Bulgarian Startups And The Crisis: Liquidity Issues, Bankruptcy Concerns And Team Scale-downs

Three-fourths of the companies that participated in a recent survey by the Bulgarian Startup Association (BESCO) have stated they fear going out of business in six months if the economic landscape doesn’t change. Most of these businesses expect a drop of over 40% in revenues, driven to a larger extent by decreased local market demand. Close to two-thirds of the companies will have to lay off employees, whereas marketing, sales, and administrative positions are the first to be temporarily cut. Every fifth company expects to lose all employees.

In order to prevent these worst-case scenarios, the business calls out to the government to become a client of Bulgarian SMEs and startups, аnd to temporarily allow VC funds to invest without third party private investors to assure quicker capital deployment. Not least, the report suggests that a new lighter form of a joint-stock company needs to be structured, in order to allow founders to more easily incentivize team members with stock options and equity, as part of their compensation packs.

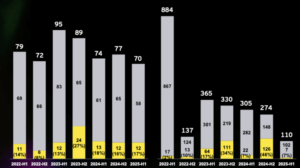

A hundred Bulgarian young SMEs and startup companies have participated in the community-driven effort to collect some data on the current state of the sector. The 100 respondents come from 27 different fields – from travel tech to pharma tech, fintech, gaming, food tech, industrial IoT and others. Around 40% of them are developing software solutions. Half of the companies are in the R&D or early-stage phase of development. Altogether the respondents have generated €80M in revenues last year. Most of the companies (72%) have teams smaller than 10 people.

Although the results may not be statistically representative, they shed some light on the concerns of the sector.

The most pressing and urgent problems

Although the recent study by the Sofia Investment Agency suggested the tech, startup and innovation sector will be the least hit by the current and upcoming COVID-19 related economic crisis, almost all of the respondents here expect a drop in revenues. Two-thirds of companies forecast a drop in revenue larger than 40%, with half of them forecasting a monthly decrease of up to 60%.

Most of the businesses that participated indicate that the biggest revenue-generating damage is the loss of local customers, followed by the loss of international customers. Lack of liquidity is pointed by 53% of the companies as the biggest impediment during the crisis. Medium to high risk of bankruptcy in the next three months are experiencing 42% of the companies, and 74% believe there’s a chance of going out of business in case the economic landscape stays the same in the next half a year.

All these risks naturally lead to taking measures to assure the business goes through the crisis. Cutting costs is usually the number one action taken by companies in times of crisis and reducing headcount is part of the measures here. Close to two-thirds of the companies expect to be pressed to lay off up to 25% of their teams with marketing, sales, administrative and engineering (not software developers) positions being the first to be cut.

How can the government help

BESCO plans to use the analysis and the report to lobby for the interests of the startup and innovation ecosystem. Therefore, the organization has also collected from the community some ideas on what is needed to help these companies sustain their businesses throughout and after the crisis. The majority indicated capital needs of between €10K and €100K, with 31% in need for €10-€25K. Venture capital is the main source of funding startups are looking for, and only 12% of the respondents think that there should be mechanisms that allow banks to finance young businesses more easily. Temporary suspension of requirements for capital fundraising from third parties at the fund and deal level, that would allow VC firms with public capital to invest the capital they already have more easily, is one of the suggestions in the report that the government could act upon. Making sure not to fund companies that wouldn’t be viable in non-crisis situations is, however, one of the risks here.

Direct financial support is however not everything that the ecosystem needs to make the leap – the government becoming a customer of the local startups is what a bit over one-fifth of the companies think is an important measure.

So far, the government hasn’t proposed any concrete measures tailored for the startup and innovation sector. Two weeks ago, a coalition of four organizations – the entrepreneurial network Endeavor, the Bulgarian Private Equity and Venture Capital Association (BVCA), think-tank Move.bg, and BESCO, sent an open letter to officials asking for measures supporting the businesses with innovation potential. The governmental Fund of Funds just announced a new bank guarantee instrument that may be useful for young companies with no collateral a.k.a startups in early stage of development (details to follow soon).

The report will be sent to government officials on April 14th and the startup association hopes to receive the support of the startups and SMEs, and to be heard.

This may also interest you: