Warning: “The AI bubble is bigger than the tech bubble in the 1990s”

Anyone who has invested in the S&P500 or other stock indices dominated by Big Tech in the last 12 months is certainly happy at the moment. As reported several times, the so-called “Magnificent 7” – Apple, Microsoft, Alphabet, Meta, Tesla, Nvidia and Amazon – have driven the prices of the S&P500, Nasdaq 100, and Co to new heights. Among these “Magnificent 7” there are above all the stocks driven by the AI hype, namely chip giant Nvidia, major OpenAI investor Microsoft, and Meta Platforms.

But how long will the highs continue? More and more observers are asking themselves this question. Among others, Torsten Sløk, chief economist at Apollo Global Management, one of the largest private equity companies in the world. Apollo recently took over the once leading search engine Yahoo! Bought to bring it back into shape – and therefore has in-depth know-how about the period of the dot-com bubble.

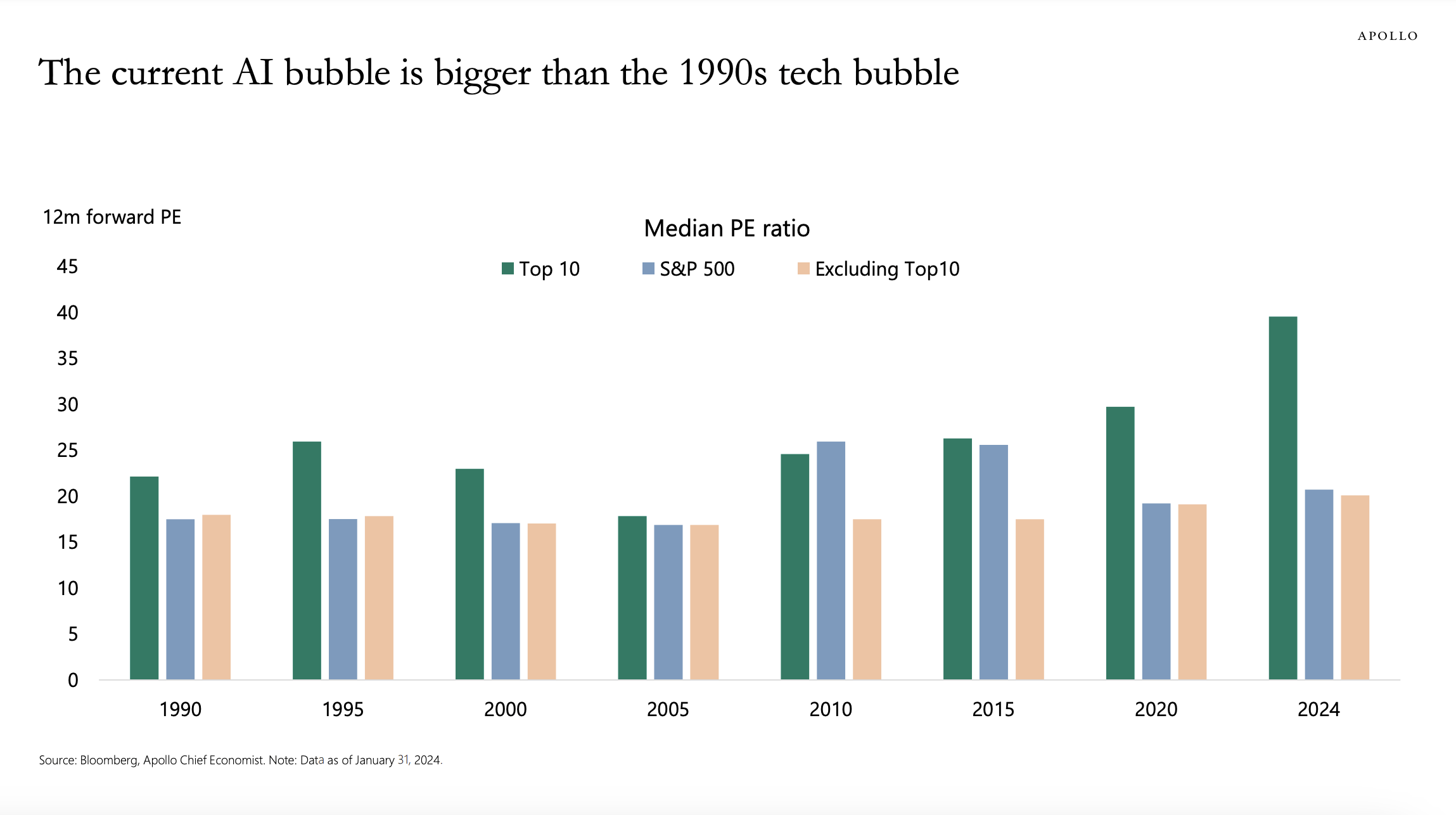

And that’s why it’s at least interesting, if not alarming when chief economist Sløk states in an analysis: “The current AI bubble is bigger than the tech bubble in the 1990s.“ He determines this by comparing the valuations of the ten largest companies in the US with those in the mid-1990s – the time before the dot-com bubble burst. “The 10 largest companies in the S&P 500 are more overvalued today than the 10 largest companies were during the tech bubble of the mid-1990s,” says Sløk. Here are his calculations:

Share sales confuse observers

Now, of course, the question arises: Given the drastic increases in valuation (Nvidia’s valuation, for example, grew more than three times from $600 billion to $2 trillion within a year), is the stock market about to see the bubble burst again? The prices are currently being driven by recently presented, very good business figures from Nvidia, for example, which more than doubled its sales in 2023 as the leading manufacturer of GPUs.

Another indication that the fantastic growth, which is not reflected in the rest of the economy outside the Big Tech league, will not continue for long, could be shown by the behavior of Big Tech CEOs. As reported, Amazon founder Jeff Bezos as well as JPMorgan CEO Jamie Dimon and Meta CEO Mark Zuckerberg recently sold shares in their respective companies worth $9 billion. This sort of thing happens all the time, but the level of stock sales makes some people uneasy.

John Hussman, President of the Hussman Investment Trust, who – among others – predicted the stock market crash of 2008, and Bank of America as early as mid-2023 – at that time there was still talk of a baby AI – warned that an AI bubble was forming. Bubble the speech. But since then, the prices of AI-driven tech companies have continued to rise, not only in a vacuum but also on the basis of significantly increased sales and profits.

AI boom promises new “Roaring ’20s”

In comparison to other hypes, it is often argued with AI that the new technologies can be used very broadly in the economy – this was different with other hypes such as crypto, metaverse, or augmented reality. That’s why some other analysts see only the beginning of even larger AI developments. Goldman Sachs sees Nvidia as the “most important stock in the world,” while Jason Draho, Head of Asset Allocation Americas at UBS Global Wealth Management, speaks of a new edition of the “Roaring ’20s.”

“This is a 1995 moment, as the AI revolution and $1 trillion in additional spending over the next decade hits the software ecosystem and the rest of the technology sector,” writes Daniel Ives of Wedbush Securities. “Nvidia and the golden GPUs are the beginning of the spending wave”.