2021 Recap: The Trending Topics of the year

2021 didn’t bring a spectacular new iPhone, but it set the course for the future. At ten turning points in the past year, we show where we are headed.

Reinventing Wall Street

At first, it just seemed like a storm in a glass of water when in the Reddit subforum #WallStreetbets users encouraged each other to invest in the shares of companies like GameStop (video game retail chain) or AMC (cinemas) that were ailing during the crisis. But it was only the symptom of a broader trend: During the crisis, people looked for alternative investment opportunities – and found access to the global financial market in trading apps such as Robin Hood, Trade Republic, or Bitpanda.

Neobrokers, but also neobanks and other fintechs have shown in 2021 how much the financial world is in upheaval. Investing in stocks, ETFs, and crypto currencies are now an integral part of every finance app. And beyond that, too, consumers are breaking old habits quickly inside. In 2021, for example, it became clear that the so-called “Buy Now Pay Later” (BNPL) has become a mass-market option as a new online payment option. PayPal, Klarna, Square – they are all investing billions in this new market that is preparing to replace the credit card.

The automotive industry is upside down

Bet there are four in the top 10 most valuable car companies that you would not have suspected or even heard about for the first time? Ready? Off we go: BYD. Rivian. Lucid Motors. Great Wall Motors. Not in the top 10 are: BMW, Ferrari, Hyundai, and Volvo. Amazing, isn’t it? 2021 marks an absolute turning point in the automotive industry, and we at Tesla have not even started there. A fireworks display made Elon Musk’s electric car company so valuable that it not only surpassed the one trillion dollar mark but was also worth more than the next seven automakers combined in mid-November. These upheavals happen at a time when tech companies such as Apple, Sony, Xiaomi, or Foxconn are not yet on the market with their electric cars.

The year of the cryptos

In the end, one has to state Michael Saylor, CEO of the software company MicroStrategy, and a few others… They correctly predicted an absolute boom year for Bitcoin and Co. as a result of the Corona crisis. Investing in crypto assets in 2020 really paid off a year later when BTC, ETH, and others shot to new heights and raised the market capitalization of cryptocurrencies to three trillion dollars – more than the world’s most valuable companies are worth. This crypto frenzy also led to the world’s largest investors jumping up in 2021. Softbank, Coatue, Tiger Global – even a Canadian pension fund for teachers – no longer want to leave out and pumped billions into those companies

At the same time, blockchain in the form of NFTs has become a cultural phenomenon. Artists, musicians, athletes – they are all increasingly relying on technology that is supposed to write property and copyright in blocks forever and ever.

Rain of money for founders in Europe

It has never been such a good time as 2021 to be founder: in. In that year, a real rain of money fell over startups and scale-ups and created so many new unicorns (companies with a valuation of more than billions) that investors are now on the lookout for the Dekacorns (valuation of 10 billion dollars).

There are good reasons for the glut of money for European scale-ups such as Klarna, Northvolt or Celonis. This is how the investor’s money sits: thanks to the low-interest rate policy that has been going on for years, the investor’s money is already loose, and the rising inflation is also making people look for alternative investment opportunities. But it is one thing above all: European tech companies have finally reached the level of maturity to get the really big financing rounds, showed resilience during Corona – and met investors willing to pay.

Recap: €100 billion brought almost 100 new unicorns to Europe in 2021

Tech crackdown in China

In 2020, when China emerged from the Corona crisis better than many other countries, you could get the impression: China’s tech giants will roll everything down. But then came Xi Jinping. The president for life does not tolerate private men (yes, unfortunately there are always men) with a lot of power and influence next to him. And so the big tech companies were trimmed one by one. First the fintech giant Ant Group, then Alibaba from Jack Ma, and finally EduTechs and the game industry. Until it was finally clear to everyone: The last word in China is not for the tech billionaires, for the almighty state.

