Ivailo Gospodinov: Let’s Face It, Scaling A Business From Bulgaria Globally Is A Hard Task And Requires More Than Just Money

In the startup world, almost everyone is talking about global scalability. But once the enthusiasm cools down, things change. To scale globally a company needs different type of support, even different type of capital.

Deals in the growth capital and private equity domain have been rather exotic in Bulgaria. So far, there have been only three funds in this segment, which closed altogether less than 30 such deals, whereas some are with companies from other countries in the region. Typically, growth equity funds invest larger tickets in companies that are not necessarily technology ones, and at a later stage of their development.

Started in 2014, BlackPeak Capital is one of these funds that in the past years invested in 12 high-growth small and medium businesses in Southeast Europe. Five years ago, the co-investment fund received €15m from the European Investment Fund, and another €15m were deployed to it in 2016. BlackPeak is an interesting player on the market to the extent that it provides equity, mezzanine, and other forms of hybrid capital and tickets of up to €1-8 million per transaction. As a co-investment fund, BlackPeak Capital invests alongside other private institutional or individual investors. On its portfolio we find some of the fastest developing IT, but not only, companies with Bulgarian roots like Bulpros, Software Group, Excitel, and Walltopia. Just recently one of the portfolio companies – the tourism agency Astral Holidays had to shut down due to the bankruptcy of its main global partner.

To explore the growth equity domain and the way investors in this space pursue business, innovation and scalability, we talk to one of the partners at BlackPeak – Ivailo Gospodinov. Prior to establishing BlackPeak Capital, Ivailo Gospodinov was a Managing Partner of Entrea Capital. He has more than 10 years of experience in numerous sell- and buy-side mandates, as well as long corporate finance and audit experience, and another eight in M&A in Raiffeisen Investment, where he was a Managing Director for Bulgaria.

Trending Topics: What brought you to this industry?

Ivailo Gospodinov: I have been in corporate finance and investment banking for many years. My partner and I were in the M&A business and we were going to make an M&A boutique, but this opportunity came up. It seems a logical continuation of our careers – transition from investment banking to managing assets. At that time we had a good number of pipeline companies. We knew a lot of companies, and a good understanding of the market, we had the confidence that we could handle it, and also based on our capabilities to execute deals.

What type of companies does Black Peak invest in? Some time ago, at some events, I heard you discussing your vision for an innovation that went beyond the software business.

We are looking for companies that have an interesting business model and are a leader in a particular segment in the Bulgarian geography, or work in a niche where they have managed to catch a trend at European or global level and have the potential to grow just because of the current market trends. They can be in a variety of sectors, not necessarily technological – they can be in services or FMCG, energy and engineering. We are not limited to industries. For example, I really want to do something in the field of healthcare. There are no industry experts in our team, but we have gained experience from our previous jobs and feel comfortable investing in different segments, and where we lack knowledge, we use industry specialists.

How important is it for you the business you invest in to be scalable globally?

Let’s face it – scaling a business from Bulgaria globally is a very difficult task, and it is definitely not just a matter of money. It also requires structure, an accurate assessment of how to scale. Very often, companies are eager to seize new and emerging markets. We have had such cases in our portfolio too, where we are struggling to step in because there is a potential market and the company focuses on growth, and then things start to break because the structure of the company itself is not scaled enough to handle this growth. This bounces back and the processes that don’t work are very clearly seen. Multinational companies are developed slowly and step by step. Growing too fast could lead to many internal problems and also leads to liquidity problems. Then the use of funds has to be very reasonable and there has to be a very good cash flow management. With such companies, one or two mistakes can take you on the brink of failure. We want to invest in companies that can become global, but such, which understand that it’s not going to happen for a couple of years.

What is your most successful investment to date?

