Tesla: Dark forecast for 2024 and beyond

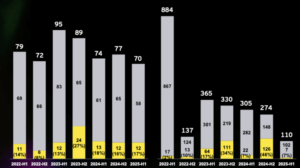

Tesla’s performance has declined. The first quarter of 2024 is coming to an end and Tesla shares have had their worst value in the large S&P500 stock index for over a month. Experts speak of a “growth company without growth”.

Price drop and ten-month low

Since January, the company’s shares have fallen by almost 32 percent, reaching their ten-month low. The forecast for the rest of the year doesn’t look much better – several analysts agree on that. Wall Street expects earnings of just $3.02 per Tesla share in 2024, down more than two percent from last year’s $3.12. Adam Jonas , executive director at Morgan Stanley and known as a Tesla bull, last week cut his profit forecast for Tesla this year by 25 percent. According to him, the electric car giant could “possibly” lose money in 2024. According to a report by the banking and financial services provider Wells Fargo & Co, Tesla shares should now be “sold” instead of “held”. It is assumed that there will be zero growth in sales figures this year – they are even expected to decline in 2025.

Causes of Tesla’s difficulties

One reason for the stock fall is the increasing number of competitors in the electric vehicle sector. The offer from China is putting pressure on – especially the fact that the middle country has already claimed a larger share of the global market for electric vehicles. The vehicles from many Chinese manufacturers are often simply cheaper.

In addition, Tesla is having problems managing the order situation while resale values are falling significantly. A study by online automotive search engine and research website iSeeCars shows that Tesla cars are losing value due to recent price cuts . According to her, the value falls faster than that of a Maserati. Investing in a Tesla therefore does not hold up to what Musk predicted in 2019. At the time, he said the vehicle’s value would increase as its self-driving capabilities matured.

Apple stops autonomous electric car project, Musk celebrates

Enormous pressure on prices for electric cars

Tesla has reduced vehicle prices to keep up with the rest of the world. According to Futurism, they are nevertheless preparing for a significant decline in demand. Colin Langan, analyst at Wells Fargo, believes that the valuation of Tesla shares is still too high in terms of profits and revenue. CEO Elon Musk wants to be aware of the challenges. After publishing the 2023 results, he predicted a growth rate in vehicle volumes for 2024 that could be significantly lower than the previous year.

Musk also pointed to a possible sharp slowdown in sales growth. He announced production of the next generation of Tesla, which will be manufactured in the Texas Gigafactory 5 factory, for 2025 – “sometime in the second half”. The Tesla CEO is also said to have told his investors that he is often optimistic about the times.