Report: CEE women-founded startups outperform male but raise fraction of available capital

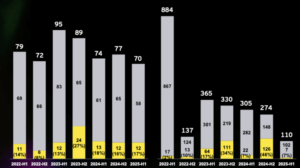

Women startup founders in CEE outperform men by as much as 96% in terms of capital productivity but only raised 2.2% of the available venture capital in 2016-2020, according to a recent report on Funding in the CEE region – through the lens of gender diversity and impact.

Women raise just 1% of venture capital available in 2020

In 2020, this share was a mere 1%, 5% went to mixed-gender founding teams, and 94% was raised by all-men teams.

“The numbers and size of female-led VC funds, companies, and projects have stayed flat at its same low single-digit percentage. Central Europe, in particular, is at a low starting point with only 1% of VC money invested in female-led businesses in 2020 and female-led or co-led VCs having one-fifth of the fire power of male-led ones. The gap is immense,” said Kinga Stanisławska and Marzena Bielecka, General Partners at Experior VC and Founders of European Women in VC, commented.

Women outperform men by 96%

+++Entrepreneurs, Innovators, Leaders: Women from North Macedonia Pave Way to Future+++

While female founders are still a minority, and they get just a fraction of the capital men get, women founders perform much better when looking at the revenue to funding ratio, the report revealed In capital productivity, women outperform men by as much as 96%.

All women teams in the CEE region raise far less capital per round compared to all men and mixed-gender teams. Even though between 2016 and 2020 all women teams landed 4.2% of the deals, they only raised 2.2% of the capital.

Women heavily underrepresented in VCs

One reason for the lack of funding to females was a correlation with the lack of female decision makers in VC, the report found. Male-only led VCs headquartered in the CEE region make up 81% of the VC pool and women-led and managed VCs are heavily underrepresented, accounting for only 3%.

According to the report, funders, investors and decision makers are predominantly men. Of funds active in CEE, 85% of venture capital investment roles at any level are held by men, rising to 93% at Partner level and even higher at General Partner level.

+++How And Why Should The VC Industry Fund A Gender Equal Future++

Women-managed VCs are only 3% of all VC funds in CEE. VC funds with all-men General Partner (GP) teams have 5X the firepower (AUM) to invest in companies compared to all women GPs of venture funds.

The report was produced by European Women in VC, Unconventional Ventures, and Experior Venture Fund. The main data partner for the report is Dealroom, with support of Invest Europe, Slush, and European Women in VC.