RBI: „Open Banking is not just about technology, but also about a change in mindset“

Open Banking is a current mega trend that brings numerous opportunities to disrupt and transform the nowadays-known banking industry and create completely new value-added services for customers. One of the major players in this area is Raiffeisen Bank International (RBI), which serves almost 17 million customers across the CEE region.

In an interview with Trending Topics, Tanja Imamovic, Open API Business Owner at RBI, talks about the opportunities Open Banking offers not only to banks, but also to fintechs and other startups.

Trending Topics: The PSD2 Directive imposed by the European Union ignited a whole new generation of digital banking services. What role does Open Banking play in RBI’s digital strategy?

Tanja Imamovic: As expressed by our vision to „transform continuous innovation into superior customer experience“, RBI defined Open APIs (Application Programming Interfaces) as one of the key enablers for the future. Although we witness that open banking is occasionally identified as PSD2, we knew from the very start that the Directive is only the beginning of the journey.

We define Open Banking as a new partnership, cooperation and innovation model that is enabled by Open APIs. The concept brings numerous opportunities to enhance existing products and services, but also to create new offerings that go beyond traditional banking products and services.

Open Banking is not just about technology, but also about a change in mindset.

So do banks have to think differently?

Today, our customers‘ expectations are shaped by many different players in the digital world and in order to provide these experience traditional banks have to revamp the way they create and offer their products on the market. PSD2 coming into force in the EU evolved into decreasing barriers to entry for new players, thereby shaping new challenges and opportunities on the market.

These in turn indeed pushed the incumbents into rethinking their business models, shifting from traditional closed “bank-to-customer” business models into collaboration models based on openness.

Lately, we hear a lot about “Bank as a Platform”. What does it mean?

With the global success of bigtech companies like Apple, Amazon, Alibaba and many others, platform models have become the new standard. Unlike traditional businesses, platforms connect different customer groups and, by enabling interaction, allow for a new type of value co-creation. It is interesting that Visa and Mastercard had one of the first platform-based business models, and banks have been part of these models for decades now.

The „Bank as a Platform“ concept means a shift from the traditional business model where banks provide their own products and own the relationship with their end-customers towards a more open framework which enables third parties not only to consume but also to provide services.

Startups, especially fintechs, are attractive partners for RBI. How can they become part of the open banking ecosystem you are building?

Raiffeisen was founded based on cooperative principles conceived by Friedrich Wilhelm Raiffeisen more than 130 years ago, and today we can see the same principles being a crucial part of doing business. Following the vision of its founder, the bank translates these principles into activities that allow for scaling the cooperation across the whole RBI network.

RBI runs many initiatives that invite both financial and non-financial companies for joint value creation. Within the Open Banking area, we could talk about our API Marketplace that enables external developers to interact with internal systems and test their applications in sandboxes that reflect the real banking environment.

Within the fintech sphere, RBI runs the award-winning fintech partnership program Elevator Lab™ which already allowed it to create partnerships with twelve fintechs across CEE.

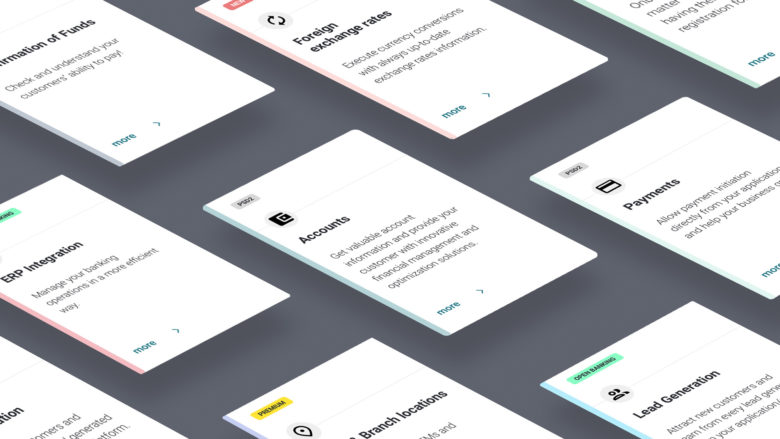

What is this API Marketplace about and what does it offer today?

Our API Marketplace is a centralized platform that serves as a single point of access to all our publicly available APIs. There are also sandboxes available – dummy data environments – that serve as a playing ground for external providers and developers who want to build a product or a service based on our APIs. Bearing in mind RBI’s goal to create the largest banking partnership ecosystem, the vision for the Marketplace is to be API-provider agnostic, meaning that any entity (that we allow) will be able to publish their APIs on our platform.

Currently, it runs as an MVP version based on which we were able to learn about and understand better the needs and requirements of our new customers (i.e. developers) and that we now address in our new soon-to-be-launched version – so stay tuned!

RBI is running different initiatives for startups and developers to become part of the Open Banking (r)evolution. On September 18, the Open API Hackathon will take place in Bratislava. Why did you decide to run a hackathon and what will this year’s edition be about?

As already mentioned, RBI’s overall mission is to “transform continuous innovation into superior customer experience” and a hackathon is a great source of innovative solutions while it enables the customers themselves to be part of the development process and incorporate their requirements for such superior experience from the very start.This year’s edition is about nothing else but Open Banking! The hackers are about to battle two challenges with focus on enhanced payment experience and environmental, social and governance (ESG) impact that companies and individuals have on our planet.

To make the event available for as many of you as possible, we decided to live-stream parts of the event such as kick-off, final pitch presentations and winners ceremony. The stream will run via our „Open API Hackathon“ Facebook event, so we invite you all to follow the event and be online on Friday, 18 September (starting 17:00) and Sunday, 20 September (starting 15:30).

Another initiative of RBI is the Elevator Lab Partnership Program that invites global startups to join the ecosystem. This year, there is a special track for startups that offer solutions in the fields of Open Banking. Can you tell us more about the program and what is needed for applicants?

This year’s „Bank as a Platform“ track is hosted by Tatra banka in Slovakia, and the goal is to find a partner who will help us build a digital platform that will successfully connect Tatra banka’s clients with third-party solutions. The platform should allow to introduce new functionalities, products and value-added services and ultimately bring superior customer experience.

Some of the possible solutions are B2C and B2B digital marketplaces for the provision of banking and non-banking services, super-applications, mini programs as well as plug & play core banking infrastructure for easier integration of third parties.

The application period for this track is open until 27 September, so check out the details at https://elevator-lab.com/track-bank-as-a-platform/ and help us shape the future of banking!