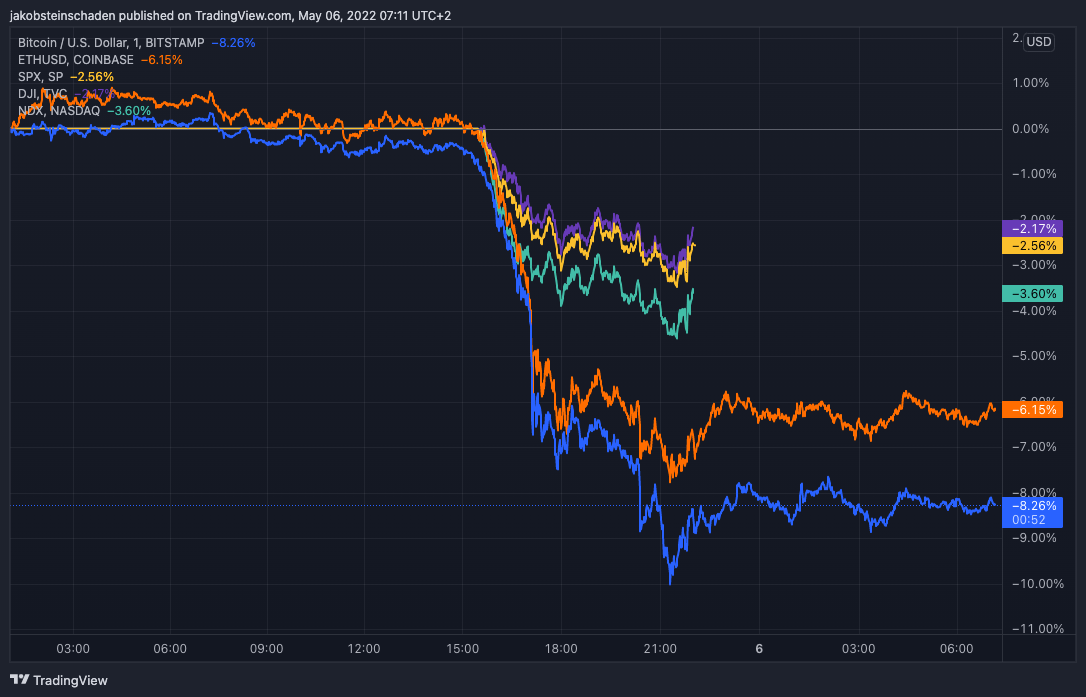

Now, markets (both stocks and crypto) seemed to breathe a sigh of relief on Wednesday. Finally concrete figures on the table, it can go on. But then, apparently, many people became more aware of the harsh consequences of this decision. The bull trap snapped shut, the rally was over, and in addition to BTC and Co., the Dow Jones, S&P500, and Nasdaq100 quickly turned negative. For example, the Dow Jones Industrial Average crashed 1,000 points. It looked like this on the stock exchanges in the last 24 hours:

- Bitcoin = Blue

- Ethereum = orange

- S&P500 = Yellow

- Dow Jones = purple

- Nasdaq100 = Turquoise

Hard hit for BTC

Bitcoin has thus reached its lowest point in the last 10 weeks, the worst day for the cryptocurrency after the January crash. In January, BTC (and thus the rest of the crypto market) already reacted very negatively to the increases in the US key interest rate announced at the time. They are finally here and have grabbed crypto assets again. However, it is currently not going as low as in January, when BTC fell to 30,000.

The matter with the key interest rates is not over, however. On the one hand, the Fed is expected to raise the US interest rate in further steps to 3% to 4% in the course of the year, and the European Central Bank is also forced to act in view of the high inflation in the eurozone. The interest rate hike in the eurozone is expected in July or August. That could also cause more violent movements in the courses.