Explained: Crisis Support Measures For Startups And VCs In Bulgaria

Although the tech and startup sector might not be experiencing the current and upcoming COVID-19 related crisis as hard as other sectors do, it is certainly a challenge for early-stage ventures that need more time to validate their product, that work in more affected sectors, or are still in their R&D phase and were fundraising before the pandemic. VCs and acceleration funds may declare that they are totally open for business, but they experience difficulties too – due to the fact that most of the local venture capital firms operate with public money, they have strict requirements for private co-investors – both on the fund, and on the deal level. And private investors are concerned. This means – for funds that were about to launch operations it is hard to collect the required private capital (usually between 10% and 30%) and for already operating investment vehicles – it may be hard to close the deals.

This was the main reason for the open letter and economic report that the startups and VC associations sent to the government. Not to ask for grants, but to ask for a temporary change of the requirements so capital can flow into companies with scalability potential. In most of the cases, there’s a demand for bridge financing that would help already existing businesses that employ people to sustain through the crisis if they are impacted. “From an economic point of view, it is crucial that right now we assure financing for growing companies that have proven viability, so they don’t go in bankruptcy and cut jobs. In the same time, it’s a huge moral hazard with the early-stage products, and we must be careful not to fund projects that wouldn’t be competitive and capable of surviving under normal conditions too,” comments Evgeni Angelov, the founder of the Bulgarian Private Equity and Venture Capital Association, and he was also the engineer of the first-ever VC fund in Bulgaria back in 2012.

Misconceptions vs reality

For startup founders measures like the widely commented 60/40, the governmental promise to cover 60% of the salaries of employees under several conditions, is not too relevant. The associations ask for easier access to the capital that is already put aside for venture investments. At the same time, VCs started sending out advice that startup founders should consider also EU aid programs. With the whole information overload, this is a quite hard task, and with enough media lost in translation and without understanding for the matter, it could get even harder. We’ve put together some pieces of the puzzle and hope this will be helpful:

The problem with the private co-investments in funds and the solutions

As mentioned, the VCs whose major LPs are public funds are in a tough situation. Some private investors are now withdrawing commitments, making the launch of the fund harder. Examples: the recently chosen fund managers Vitosha Venture Partners, Morningside Hill and Innovation Accelerator, which were all selected to deploy capital in ventures in different stages of development and financed by the governmental Fund of Funds.

Upon request, we received an official statement from the Fund of Funds, promising they are currently actively working on more flexible rules that would allow these funds to invest with less private co-investment. The new rules, whenever ready, will be compliant with the requirements of the European Commission and only applicable until the end of 2020. The registration process for Vitosha Venture Partners has been shortened and Innovation Accelerator is also expected to close first deals soon, says the statement.

There’s one more potential solution for funds that need private co-investment, tells us Evgeni Angelov – EIF and The European Bank for Research and Development could structure instruments that would allow them to enter as private co-investors in VC funds. Wouldn’t that distort the market as VCs become almost 100% public-money-backed? “There’s no market right now. These are measures that will be applied only for the time of the crises. Also, EIF and EBRD have different pockets and operate commercial capital too,” he explains. According to our sources, the EIF is currently working on one such €100M instrument.

Fund of Funds guarantee schemes and cheap loans

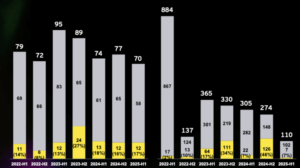

The governmental Fund of Funds, which is operating and channeling program finances of the European Commission under the Junker plan, has recently announced its mobilizing around €205M to support SMEs, innovative companies and self-employed people. The Fund of Funds has designed a brand-new guarantee product to provide liquidity support to small and medium-sized enterprises operating in various sectors, including those most affected by the crisis, such as tourism, transport, wholesale and retail trade, etc. In practice: there’s €87M for bank guarantees for long-term low-interest loans that will assure working capital to SMEs. The expectation is that by providing the guarantee banks can grant loans of up to €435M in total. “The possibility for loans to be offered interest-free to businesses that retain their staffing levels from before the crisis is also being considered,” reads the official announcement. It’s still not clear which are the banks that these grants will be provided to.

In addition, there is another €12M that will be deployed in loans of up to €25K and below the market interest rates. It’s targeted at “self-employed individuals and small start-ups having a very short business track record, if any, including those set up by vulnerable groups (people with disabilities, young people aged 29 or less, people who have been unemployed for more than 6 months).” The microloans, that are indeed on the market since last year, are provided through selected intermediaries – First Investment Bank, Microfund AD, and SiS Credit AD. The measure is in a way applicable also for very early-stage startups that would otherwise not be bankable.

The EU mobilized €1.2b for startups due to COVID-19. NO.

We stumbled across this news in the past days. Here’s what it’s all about: A new instrument called ESCALAR that was initially announced back in 2018 is now piloting. Its pilot size for 2020 is €300M and it’s targeted at scaleup, private equity and growth equity funds from Europe. Fund managers can apply for 50%-70% funding from ESCALAR and either launch a side vehicle to support their existing portfolio companies, for which they are not allowed to charge management fees, or start a new fund. According to Barry McGrath and Stefan Tzalov from the European Investment Fund (EIF), who are directly involved in structuring the fund, there are around 30 funds in the EU that may benefit from the instrument. McGrath expects that up to 8 funds could benefit from the program, whereas the maximum participation of ESCALAR is €100M. By design, the fund comes with a larger risk for private investors, which means the fund managers will really need to have the track record and be able to convince private LPs to jump in. In a nutshell, this is a financial instrument, that doesn’t target startups and is not really related to the coronavirus situation, also the €1.2b is a just forecast.

The €1B for SMEs and Startups Unlocked By EC and what it means in Bulgaria

At the beginning of April, the European Commission unlocked €1B to allow its EIF to back loans for small and medium businesses, effectively making it easier to borrow money from banks. The measure has been popular with startups, and should translate into €8b more in estimated available financing for small and medium-sized enterprises (SMEs), the Commission expects. This means that financial intermediaries with existing EIF agreements under these COSME and InnovFin programs will be able to access the new guarantees immediately upon their request. Other financial intermediaries can access the guarantees following a swift application process. Here’s a list of the relevant intermediaries in Bulgaria that provide loans to startups and early-stage companies under the mentioned agreements.

The 60/40 scheme

Also, the Commission has adopted a Temporary Framework to enable the Member States to use the full flexibility foreseen under State aid rules to support the economy in the context of the coronavirus outbreak. The framework provides financing for the following types of aid, which can be granted by the Member States: direct grants, equity injections, selective tax advantages, and advance payments, up to the nominal value of €800K per company zero-interest loans or guarantees on loans covering 100% of the risk. For Bulgaria, this means a €770M wage subsidy aid scheme that would allow the Bulgarian authorities to finance 60% of the wage costs.