Startups in Europe see compliance processes as the biggest obstacle to growth

In the USA everything is allowed that is not expressly forbidden, in Europe it is the other way round. This is how you could summarize the results of a new Stripe study on startups in Europe. Because the survey of almost 200 startups shows that they see regulatory hurdles in particular as a stumbling block. Above all, complicated compliance processes are seen as a hindrance to rapid growth.

According to the survey, 83% of those surveyed believe that politics is more geared towards established companies. “Just a minority of startups (12%) believe that policymakers understand the realities of what they are facing,” says Stripe. The fintech was founded by the Irish Collison brothers, but their success with the payment service provider only came in Silicon Valley.

“Tech companies across Europe are facing an increasingly difficult economic environment. It’s more important than ever to take the needs of the startup community seriously,” said Matt Henderson, Global Business Lead at Stripe. One in three startups initially considered setting up their business elsewhere due to the high level of effort required to comply with regulations.

Education, talent, and new markets as advantages

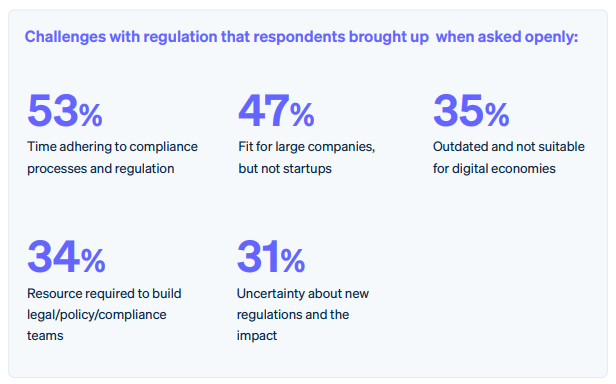

Above all, the regulatory hurdles cost the startups time. More than half (53%) of respondents say that the time it takes to comply with regulatory requirements is the number one obstacle for their business, and more than three-quarters (79%) say it has increased in recent years. However, a location in Europe also has advantages. 73% name the level of education and 41% the availability of talent in the labor market as clear advantages. 56% see the geographical proximity of different markets as an advantage, which enables rapid internationalization.

As a provider of payment infrastructure, Stripe is of course very interested in a flourishing digital ecosystem. With “Stripe Atlas” there is even a separate service that makes it very easy to set up a company in the US state of Delaware. This includes the ability to obtain a tax identification number from the United States Internal Revenue Service (IRS). Of course, the fintech then sells its financial services to these companies.