China’s internet crackdown wipes out hundreds of billions of dollars in stock market value

Metaverse: The game becomes serious

For a long time, it was fiction made up of science fiction novels, computer games, and Hollywood films – but 2021 is likely the year the Metaverse finally started to take shape. It didn’t even need Mark Zuckerberg from Facebook, sorry, Meta – even without the big AR / VR plans of the much criticized internet billionaire, new 3D worlds that are more than just games will emerge. Companies such as Niantic (“Pokemon Go”), Roblox, Epic Games (“Fortnite”) or Microsoft (“Minecraft”) have long been working on metaverses that will become a 3D twin of the earth, which you can use VR or can “enter” AR glasses.

The blockchain naturally also comes into play here: In Decentraland, which is somewhat reminiscent of “Second Life”, you can already buy virtual properties for tokens. More and more companies around the world are helping to build the Metaverse. Blackshark.ai, for example, has calculated a complete 3D twin of the planet, and resourceful founders such as those from Cybershoes deal with the not unimportant question of how we will go in the future in the Metaverse. Exactly, with cybershoes.

Work like never before

4-day week, remote work, onion architecture, work from anywhere, 3-2-2 model – and so on and so forth. While it was assumed in 2020 that now where, only works, remote work will be switched to and that life in the country will celebrate its big comeback, the dust will have settled in 2021. And it shows: There is no one model that will shape the working world of the future, there are many different ones. Exactly: there is no universal formula. Corona has asked every company to deal with the topic of working in the future, but the implementations are very different. While some companies have gone completely decentralized into remote mode, others are building large new HQs. They only have one thing in common: Corona provided the opportunity to make work more livable.

Hype and homeless: how digital economy and COVID are changing the lifestyle of SEE’s modern nomads

The crises of the chips

At first, it was cars, then the bottleneck expanded to include game consoles, dishwashers, and printers: even if you often talk about oil, Bitcoin, or data, in the end, 2021 showed that it is computer chips that keep the world going. And when supply chains stall, it is not only giant containers stuck in the Suez Canal that are the reason, but also production downtimes in the semiconductor industry. The dependency on chips was revealed more clearly than ever before in 2021. Apple, Google, and other IT giants broke away from their suppliers with their own processors, and the EU is now also taking action against the impending loss of one of the last chip companies (ARM is to be swallowed by Nvidia). Its own chip law should make Europe more independent from Asia and the USA – the outcome is uncertain.

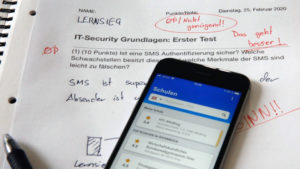

It is no longer possible without cybersecurity

“You are fucked.” The managers of SalzburgMilch, one of Austria’s largest milk producers, received this message on their screens in 2021. Paying Bitcoin or risking a complete IT failure was the choice that cyber attackers left inside the company. In the end, the company was idle for almost ten days before it could start operations again – with millions in losses as a result. The attack on MediaMarkt was even bigger when blackmailers paralyzed the till systems. When complete business models are digitized or at least based on digital tools (payments, deliveries, etc.), it becomes clear that it is no longer possible without cybersecurity. The sector is booming like no other. So it was hardly surprising when the German Schwarz Group (Lidl, Kaufland) donated a proud $ 700 million for the Israeli cyber security specialist XM Cyber. It will continue in the same tone in 2022.

On the hunt for CO2

The abbreviation CCS has to be remembered since 2021 at the latest. It stands for “Carbon Capture and Storage” and describes the many efforts around the world to capture, store or recycle CO2. The cooperation between the two startups Climeworks from Switzerland and Carbfix from Iceland caused a sensation: together they collect CO2 from the air and pump it into the rock of the earth. Climeworks and Carbfix are representative of a number of companies that are fighting the climate crisis with new technologies. In addition, there are countless other companies that want to achieve the climate goals with the circular economy, reforestation, renewable energies, and (attention, controversial!) Mini nuclear reactors. Yesterday’s eco-fuzzis became the heroes of tomorrow.

“Greensand”: Up to 8 million tons of CO2 are to be stored in the North Sea

This story comes from our new magazine “Trending Topics 2022”. It is available in German from December 29th for free download.