Crypto: Insights on The Recent Market Crash

In this guest article, Lanre Ige and Eliezer Ndinga, Research Associates at 21Shares AG , deal with the causes of the latest crypto crash. 21Shares is a crypto asset manager from Switzerland that provides a transparent way to access the world of finance and technology.

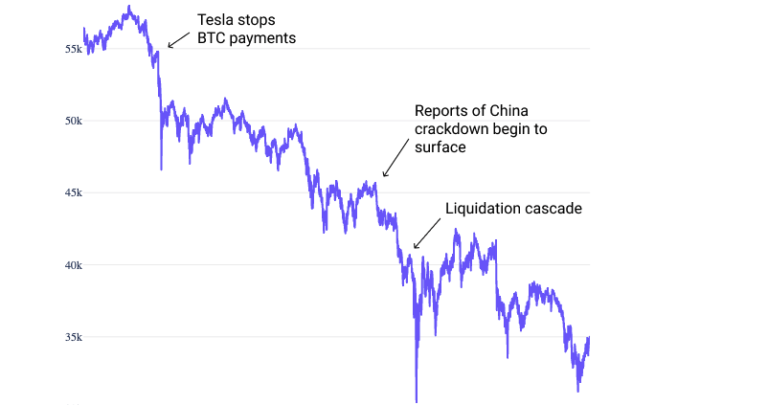

On May 21st, the State Council of the People’s Republic of China, the executive governing body of China, issued a statement on financial stability, which included a crackdown on Bitcoin mining and trading activities. The crypto market sentiment has turned bearish again due to increased uncertainty in China, exacerbating last week’s selling pressure as Tesla stopped Bitcoin payments due to environmental concerns.

Despite the lack of more details and clarity on this crackdown, Bitcoin fell by 8% within an hour as market participants based in China anticipated tougher curbs on crypto adoption and liquidity. In anticipation of a potential liquidity crisis in the Chinese market, the selling pressure continued during the weekend of which 80 percent predominantly came from short-term traders who purchased Bitcoin over the past 6 months.

Low-cash miners

This overriding concern is undoubtedly the case for cash-poor miners regularly seeking to cover their expenses by converting their bitcoin holdings to the Yuan (CNY), as such a flight to safety occurred. Since banks were closed on the weekend, the capital stayed onchain as the crypto market is open 24/7. Crypto holdings were converted to USD-pegged stablecoins such as Tether and USDC, which reached new highs in market value, for instance, USD Coin (USDC) broke the $20 billion mark in market capitalization for the first time.

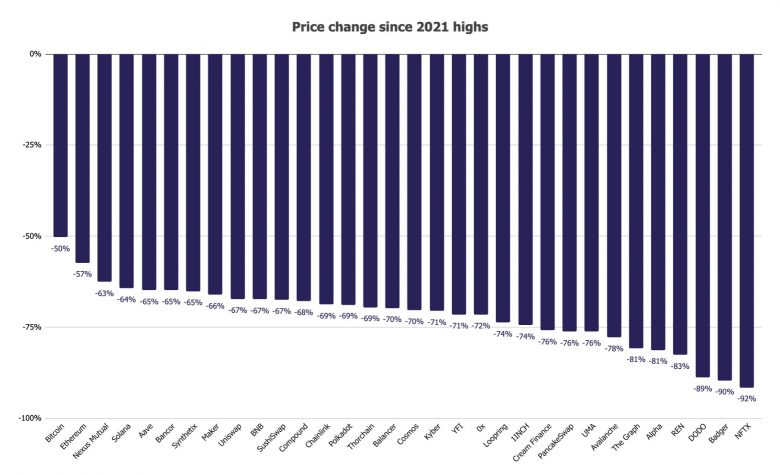

In the same vein, volatility spiked across assets. DVOL (the Deribit Implied Volatility Index) serving as a great volatility indicator or the fear gauge, unexpectedly soared. DVOL is the VIX of the bitcoin market that measures implied or expected volatility based on Bitcoin’s options traded on Deribit, the largest options exchange. This panic selling also affected the long tail of cryptoassets, most of which dropped by more than 50% from their respective all-time high and hence wiped out hundreds of billions of dollars in total market value.

Although this news item didn’t entail anything concrete, the Bitcoin market experienced the most significant sell-off in history, which accounted for $2.56 billion in net losses for traders, surpassing the most notable deleveraging events such as March 2020 ($1.38 billion) and in the last bear market in November 2018 ($0.95 billion). But the good news is unlike during the COVID-19 panic on March 12, 2020, today’s trading volumes are an order of magnitude higher than last year. As such, the bitcoin market absorbed this week’s sell-off much better than at that time.

Despite the large sell-off, as of writing, Bitcoin is up 15% from its weekend low of $32K. We’ll closely follow how the whole market will evolve in the coming weeks, as predicted a year ago, we believe that Bitcoin mining is experiencing a China exodus and will be gradually shifting to North America.

In line with our prediction, Elon Musk and Michael Saylor of MicroStrategy, recently held a private meeting with miners based in North America to form a council to disclose energy usage in a standardized manner and promote the use of renewable energy in the world.

Fundamentals haven’t changed

From our perspective, crypto-related fundamentals have not changed. Crypto is an emerging asset class aiming to upgrade the backend of traditional financial systems. With just 2.5% of the internet population being crypto users, we are still in the early innings of its adoption lifecycle. As such, corrections will occur along the way.

Bitcoin is a better asset than gold in many aspects though gold has the benefit of time. It is digitally native and accessible anywhere with an internet connection, more transparent, divisible, verifiable, programmatically scarce, and easier to store than gold. For the record, Ray Dalio, legendary hedge fund manager and historically a bitcoin skeptic, disclosed that he now owns Bitcoin, which he deems better than government bonds. On the other hand, Ethereum has been the best performing asset in the past 5 years and has enabled the democratization of financial services by eliminating the middleman.

After all, the majority of market participants are long-term investors while most of the selling pressure comes from newcomers and leveraged trading. These two factors are reasons why we don’t believe that anything fundamental has changed in the market at the moment.

Disclaimer:

This article is for informational purposes only. We do not recommend any actions based on this information. The material is not to be construed as an offer or recommendation to buy or sell any security, or as investment advice. Furthermore, this information does not represent a guarantee that the systems described here are suitable or useful for a person. Past performance is not an indicator of future price developments.