It is too early to say. There are several names in our portfolio, but the business is dynamic and we have not made any exits. Definitely, Walltopia, Bulpros, Software Group, Resalta, and International Power Supply have managed to overcome a lot of difficulties and are on a very good level to get to the next stage of development. With them, at some stage, we will be too small investors and we will have to exit to larger financial or strategic investor, who can take the company to the next level of development. These are successful examples. The other companies in our portfolio might not become superstars, but we remain confident that we can do successful exits.

What metrics do you look at when deciding whether to invest?

For us the management is the most important factor – the people who generated the idea, developed it and believe in it. This is the first clear signal. We are looking for capable managers. Let’s say you like the business case, if you do not see that management is capable of following a rational action plan, and cannot defend its business initiatives – it would be better not to invest. It’s somewhat different from working with early-stage companies and investing in them. In that spectrum, there is more tolerance to risk and typically founders usually lack experience. I personally look for humble founders, because it is the one trait that portraits leadership.

What kind of return do you expect from the first fund?

At the moment I think we are at around 20% IRR of funds invested on paper. That is based only on the current valuation of the portfolio, as the fund has not made an exit yet. We are working on a few processes to exit companies, but these processes take time and still the visibility of an exit is unclear. The factors around any exit of a company are multiple and many are beyond our control. The global economy is probably going to hit a recession point sometime soon, which will make exits even more complex. Still, we believe that given the development of the portfolio we should be able to make 2.5 times return on capital invested.

Is the fund currently invested?

Yes, our fund is fully invested and our investment period is over. We have a small buffer of funds to be used only with existing portfolio companies. The buffer should be used only where it makes sense to support companies further.

You are currently raising a new fund, right?

Yes. We are currently beyond our investment period and the restriction on raising new funds has dropped. We think it is now a good opportunity to start raising a new fund. We have started the process, but it will take some time. We are in the initial phase now and have planned to make the first financial closing in the next six months or so.

We aim to raise a new regional fund for Southeastern Europe – Bulgaria, Romania, Serbia, Croatia, and Slovenia. We already have a good footprint in the region, along with one of our companies. We have also attracted one new partner with experience in the region to strengthen the team. Given the extended team and our regional strategy, we think it would be feasible to raise a new regional fund. We believe that a regional fund of the size of €100-120 million should be sufficient for us to cover our regional growth equity strategy. What we can see is that Limited Partners are clearly not interested in one single country, especially in this region.

What is the thesis and strategy of the first fund and in what would you invest with a possible next fund?

Our objective in the next fund would be to invest a single ticket between € 5 million and € 10 million in well developed small and medium-sized companies. We look for scalable businesses with a clear advantage – be it team, product, or trend. We look at technology, engineering, outsourcing, recycling, healthcare, and other niche industries. There are many capable teams in Bulgaria, Romania, Serbia, Croatia, and Slovenia. We want to invest in companies that are involved in the next technological wave, even if they are not in the domain of artificial intelligence. We are looking for the far-sighted ones.

What role did the EIF funds play and do you think it was well invested money?

In most cases, the idea is this: with our first fund to promote the development of growth equity throughout the ecosystem and then to have other ambitions. These funds have a certain time period, and if you do not manage to raise a new fund in 5-6 years, you will push some companies and hope that you will make some cash-out, but it will be very difficult for you to continue to structure the financing. Our idea is to create a proper fund manager that can develop in the segment for the next 20 years. In the SEE, and this is also our thesis for the new fundraising, there is little competition in the segment of 5 to 10 mln single equity tickets. There is an existing ecosystem in Bulgaria, true, it has developed, but it is not enough for an economy with a GDP of 50 billion euros. Our fund is now all invested, but other local funds have recently raised money and are in investment mode.

Considering all of the funds in Bulgaria, who invest bigger tickets, there is not more than € 50 – 60 million of capital available. This is nothing for this economy. In Romania, such an ecosystem is just starting to develop.

The EIF developed equity products first in Bulgaria from the entire region to understand how an ecosystem can produce results, and I think they were surprised (laughs). All these efforts resulted in a vibrant ecosystem and this is good because it created credibility for the region. When we go these days to institutional investors in Western Europe, they still find the region quite exotic, but over time, I hope this will change to our advantage.

