RBI CEE Fintech Atlas: Perspectives and developments of fintech and digital banking in CEE

Elevator Lab, powered by Raiffeisen Bank International (RBI), is a program connecting fintech startups with RBI Group in order to establish long-term partnerships. The team behind Elevator Lab launched the new digital format of the CEE Fintech Atlas, a website providing information and an overview of the CEE fintech startup scene in June 2021. The goal of the CEE Fintech Atlas is to share RBI’s knowledge and expertise on fintech startups as well as technology and digitalization topics with a broader audience.

Casper Engelen, a Research Analyst at Raiffeisen Research, sums up conclusions from the data provided for the launch of CEE Fintech Atlas – including the data on Digitalisation, Digital Banking, and Fintech Impact in the CEE region.

Digitalization as an engine for convergence

Since the start of the digital revolution, the pace of technological developments and their spread has accelerated significantly. Due to their scalable nature, digital technologies and fintech can diffuse more rapidly than other kinds of technology. Thus, the lags of technology adoption in developing countries have declined significantly and this decline has even accelerated. This technology adoption, together with the buildup of digital skills, can induce competitiveness in the CEE region and, therefore, growth. Further, especially fintechs can lead to higher levels of financial inclusion, which in turn increases the growth potential of the region. Thus, fostering digitalization can be an important avenue for the economic convergence of the CEE region and create a more level playing field.

Impact on Digital Banking

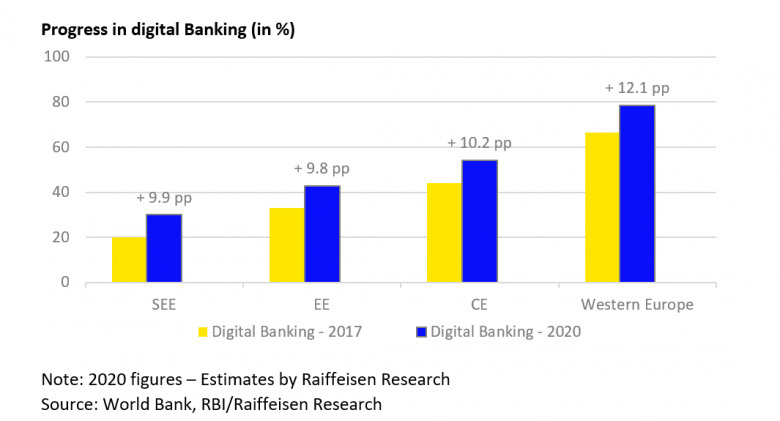

The digitalization of financial services and banking is a key facilitator of financial inclusion and the transition towards a digital economy. It is therefore of great importance for the CEE region. Even though the Covid-19 pandemic has likely made face-to-face usage of financial services harder, it has sped up the development and the usage of digital financial services greatly. By our estimations, the pandemic has sped up the advancement of financial access, particularly the progress of digital banking, by around two to three years.

In relative terms, digital penetration has grown faster in the CEE region than in Western Europe since the start of the pandemic. However, we do see a certain heterogeneity between the extent of the digital windfall created by the Covid crisis in this regard. Our estimates show that the correlation between the level of banking penetration and the growth of digital penetration is very high. This means that even though digital penetration in the CEE region has advanced rapidly, growing about 10% on average since 2017, the gap has widened in absolute terms. This means that the progress in digital banking penetration is, at least for now, seemingly linked to the overall banking penetration, which still acts as the facilitating infrastructure.

Fintechs to facilitate financial inclusion further

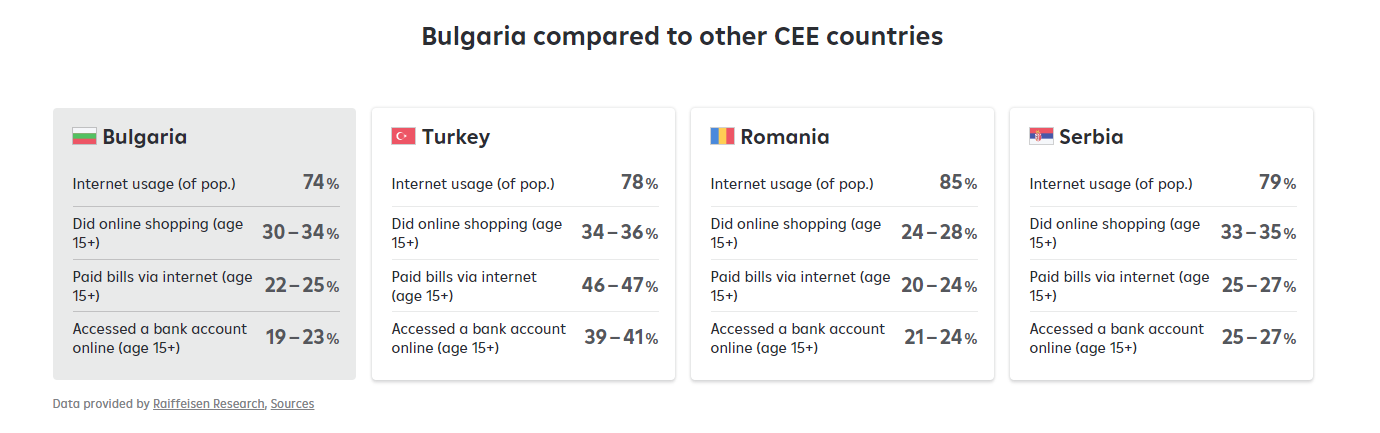

Given that in terms of internet and smartphone usage many CEE countries are closer to Western European markets than in traditional banking penetration, fintechs can also cater to those population groups that are traditionally underbanked. By increasing financial inclusion in this regard, digitalization can contribute to the economic growth and convergence of the region. However, fostering the transition towards digital economies still requires major efforts by local governments as well as international organizations, both in terms of skills and in infrastructure, and investing into and strengthening the digital sector in the region should be seen as an important focus point.

For Atlas, the Elevator Lab team cooperated with Raiffeisen Research, a diverse team of approx. 80 analysts based in Austria and 13 countries of Central and Eastern Europe (CEE). Raiffeisen Research is a research boutique with a long tradition of research on economics and the banking sector, in recent years, digitalization in the region was an important focal point in their research. Raiffeisen Research’s products and expertise rely on continuous and close collaboration between the research teams in CEE and Vienna. The team behind Raiffeisen Research researched, consolidated, and provided macro-economic and digitalization data for 19 CEE countries.

Find out more about the data from the previous CEE Fintech Atlas reports: 2018, 2019.