VC snapshot: These Are the Top 10 Venture Capital Funds in Eastern Europe

Venture capital (VC) and private equity (PE) funds have been gaining substantial ground despite the COVID 19 pandemic, according to the latest European Capital Report 2021, published by i5invest and the Vienna University of Economics’ Entrepreneurship Center. Though still underfunded, Eastern Europe is showing some good examples including Hungary’s HIVentures and Croatia’s Fil Rouge Capital.

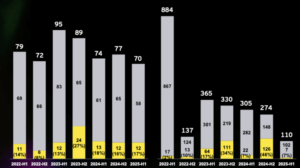

With 64 new European funds set up in the last 24 months, the total number of venture capital players in Europe has increased to 676, including 443 VCs and 233 PEs. Players in the industry demonstrate a strong focus on early-stage investments in Industry 4.0, Life Science and HealthTech.

The most powerful newcomers based on Assets under Management are London-based Corten Capital, Röko from Sweden, a/o PropTech headquartered in the UK, Future Energy Ventures from Germany, and NordicNinja VC based in Finland.

With only four new funds (Smart Works from Austria, Helen Ventures from Finland, Sparrow Ventures from Switzerland, and DNV GL Ventures from Norway), the corporate venture capital (CVC) ecosystem in Europe has failed to demonstrate substantial growth. In total, there are 55 CVCs, with most powerful based on Assets under Management beingre Novo Holdings from Denmark, Rabo Corporate Investments based in The Netherlands, Novartis Venture Fund from Switzerland, and BMW iVentures from Germany.

The UK is home to the highest number of CVCs is the United Kingdom (18), followed by Germany (16), and Switzerland (6). The key investment verticals for CVCs in Europe are AI and Big Data, Industry 4.0, Life Science & HealthTech, Software as a Service and Future of Mobility.

“For 2021 we’re hoping to see many more corporates making Venture Capital part of their innovation strategy”, says Stephan Jung from the WU Entrepreneurship Center.

Where is Eastern Europe?

Eastern Europe as the most underfunded region, the report revealed. Nevertheless, there are some good examples from the report, including Budapest-based HIVentures, which dominated the investment scene with 200 deals in 2020, four times higher the second most active fund, Zagreb-based Fil Rouge Capital.

The most popular investment focus among European funds in 2021 is Life Science & Health, followed by IT, Media and Telco, everything B2B and Industry 4.0. In terms of stage focus, funds based in SEE prefer to invest early-stage, while the rest of Europe continues a stronger focus on funding growth-stage companies in 2021.

The report does not mention any VCs with headquarters in Bulgaria, Romania, or the Western Balkans.

Top 10 VCs in Eastern Europe

- Hiventures (EUR 700 million) with headquarters in Budapest, Hungary searched early stage and growth companies for investment in the field of Future Mobility Fintech, Construction & Proptech, eCommerce & Retail , Education & HR, Life Sciences & Healthtech, Agritech & Foodtech, IT, Media & Telecommunications.

- PortfoLion Capital Partners (EUR 220 million) with headquarters in Budapest, Hungary searched early stage and growth companies for investment in the field of SaaS, B2B, General industries.

- AltalR Capital (N/A) with headquarters in Tel Aviv, Israel searched early stage and growth companies for investment in the field of Fintech & Insurtech, Life Sciences & Healthtech, Blockchain, Industrie 4.0, AI & Big Data SaaS.

- Aria (EUR 50 million) with headquarters in Warsaw, Poland searched early stage companies for investment in the field of AI & Big Data, SaaS, Cybersecurity & Defense, Industrie 4.0, Education & HR, Life Sciences & Healthtech.

- Credo Ventures (EUR 170 million) with headquarters in Prague, Czech Republic searched early stage companies for investment in the field of Fintech & Insurtech, Life Sciences & Healthtech, Blockchain, Industrie 4.0, AI & Big Data SaaS.

- EnerCap (EUR 450 million) with headquarters in Prague, Czech Republic searched for Private Equity investment in the field of Energy & Sustainability

- Fil Rouge Capital (EUR 47 million) with headquarters in Zagreb, Croatia searched early stage and growth companies for investment in the field of Fintech & Insurtech, Life Sciences & Healthtech, Blockchain, Industrie 4.0, AI & Big Data SaaS.

- Practica Capital (EUR 52 million) with headquarters in Vilnius, Lithuania searched early stage and growth companies for investment in the field of Fintech & Insurtech, Life Sciences & Healthtech, Blockchain, Industrie 4.0, AI & Big Data, Construction & Proptech, Supply Chain & Logistics, Education & HR, Energy & Sustainability.

- RTP Global (N/A) with headquarters in Moscow, Russia searched early stage companies for investment in the field of Future Mobility Fintech, Construction & Proptech, eCommerce & Retail, Education & HR, Life Sciences & Healthtech, Agritech & Foodtech, IT, Media & Telecommunications.

- S7 Ventures (N/A) with headquarters in Novosibirsk, Russia searched early stage and growth companies for investment in the field of Fintech & Insurtech, Life Sciences & Healthtech, Blockchain, Industrie 4.0, AI & Big Data, Construction & Proptech, Supply Chain & Logistics, Education & HR, Energy & Sustainability.