What should the ECB do to combat the high inflation

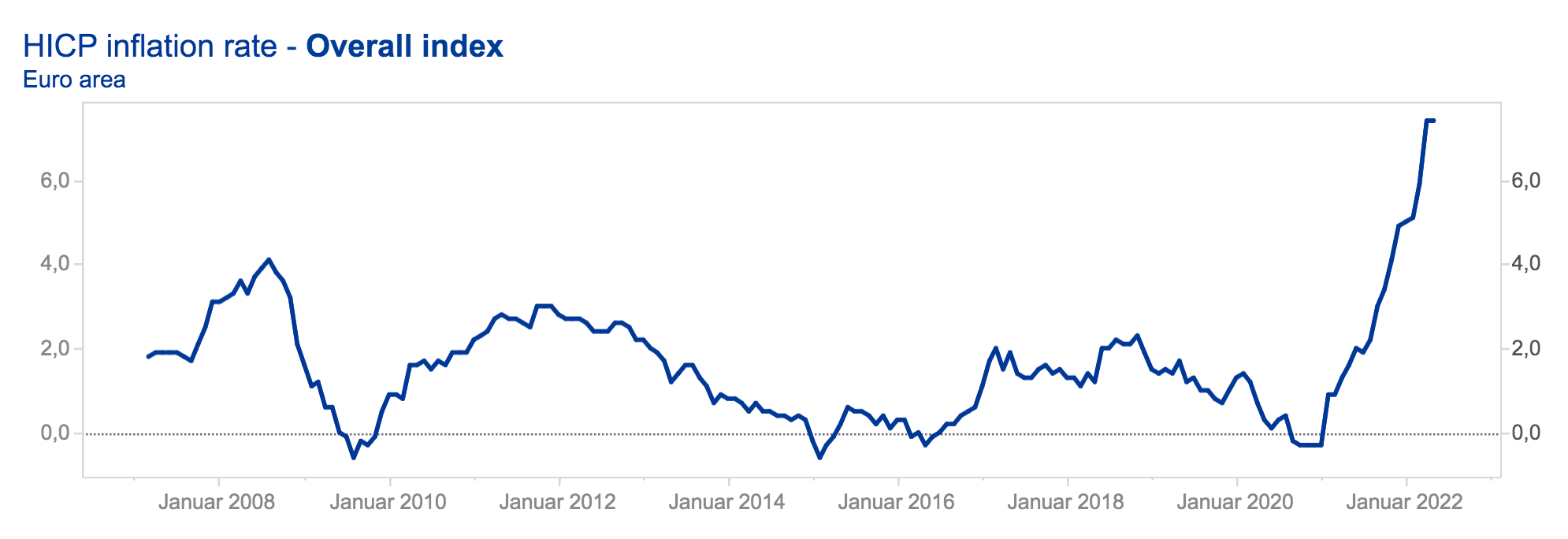

7.5% in the eurozone – the inflation rate is rising and rising, and more and more people are wondering what the next actions shall be. More and more observers are now accusing the European Central Bank (ECB) of acting too slowly. It is actually tasked with keeping inflation at around 2%, but it is far from that today.

Instead of raising interest rates as the US Federal Reserve has done, they continue to wait. ECB boss Christine Lagarde recently hinted that the interest rate hike in the euro area should now come by the end of September (Trending Topics reported). Some economists believe that this is not possible beforehand. First, the asset purchase programs (APP) that pump a lot of money into the economy would have to be phased out. Raising policy rates while APP is still running would risk inverting the yield curve. It is considered very bad for banks. If they had to pay high-interest rates in the short term and receive low-interest rates in the long term, this would jeopardize their business model.

Development of the inflation rate in the euro area since 2007:

Measures take up to 2 years to make a difference

But not everyone is of the opinion that one must first wait for the end of the APP. “The ECB has already started to normalize monetary policy: the Corona bond purchase program has already ended, and the second program (APP) ends in July. So far, it has not initiated any rate hikes. Your previous approach was very hesitant. After the surprisingly high current inflation figures, it should therefore initiate faster and higher interest rate hikes,” says Heike Lehner from Agenda Austria. “Furthermore, nowhere is it stipulated that it must first phase out the asset purchase programs before raising interest rates. In order to initiate a faster turnaround in interest rates, she could already raise interest rates at the ECB meeting next week, but only let the bond purchases end in July as planned.”

If the key interest rates in the eurozone get raised at the end of September, the effects will not be noticed immediately – rather only many months or years later. “Monetary policy measures such as interest rate hikes naturally have a time lag. Most of the time they need between half a year and up to two years to have any effect at all. As such, the raises are coming very late now, which doesn’t mean they’re unsuitable. Ultimately, the ECB’s rate hikes are the best way to get inflation under control across the board. That’s why the ECB should finally raise interest rates despite its late action,” Lehner continued.

Financing problems for companies

“In itself, eurozone inflation is predominantly supply-side: that is, it is primarily driven by higher production costs, higher energy prices, and supply chain disruptions. However, that doesn’t mean you can’t adjust demand. In the Corona crisis, income was largely secured with generous aid, and in some cases, the economy was even boosted by investment premiums,” says Monika Köppl-Turyna, director of the economic research institute EcoAustria. “In this environment, where stable demand meets tight supply, prices naturally rise.”