Is there competition between investors in Bulgaria?

I do not think so. I believe there are opportunities for all equity funds in Bulgaria. Seed, venture, growth equity and buyouts are different categories of investment capital for the different stages a company goes through. We have looked at companies that we consider will be better off with venture capital instead of growth equity and therefore we pass them to funds with venture strategy. More mature companies require more capital and different value-added from the investors and such would usually fit in our investment profile. Funds have different strategies and therefore different tolerance to risk. Bulgarian equity fund ecosystem is still very much in the development stage and I think there are basically more opportunities than there is available capital.

They are different in your segment anyway.

Yes, you have bigger risks in venture capital – there is a good idea, there is a good product, you may have come up with a business case and it is validated, but you cannot monetize it yet. This is normal for many reasons. The companies in Bulgaria are 95% small and medium-sized and all are underfunded. Even in our segment, when they have good management teams and accomplished milestones, there are still many challenges – they lack capacity or management resources, do not know how to do certain things, cannot implement best practices, cannot attract finance, etc. There is always something missing. What we do is work with each company individually. In our portfolio of companies, we have selected and hired people for many different positions including CEOs and CFO, and with them, we work very seriously on the topic of governance, reporting, and application of best practices. We have invested around € 25 million and have attracted over € 35 million from co-investors and over € 40 million bank financing, which would not have happened without structured transactions. Having all that, you see that the effect on the economy is 100 million euros. And these companies are starting to grow, to be interesting for other investors, to create jobs, etc.

Companies that are Light on Assets, find it very difficult to finance with banks. Our capital in some cases is critical to make a solid base for additional debt funding. So far, with the companies we have backed up, we have built 5 factories, where additional bank debt was raised.

And how would you improve the way EIF-funded funds are structured?

Many people do not know what requirements these funds actually have. For example, in the current fund, we had specific limitations imposed to make an investment within a limited period of time. This was difficult. You can’t have a year and a half of the investment period and make 10 meaningful deals. That is why we have some not so successful investments. Some deals we had, were made in order to meet this specific condition. In the case of a short investment period, trade-offs are being made. There were other companies in the pipeline, but our product is complex and we did not have the time to properly structure all deals.

Unfortunately, in our segment, deals require you to put together many elements in order to achieve an optimum deal structure. Creating relationships, negotiating the terms and conditions, making proper due diligence, finding a co-investor, drafting the deal documentation, all of this takes time. Such complicated deals can’t happen for two or three months. Investments in such deals cannot be executed in less than 6 months. We have invested in 12 companies and where we had to rush to close a deal we did not achieve optimum structures because we had to make certain concessions to close the investment. And when a company goes in the wrong direction the fund is in a difficult situation, because other trade-offs inevitably need to be made.

In my opinion, the EIF aims to continue to support the region, and I think it will be a major factor for maintaining the ecosystem vibrant in the next ten years.

Where are you on the European Investors’ map?

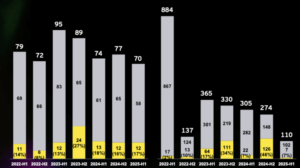

Well, it’s hard to say. A few years back, when we were pushing hard to deploy capital, we did 6 deals in one year and back then we were ranked as one of the top funds by number of deals.

That looked awkward. In my opinion, funds should be valued first according to their exits. I also like to look at the effect on the economy and the ecosystem. We measure our effect on the economy by company growth, building additional infrastructure and creating jobs.

Do you think that fund managers in Bulgaria work for management fee?

I’m far from that thought. It is not logical, it’s even stupid. It is very important to remember that the management fee goes to cover the costs of the fund, administration and transaction costs. Only a set-up cost in the Netherlands is € 100,000 and above. They are either taken out of the pocket or by the management fee.

These other perspectives might also interest you: