Crypto exchange: How FTX can kick Binance from the throne

Until now, people have watched FTX from afar and been amazed at how quickly a company can grow. The crypto exchange was only founded in May 2019 by Sam Bankman-Fried and Gary Wang after doing crypto trading quite successfully with Alameda Research.

Three years later, the company is worth $40 billion (FTX: $32 billion + FTX US: $8 billion) and hasn’t even officially launched in Europe yet. But that has now suddenly changed. The takeover of the Swiss Digital Assets AG (DAAG) creates FTX Europe AG, which will operate in the European Economic Area with a license in Cyprus and headquarters in Switzerland.

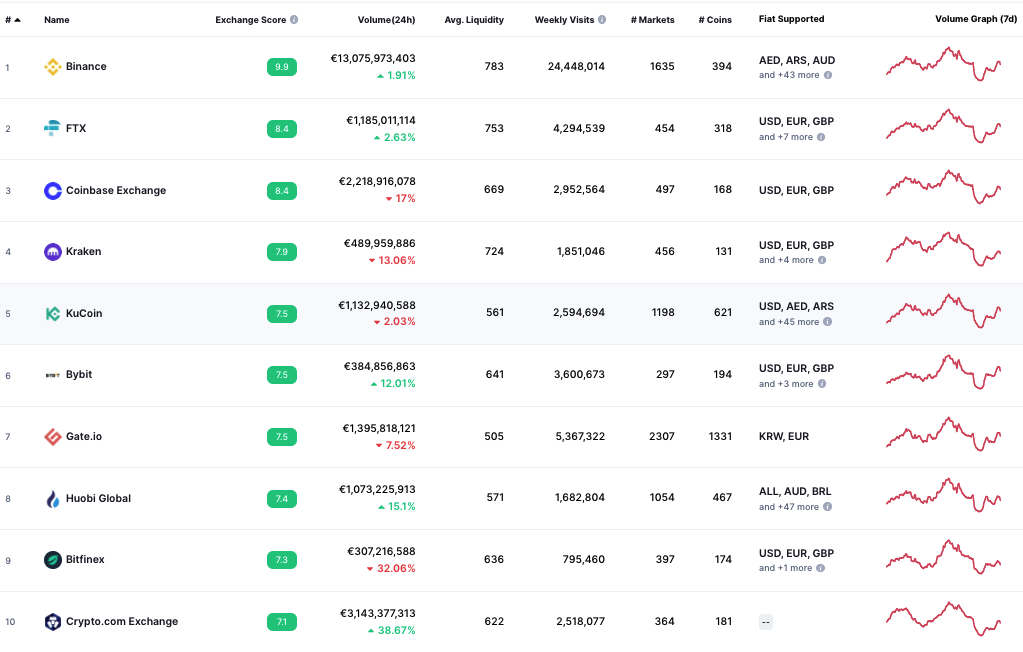

Boss Binance

The new head of Europe is Patrick Gruhn, an Internet entrepreneur for many years and with DAAG an important partner of FTX in the tokenization of shares. His task: Europe should contribute 35 percent to FTX Global’s sales in the medium term. In terms of most key figures, the crypto exchange has overtaken other big names in the industry such as Coinbase Exchange, Kraken, KuCoin, or Bitfinex, there is actually only one boss: Binance.

Gruhn drew up a master plan with Sam Bankman-Fried. “The European market is just waking up, but Europeans are watching who they’re trading with and may not want to trade with any offshore company anywhere else in the world,” Gruhn said. These are the points of the strategy with which you want to become number 1 in the market:

1. Derivatives bring large trading volume

FTX stands for “Futures Exchange”, and not without reason. Derivatives (i.e. financial products that reflect the price of Bitcoin and allow it to be traded without buying BTC directly) account for 80 to 90 percent of the trading volume. “FTX is aimed at heavy traders and not at newcomers who are buying Bitcoin for the first time,” says Gruhn. “We are the first crypto exchange that can offer derivatives through a licensed company in Europe. This is our unique selling proposition and we want to use it to attract many crypto traders in Europe.”

Sure: Professional traders, maybe even from large institutions, involve large trading volumes. And this allows FTX to grow quickly.

2. NFTs for retail customers

However, retail customers, i.e. end consumers like you and me, do not want to leave out FTX. While the Exchange caters to the pro traders, there is something for retail customers too. “The trading platform is for heavy traders, but for normal customers, there is, for example, the NFT marketplace. You don’t need a lot of trading experience or technical analysis to buy NFTs,” says Gruhn. Mass advertising is needed to reach end consumers interested in NFTs (see below).

Even if the NFT market ran out of steam recently, FTX will continue to rely on the token category. “It’s always like this in the crypto sector: whenever something new comes along, this rapid hype comes with an extreme volume, with exaggerated expectations, and then unfortunately also with many setbacks. We have also seen that with NFTs.” There are also some players in the market who have made quick money with NFTs, while some retail customers are looking through their fingers. But with a controlled, trustworthy offer you can eliminate many problems of the young NFT market. “This is exactly why marketplaces like FTX are needed.”

3. Sports Sponsorship

While Coinbase, Binance, or Bitpanda already have strong brands in Europe, FTX is only known to a few today. But with the new license in Cyprus, that will change. Because FTX has not been allowed to actively advertise so far. The really big advertising campaigns have already started in the USA. The company paid a whopping $135 million to brand the Miami Heats arena for 19 years. There was also Super Bowl advertising.