An increase in interest rates will depress demand as higher financing costs lead to less investment. “In this way, demand and supply can also be brought together and price developments can be stabilized,” says Köppl-Turyna. “However, this does not come without costs: the companies, which are already exposed to higher costs, may have financing problems as a result. This weakens the economy, but is still necessary for handling inflation.” Such financing problems can already be seen in the start-up and scale-up industry. Investors are now very hesitant, there are downrounds and mass layoffs (Trending Topics reported).

Head of ECB signals rate hikes in the Euro zone by the end of September

“Targeted grants for low earners”

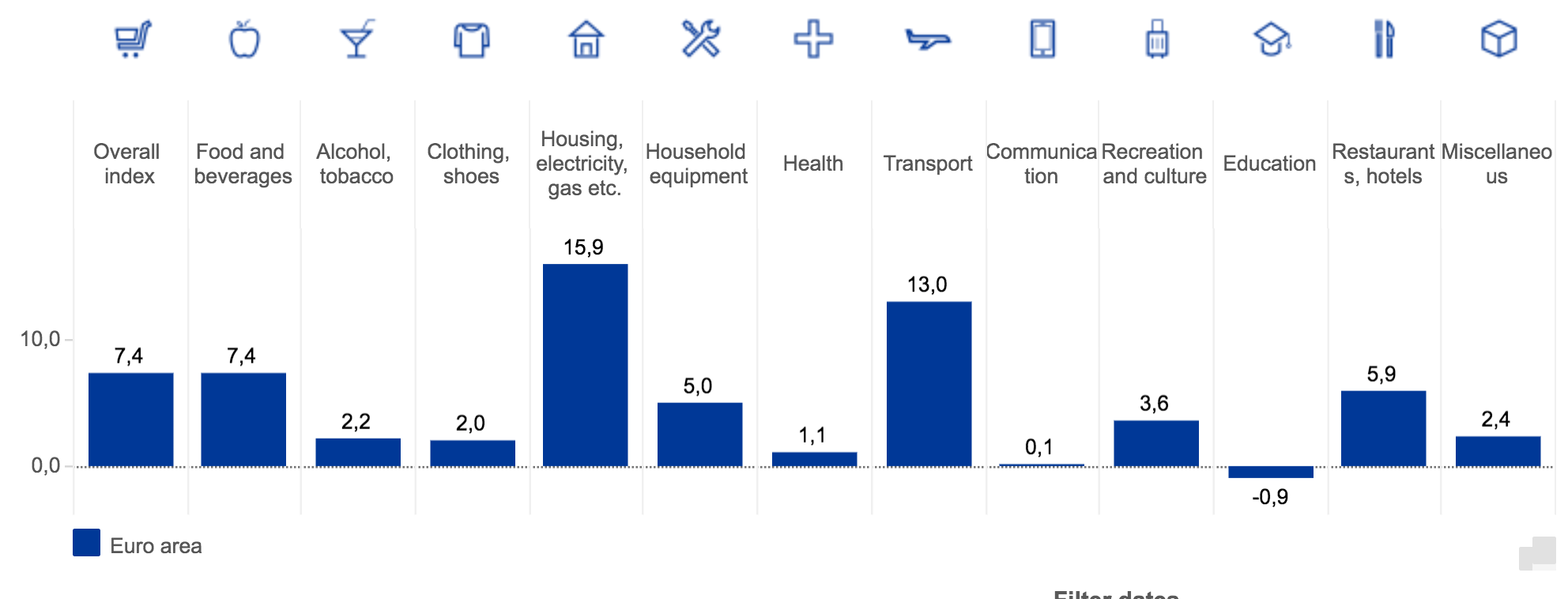

While those with money in savings accounts are wondering what to do with it before it melts away further, high inflation is hitting low-income households the hardest. Housing, groceries, electricity, gas, and fuel are the things that have become particularly expensive. A chart by the ECB shows which everyday items have become more expensive. There are also a few rays of hope: health services, communication, and educational offers are at least not or only slightly affected by inflation:

Meanwhile, there is one very clear beneficiary of high inflation: the state. He receives additional income of many billions from taxes. If, for example, food prices rise, tax revenue from VAT also increases. That is why the discussion is raging as to what should happen with these many billions.

“The ECB has a duty to fight inflation, the state can only cushion the effects of inflation. But he should only do this purposefully. It is therefore important that he primarily helps those who suffer most from inflation,” says Lehner from Agenda Austria. “These are mainly low earners who can be helped with targeted grants. At the same time, one must not forget that the cold progression is currently particularly important. This creeping tax increase means additional income for the state due to the high inflation and is currently affecting the population even more. Abolishing cold progression based on the Swiss model would therefore be a way of relieving the burden on the population in the long term. It doesn’t take the pressure off inflation.”

Abolition of cold progression

“The abolition of the cold progression, preferably retrospectively from the beginning of the year, would relieve people with low and middle incomes, in particular, more and take the pressure off the wage negotiations by securing the net wages and thus reduce the risk of a wage-price spiral,” says Monika Köppl-Turyna from EcoAustria. “Broad tax cuts, such as VAT, are less suitable because on the one hand they are associated with a lot of deadweight and on the other hand, when it comes to energy, they continue to drive demand for fossil sources, which would be completely counterproductive in view of the necessary decarbonization of the economy.”

Fiscal measures are a tightrope walk. Broad relief would further strengthen overall economic demand, i.e. increase prices even further. Köppl-Turyna also advocates targeted measures: “I see direct support through social assistance as a particularly suitable measure, which is very accurate because it works regardless of whether you are unemployed or have a lower income from work and also takes into account the family situation takes.”