“We are planning similar marketing measures in Europe. We have not done so until now due to the lack of a license,” says Gruhn. When asked whether there would be major advertising appearances in the Champions League, there was no denial. In the king of European football, you can imagine how FTX will make its brand big.

4. Compliance First

While the market leader Binance in particular has had to struggle with regulatory authorities in euros (e.g. the German Bafin or the British FCA) in Europe in recent years, FTX wants to do everything right in terms of regulation. “We are really regulated in finance. We can offer professional traders in particular a counterparty they can rely on and trade with. It is part of our strategy to set a very high regulatory standard and thus create trust among traders,” says Gruhn. “Sam (Bankman-Fried, ed.) has seen other crypto exchanges being unprofessional, to the detriment of traders. The professionalism is exactly why FTX is growing so fast.”

5. Solana

With Solana, Sam Bankman-Fried and FTX have brought a blockchain close to them that is considered one of the main Ethereum rivals since 2021. “There’s a close relationship between Sam Bankman-Fried and Solana,” agrees Gruhn. “The Solana blockchain is superior to Ethereum in terms of transaction costs.”

That is why his former Digital Assets AG and FTX have already jointly implemented tokenized shares using the Solana blockchain. For a derivatives exchange in the crypto sector, a cheap way to trade tokens in large quantities and at high speed is important. For technical reasons and above all the many possible transactions per second, Solana would have been chosen. “That’s the level that Visa or NASDAQ can do.”

6. Cheap Fees

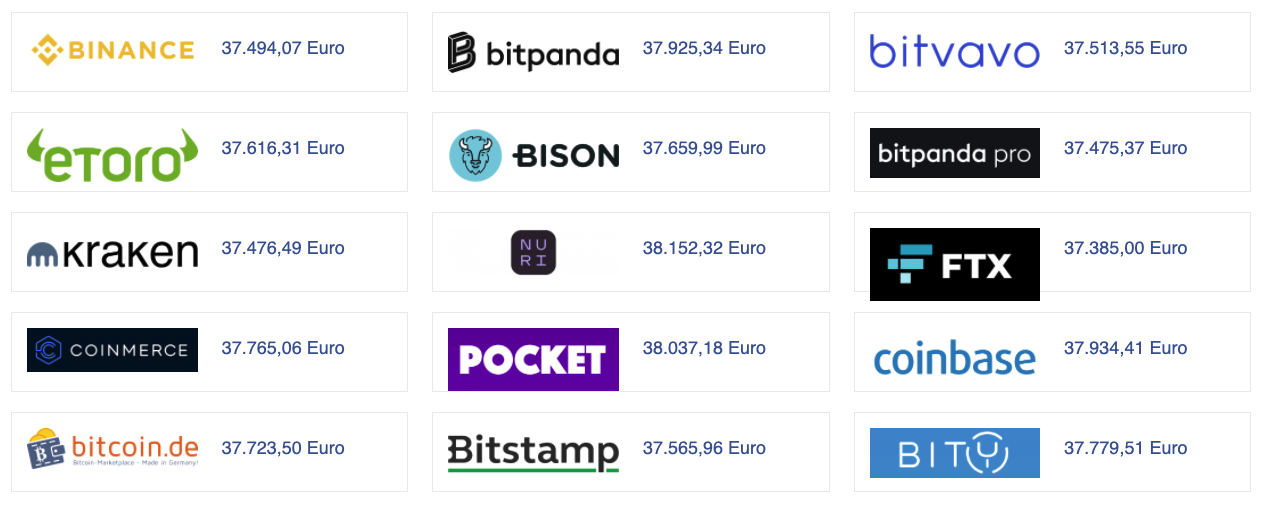

Also always a factor: the price. FTX wants to score with low fees. “If you compare the Fee model to others, the Fee structure clearly speaks for FTX,” says Gruhn. The price comparison by Blockchaincenter shows that FTX is significantly cheaper at the BTC price than many other market competitors (as of March 20, 21:00):

7. Sam Bankman-Fried

And then, of course, there’s him, one of the planet’s youngest billionaires and the mastermind of FTX: Founder Sam Bankman-Fried. “He has a background that is rarely found in the crypto industry in terms of professionalism and seriousness. Some crypto entrepreneurs globally don’t have the same reputation as Sam,” says Gruhn. In his opinion, Bankman-Fried (mathematically gifted, law professors at Stanford Law School as parents) was a “genius”.

And this “genius” at the top apparently manages to get a lot of very smart people excited about his company. According to Gruhn, it would be possible to get top people into the company, “quality before quantity”. And it is ultimately this team that drives growth forward.

8. Prominent investors

Finally, dear money. The list of investors reads like a Who’s Who of the global VC and PE industry. FTX and FTX US may have funders such as Temasek, Paradigm, Ontario Teachers’ Pension Plan Board, NEA, SoftBank Vision Fund 2, Lightspeed Venture Partners, Tiger Global and Insight Partners. In total, she and others have invested $800 million in FTX and its US sister. These are amounts of magnitude that otherwise only neo-banks or neo-brokers who have been on the market for much longer get.